Author: KarenZ, Foresight News

The博弈 concerning the development of the Digital Asset Treasury (DAT) industry continues to intensify.

In October, global index provider MSCI put forward a proposal to exclude companies with digital asset holdings accounting for 50% or more of their total assets from its Global Investable Market Indexes. This move directly threatens the market position of companies like Strategy, representative of digital asset treasury companies, and could potentially redirect capital flows for the entire DAT sector.

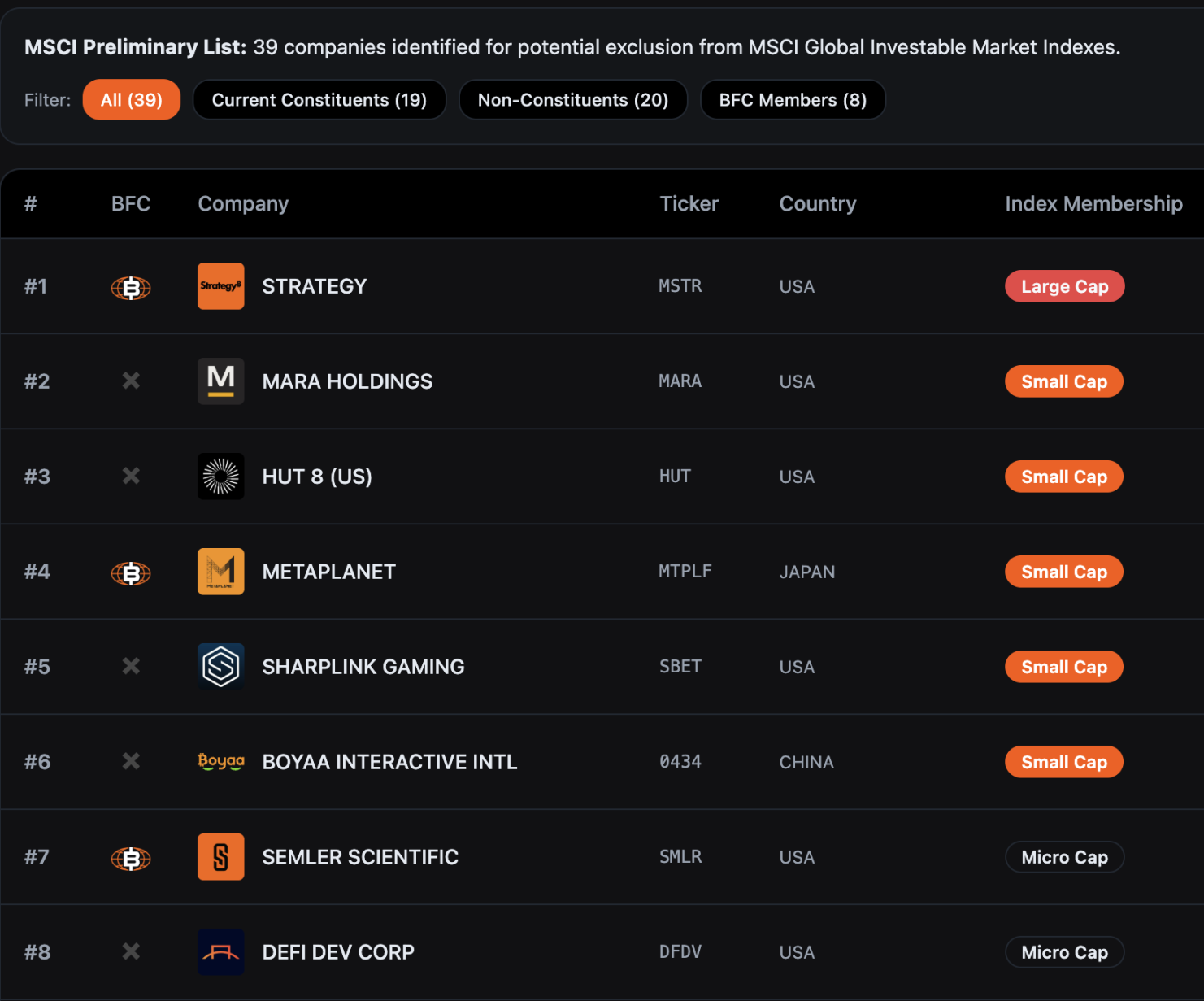

According to statistics from Bitcoin for Corporations, 39 companies risk exclusion from the MSCI Global Investable Market Indexes. J.P. Morgan analysts previously warned that the exclusion of Strategy alone could lead to nearly $2.8 billion in passive fund outflows. If other index providers follow suit with similar rules, outflows could reach as high as $8.8 billion.

The consultation period for this MSCI proposal is currently open until December 31, 2025, with a final conclusion expected by January 15, 2026. Any adjustments would be formally implemented during the February 2026 index review.

Faced with this urgent situation, Strategy submitted a strongly worded 12-page public letter to the MSCI Equity Index Committee on December 10th. Signed jointly by Executive Chairman and Founder Michael Saylor and President & CEO Phong Le, the letter clearly expressed firm opposition to the proposal. It stated unequivocally: "This proposal is seriously misleading and will have far-reaching destructive consequences for the interests of global investors and the development of the digital asset industry. We strongly urge MSCI to completely withdraw this plan."

Strategy's Four Core Arguments

Digital Assets Are a Revolutionary Foundational Technology Reshaping the Financial System

Strategy believes MSCI's proposal underestimates the strategic value of Bitcoin and other digital assets. Since Satoshi Nakamoto introduced Bitcoin 16 years ago, this digital asset has gradually grown into a key component of the global economy, with a current total market value of approximately $1.85 trillion.

In Strategy's view, digital assets are far more than simple financial instruments; they represent a fundamental technological innovation capable of reshaping the global financial system — companies investing in Bitcoin-related infrastructure are building a new financial ecosystem, much like leading companies that deeply invested in single emerging technologies throughout history.

Just as Standard Oil focused on oil well extraction in the 19th century and AT&T全力 built telephone networks in the 20th century, these companies laid a solid foundation for subsequent economic transformations through前瞻性 investment in core infrastructure, ultimately becoming industry benchmarks. Strategy argues that companies focusing on digital assets today are following this path of "technology pioneers" and should not be simply dismissed by traditional index rules.

DATs Are Operating Companies, Not Passive Funds

This is the core of Strategy's argument — Digital Asset Treasury companies (DATs) are operating companies with complete business models, not merely investment funds passively holding Bitcoin. Although Strategy currently holds over 600,000 Bitcoin, its core value does not rely solely on Bitcoin's price fluctuations. Instead, it creates sustainable returns for shareholders by designing and offering unique "digital credit" instruments.

Specifically, Strategy issues "digital credit" instruments including various types of preferred stock with fixed dividend rates, floating dividend rates, different priority levels, and credit protection terms. It uses the funds raised from selling these instruments to acquire more Bitcoin. As long as the long-term investment return on Bitcoin exceeds Strategy's USD-denominated financing costs, it can generate stable returns for shareholders and clients. Strategy emphasizes that this model of "active operation + asset appreciation" is fundamentally different from the passive management logic of traditional investment funds or ETFs and should be regarded as a normal operating company.

Furthermore, Strategy questions in the letter: Why can oil giants, Real Estate Investment Trusts (REITs), timber companies, etc., concentrate holdings in a single asset class without being classified as investment funds and excluded from indexes? Imposing special restrictions only on digital asset companies clearly violates the principle of industry equity.

The 50% Digital Asset Threshold is Arbitrary, Discriminatory, and Impractical

Strategy points out that MSCI's proposal employs discriminatory standards. Many large companies in traditional industries also hold a highly concentrated single asset class in their portfolios, including oil and gas companies, REITs, timber companies, and power infrastructure firms. Yet, MSCI has set special exclusion criteria only for digital asset companies, constituting obvious unfair treatment.

From an implementation feasibility perspective, the proposal also has serious issues. Due to the high volatility of digital asset prices, the same company could frequently enter and exit MSCI indexes within days due to changes in asset value, causing market chaos. Additionally, differences between accounting standards (the treatment of digital assets differs under US GAAP and international IFRS standards) will lead to differential treatment for companies with the same business model based on their jurisdiction of incorporation.

Violates Index Neutrality Principle, Introduces Policy Bias

Strategy argues that MSCI's proposal is essentially a value judgment on a certain asset class, violating the fundamental principle that index providers should remain neutral. MSCI claims to markets and regulators that its indexes provide "exhaustive" coverage, aiming to reflect the "evolution of the underlying equity market," and should not "make judgments about the goodness or appropriateness of any market, company, strategy, or investment."

By selectively excluding digital asset companies, MSCI is effectively making a policy judgment on behalf of the market, which is precisely what index providers should avoid.

Contradicts US Digital Asset Strategy

Strategy specifically emphasizes that this proposal conflicts with the strategic goals of the Trump administration to advance US leadership in digital assets. The Trump administration signed an executive order in its first week to promote growth in digital financial technology and established a strategic Bitcoin reserve, aiming to make the US the global leader in digital assets.

However, if MSCI's proposal is implemented, it would directly prevent long-term US capital, such as pension funds and 401(k) plans, from investing in digital asset companies, leading to tens of billions of dollars flowing out of the sector. This would not only hinder the development of US digital asset innovation companies but could also weaken US competitiveness in this strategic field, running counter to the government's stated policy direction.

Citing analyst estimates, Strategy states that it alone could face up to $2.8 billion in passive stock liquidation due to MSCI's proposal. This harms not only Strategy itself but will also have a chilling effect on the entire digital asset ecosystem. For example, it might force Bitcoin mining companies to sell assets prematurely to adjust their asset structure, thereby distorting the normal supply and demand dynamics of the digital asset market.

Strategy's Ultimate Demands

Strategy puts forward two main demands in its public letter:

First, it hopes MSCI will completely withdraw the exclusion proposal, allowing the market to test the value of Digital Asset Treasury companies (DATs) through free competition, enabling indexes to neutrally and faithfully reflect the development trends of next-generation financial technology.

Second, if MSCI still insists on "special treatment" for digital asset companies, it must expand the scope of industry consultation, extend the consultation period, and provide more substantial logical support to explain the rationality of the rules.

Strategy Is Not Fighting Alone

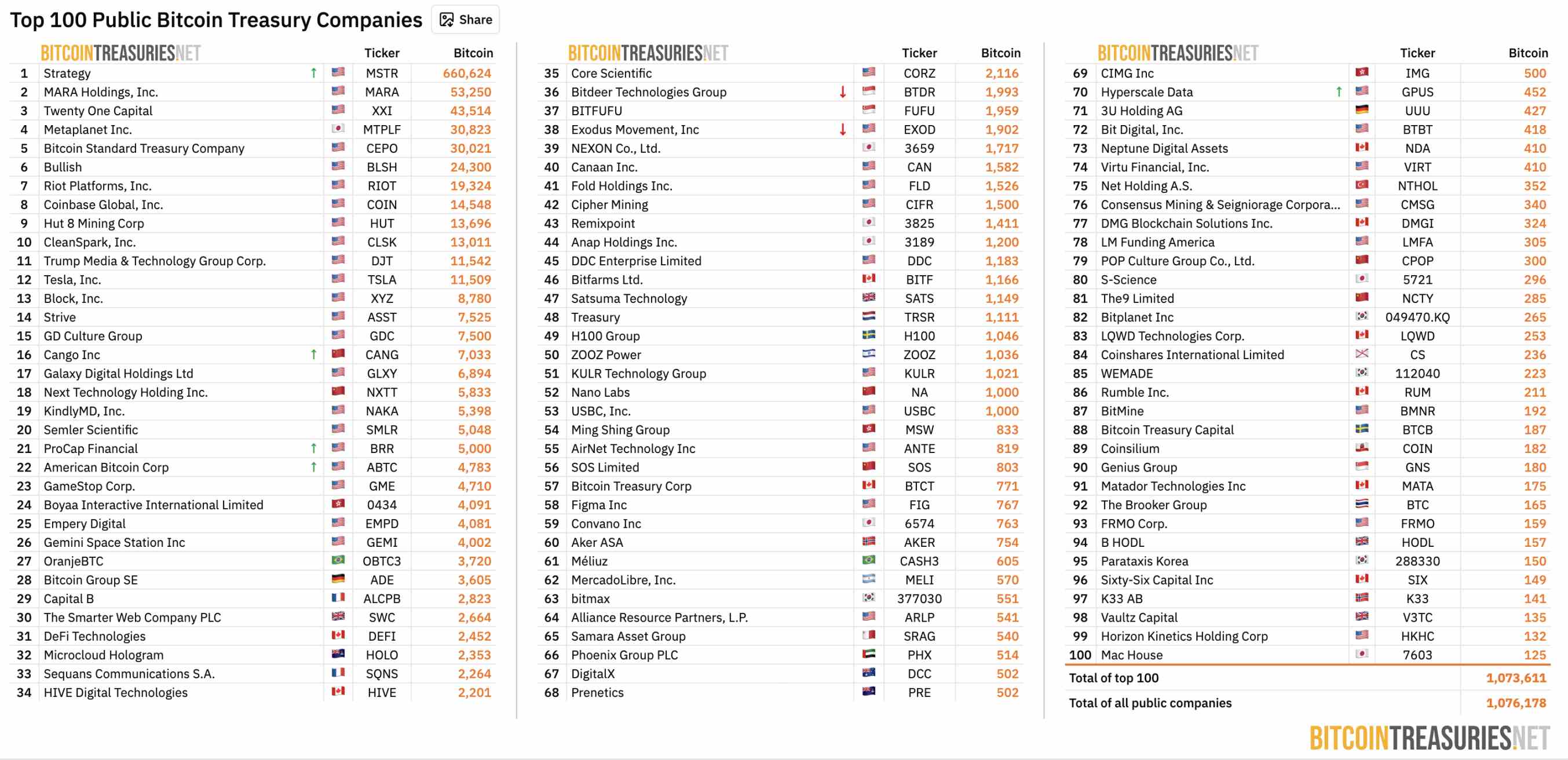

Strategy is not fighting alone. According to data from BitcoinTreasuries.NET, as of December 11th, 208 publicly listed companies globally hold over 1.07 million Bitcoin, exceeding 5% of Bitcoin's total supply, currently worth approximately $100 billion.

Source: BitcoinTreasuries.NET

These digital asset treasury companies have become important bridge for institutional adoption of cryptocurrency, providing compliant indirect exposure for traditional financial institutions like pension funds and endowments.

Previously, Strive, a Bitcoin-holding public company, suggested that MSCI should leave the "choice" regarding digital asset companies to the market. A simple and direct solution would be to create "ex-Digital Asset Treasury" versions of existing indexes, such as the MSCI USA ex Digital Asset Treasuries Index and the MSCI ACWI ex Digital Asset Treasuries Index. A transparent screening mechanism would allow investors to choose their tracking benchmark independently, preserving index integrity while meeting the needs of different investors.

Additionally, the industry organization Bitcoin for Corporations has initiated a joint petition calling on MSCI to withdraw the digital asset proposal. It advocates that classification should be based on a company's actual business model, financial performance, and operational characteristics, rather than simply drawing a line based on asset percentage. According to the organization's website, 309 companies or investors have currently signed the joint letter. Signatories, besides Strategy, include executives from industry-known firms like Strive, BitGo, Redwood Digital Group, 21MIL, Btc inc, DeFi Development Corp, as well as numerous individual developers and investors.

Summary

The standoff between Strategy and MSCI is essentially a fundamental debate about "how emerging financial innovations integrate into the traditional system." Digital Asset Treasury companies (DATs), as "cross-border" entities between traditional finance and the cryptocurrency world, are neither pure technology companies nor simple investment funds, but represent a new business model built upon digital assets.

MSCI's proposal attempts to use a "50% asset threshold" to classify these complex entities as "investment funds" and exclude them from indexes; Strategy insists that this simplified treatment is a serious misunderstanding of their business essence and a departure from the principle of index neutrality. As the January 15, 2026 decision date approaches, the outcome of this博弈 will not only determine the index "eligibility" of several Bitcoin-holding public companies but will also delineate a critical "survival boundary" for the future position of the digital asset industry within the global traditional financial system.