I. Product Core: A Structural Convergence of Traditional Assets and On‑Chain Derivatives

Equity perpetual futures fundamentally represent on-chain synthetic derivatives pegged to the price moves of traditional equities. By depositing stablecoins as margin, users can gain long or short exposure to the price moves of U.S. equities such as Apple, Tesla, and Nvidia, without actually owning the underlying shares or enjoying shareholder rights like dividends or voting. This product design adeptly combines the asset base of traditional financial markets with the mature on-chain perpetual futures mechanism, creating a novel financial instrument that retains the risk characteristics of equity prices while offering the flexibility of on-chain trading.

From the perspective of product, it is critical to clearly distinguish equity perpetual futures from tokenized equities (RWA stock tokens). Tokenized equities are typically issued on-chain by custodians who hold the corresponding real shares; their legal attributes and regulatory frameworks align closely with traditional securities. By contrast, equity perpetual futures do not involve any equity ownership. Instead, they rely solely on oracles to track stock prices and construct a trading market with pure price risks on-chain via funding rates, margin, and liquidation mechanisms. This distinction places the two products in entirely different categories: the former is about asset tokenization and on-chain transfer, while the latter is an innovation in risk trading derivatives.

The rise of equity perpetual futures is not accidental but the result of multiple converging factors. On the demand side, global users' demand for U.S. equity trading has been long suppressed given that traditional broker onboarding processes are cumbersome, cross-border capital flows are restricted, and trading hours are fixed. These contrast sharply with the crypto user’s preference for 24/7 trading, stablecoin settlement, and high-leverage flexibility. Equity perpetual futures provide an alternative pathway for users to participate directly in U.S. equity price movements outside the traditional financial system. On the supply side, since 2025 oracle technologies have matured, high-performance underlying blockchains have gained wide adoption, and competition among Perp DEXs has intensified, all of which have provided the necessary technical foundation and market impetus for the rollout of equity perps. More importantly, equity perpetual futures sit at the intersection of the “RWA (Real-World Asset)” narrative and the “on-chain derivatives” narrative, possessing the vast capital base of traditional assets along with the high growth potential of crypto derivatives, which make them a natural market focus.

II. Underlying Mechanisms: The Triple Challenges of Price, Liquidity, and Leverage

The stable operation of equity perpetual futures depends on a sophisticated set of underlying mechanisms, covering price discovery, asset synthesis, risk control, and leverage management. Among these, the price feed (oracle) serves as the cornerstone of the entire system. Since on-chain protocols cannot directly access real-time quotes from NASDAQ or the NYSE, decentralized oracles must reliably transmit traditional market price data to the blockchain. Current mainstream solutions include Pyth Network, Switchboard, Chainlink, and proprietary oracle systems developed by certain protocols. Pyth secures high-frequency updates and manipulation resistance by sourcing direct quotes from market makers and exchanges; Switchboard offers highly customizable aggregated price feeds, enabling protocols to switch update strategies across different sessions; Chainlink leverages a decentralized node network for resilient, continuous, and verifiable price delivery. Some leading protocols like Hyperliquid use self-developed oracle systems that achieve a higher degree of pricing autonomy through multi-source aggregation, internal index construction, and off-chain risk-control validation.

Oracles must address core issues far beyond simple data transmission. The U.S. equity market has unique structures such as trading session limitations (not 24/7), pre-market and post-market volatility, and trading halts, which require intelligent handling of market state transitions. Mainstream approaches introduce mechanisms such as market open/close indicators, time-weighted average price (TWAP) smoothing algorithms, and outlier filtering to ensure that on-chain prices remain anchored to real-world values during market closures, while mitigating manipulation risk in low-liquidity periods. For example, during U.S. market closures, oracles may automatically switch to a lower-frequency update mode or generate internal reference prices based on the last valid price combined with on-chain supply/demand signals to maintain trading continuity while controlling tail risk.

On the synthetic asset side, equity perpetual futures do not mint tokens representing real equity ownership. Instead, they use smart contracts to create virtual positions linked to the underlying stock price. Users deposit stablecoins such as USDC as margin to open long or short positions, with P&L determined entirely by futures prices and settlement rules. Protocols use a funding rate mechanism to balance long and short positions—the funding rate incentivizes counter-directional trades when positioning becomes excessively one-sided, helping maintain a relatively balanced risk profile across the system. Compared with crypto futures, equity perpetual futures' funding rates are also influenced by additional factors like U.S. market overnight costs and traditional market trading rhythms, showing more complex cyclical characteristics.

The liquidation mechanism is a core component of the risk-control system for equity perpetual futures and faces the challenge of managing volatility across two asynchronously operating markets: The U.S. equities trade only during specific hours, while the crypto market runs 24/7. When the U.S. market is closed and the crypto market experiences sharp movements, the value of users’ collateral can be rapidly eroded, increasing liquidation risk of equity perpetual positions. To address this, leading protocols introduce cross-asset risk engines and dynamic parameter adjustment mechanisms. During U.S. market closures, the system automatically increases maintenance margin rates, lowers maximum leverage limits, and tightens liquidation thresholds to mitigate jump-risk resulting from discontinuous information. Once the U.S. market reopens, risk parameters gradually revert to normal. This design both preserves on-chain trading continuity and lowers systemic risk from cross-market mismatches.

Leverage design also highlights structural differences between traditional assets and crypto products. While some crypto perpetual futures platforms offer leverage of 100x or more, the leverage of equity perpetual futures offered by leading protocols is generally capped between 5x and 25x. This conservative approach stems from multiple considerations: First, equity prices are driven by fundamentals including financial reports, macro events, and policy changes, resulting in volatility patterns distinct from crypto assets; second, U.S. markets can gap at open or exhibit post-market moves, where high leverage can exacerbate into cascading liquidations; finally, regulators maintain a cautious stance toward equity-linked derivatives, and restrained leverage helps reduce compliance risk. Even when interfaces display up to 20x leverage, the actual available leverage often dynamically adjusts based on market conditions, underlying liquidity, and concentration of user positions, forming a risk-control framework that is “flexible in appearance, stringent at its core”.

III. Market Landscape: Differentiated Competition and Ecosystem Evolution of Perp DEXs

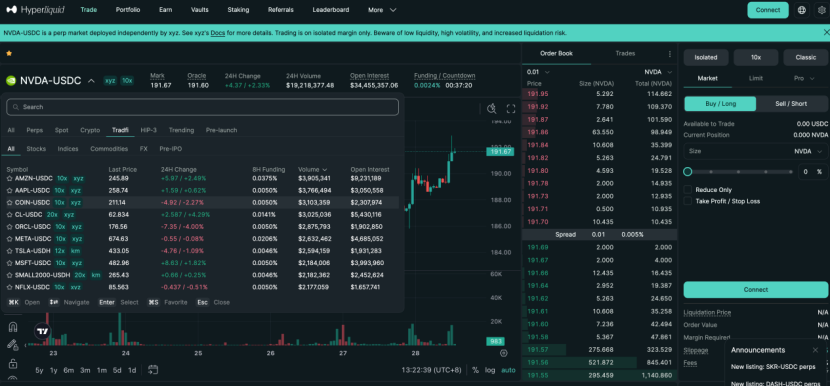

In the current equity perpetual futures market, a competitive landscape has emerged among leading Perp DEXs such as Hyperliquid, Aster, Lighter, and ApeX, with each exhibiting clear differentiation in technology architecture, product design, and liquidity strategies.

Hyperliquid has quickly entered the equity perpetual futures sector by leveraging its proprietary high‑performance chain and the HIP‑3 third‑party development framework supported by projects like Trade.xyz. Its core strengths lie in its deep order books and institutional‑level liquidity — the XYZ100 (a synthetic Nasdaq 100 index futures) records daily trading volumes of up to $300 million, while commodities such as SILVER and GOLD maintain open interest in the tens of millions. Hyperliquid uses a multi‑source median pricing mechanism that aggregates external oracle prices, internal EMA smoothed values, and order book market prices to generate a robust mark price for liquidation and margin calculations. This dual‑channel design of “professional matching + synthetic pricing” helps it balance high‑frequency trading and risk control effectively.

Aster has innovated with a dual‑mode architecture of Simple and Pro to cater to users with different risk preferences. The Simple mode adopts an AMM pool mechanism, enabling one‑click entry and zero‑slippage execution, suited for high‑frequency, small‑ticket, and short‑term traders. Its maximum leverage for equity perpetual futures is set at 25x. The Pro mode, built on an on‑chain order book, supports advanced order types such as limit and hidden orders, offering deeper liquidity and finer strategy execution, with a maximum leverage of 10x. Under Pro mode, tech equity perpetual futures such as NVDA have seen daily volumes in the millions and steadily growing open interest, indicating sustained participation by professional traders. Through this layered design of “traffic entry + deep market”, Aster has achieved effective segmentation of its user base and accelerated ecosystem expansion.

Lighter’s core proposition is its zk‑rollup provable matching system, where all trades and liquidations can be verified on‑chain via zero‑knowledge proofs, emphasizing transparency and fairness. Its equity perpetual futures currently support 10 U.S. stock tickers with a uniform leverage cap of 10x, reflecting a more conservative risk management stance. Its liquidity profile shows concentration at the top — COIN (Coinbase) often exceeds $10 million in daily volume, while NVDA and other mid‑tier names show moderate volume but relatively high open interest, suggesting the presence of medium‑to‑long‑term strategy capital. Lighter balances user experience with a simplified front end for easy onboarding, combined with a professional order book under‑the‑hood, satisfying the needs for professional execution.

It is worth noting that traffic entry points for equity perpetual futures are expanding beyond single protocol website into a diverse ecology. Aggregators such as Based.one integrate Hyperliquid’s core engine and provide more consumer‑friendly interfaces. Wallet‑embedded modules like Base.app allow users to open positions without leaving their wallet. Super apps such as UXUY further streamline the user journey, abstracting equity perpetuals into a Web2-like trading experience. This “protocol + application layer” division of labor is lowering barriers to participation and helping equity perpetual futures evolve from a niche professional tool to a mainstream trading product.

IV. Regulatory Challenges: Balancing Innovation and Compliance

The greatest source of uncertainty for equity perpetual futures lies on the regulatory front. Although no jurisdiction has yet enacted legislation specifically for on‑chain derivatives of this kind, regulators worldwide are closely observing their potential risks. The core issue centers on legal characterization: Do equity perpetual futures constitute unregistered securities derivatives?

In regulatory practice, U.S. authorities such as the SEC apply a principle prioritizing economic reality over technical form to derivatives tied to securities prices. Products closely related to regulated securities economically may fall under securities law jurisdiction regardless of their technological packaging. European regulators under frameworks such as MiCA have similarly emphasized that on‑chain derivatives pegged to traditional financial assets must still comply with existing financial regulations. This implies that even though equity perpetual futures do not involve custodial ownership of actual shares, their close linkage with U.S. equity prices could lead to classification as securities derivatives or contracts for difference (CFDs), triggering licensing, disclosure, investor protection, and other compliance requirements.

While regulatory attention currently focuses more on tokenized stocks and other products directly pegged to physical assets, the regulatory posture toward on‑chain “synthetic risk exposures” such as equity perpetual futures remains in an observational phase. Potential regulatory pathways may include: strengthening compliance responsibilities of front‑end operators (such as trading interface providers and liquidity facilitators); requiring transparency of price indices and oracle data sources; imposing restrictions on high leverage, reinforcing KYC/AML, and jurisdictional access controls; and explicitly folding these products into existing regulatory frameworks for derivatives.

To mitigate compliance risk, protocols may adopt strategies such as clearly distinguishing between “price tracking” and “equity tokenization”, emphasizing the synthetic and hedging nature of the product; employing multi‑source decentralized oracles to minimize manipulation concerns; setting prudent leverage caps and risk parameters to curb excessive speculation; and disclosing product risks and legal disclaimers comprehensively in user agreements. In the long term, the compliant development of equity perpetuals may require cooperation with licensed entities, providing services within regulated jurisdictions, or participating in regulatory sandbox programs.

In addition to regulatory risk, equity perpetual futures face a range of market and technical risks. Oracle failures or malicious manipulation can lead to erroneous liquidations; cross‑market volatility mismatches may amplify tail risk; insufficient liquidity can trigger severe slippage and difficulty closing positions; and smart contract vulnerabilities can be exploited to cause financial loss. These risks demand multi‑layered risk control frameworks, including but not limited to: redundant oracle sources with anomaly detection, dynamic margin adjustments, insurance fund buffers, futures security audits, and bug bounty programs.

V. Future Outlook: From Niche Innovation to Mainstream Financial Infrastructure

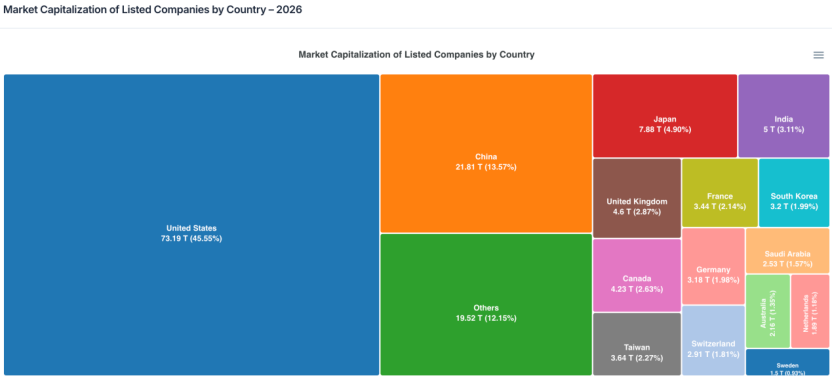

From the perspective of market scale, equity perpetual futures still enjoy great potentials. The total market capitalization of global listed companies approaches $160 trillion, with non‑U.S. markets accounting for over half of this pool — roughly $80 trillion in assets. Even a small fraction of capital participating through perpetual futures formats could easily reach hundreds of billions in scale. Drawing an analogy to crypto derivatives markets, where perpetual futures volumes have structurally exceeded spot volumes by more than three times, equity perpetual futures are expected to replicate a similar trend of derivative adoption within traditional asset classes.

In terms of product evolution, equity perpetual futures may represent just the beginning of a wider trend toward making all assets perpetual. As pricing mechanisms, clearing systems, and liquidity infrastructure mature, other asset classes including commodities (e.g., gold, oil), equities indices (e.g., S&P, Nasdaq), FX (e.g., EUR, JPY), and even interest rates — could be introduced into on‑chain perpetual futures frameworks. Perp DEXs may gradually evolve from crypto native trading venues into comprehensive multi‑asset derivatives markets, serving as crucial interfaces between traditional finance and on‑chain ecosystems.

Regulatory environments are expected to shift from ambiguity to clarity. Over the next 2–3 years, key jurisdictions are likely to issue classification guidance and regulatory frameworks for on‑chain derivatives, thereby clarifying compliance boundaries for equity perpetual futures. This transition may entail short‑term friction but ultimately benefit industry consolidation and compliant growth. Protocols that proactively build compliance capabilities, implement strong risk management systems, and maintain open dialogue with regulators are poised to gain competitive advantage under new rules.

In summary, equity perpetual futures are at a critical inflection point in their evolution from zero to one. They represent not only a natural choice for Perp DEXs seeking new narratives for growth but also a testing ground for the convergence of traditional assets and crypto finance. Despite ongoing technical and regulatory challenges, the huge underlying demand and asset scale ensure that this sector cannot be ignored. In the future, equity perpetual futures may not only become a cornerstone product of the on‑chain derivatives market, but also have the potential to reshape the way global retail investors participate in U.S. equity and broader asset trading, truly realizing a borderless, around‑the‑clock, and democratized financial market. In the process ahead, protocols that effectively balance innovation, risk, and compliance may become the builders of next‑generation financial infrastructure.