Bitcoin is closing the fourth quarter of 2025 on a weak note, reinforcing concerns that the market’s correction phase is far from over. After peaking at around $126,200 in early October, the flagship cryptocurrency has slipped into a sustained downturn, losing 30% of its market value at press time.

Since that peak, Bitcoin has struggled to decisively reclaim the $92,000 level, with repeated rejection at higher prices highlighting fading demand and growing caution among investors. Notably, crypto analyst GugaOnChain warns that the poor quarterly close could extend downside pressure into early 2026, as both on-chain data and sentiment indicators point to a continuation of bearish conditions.

Capitulation Indicators Signal Market Stress To Remain In 2026

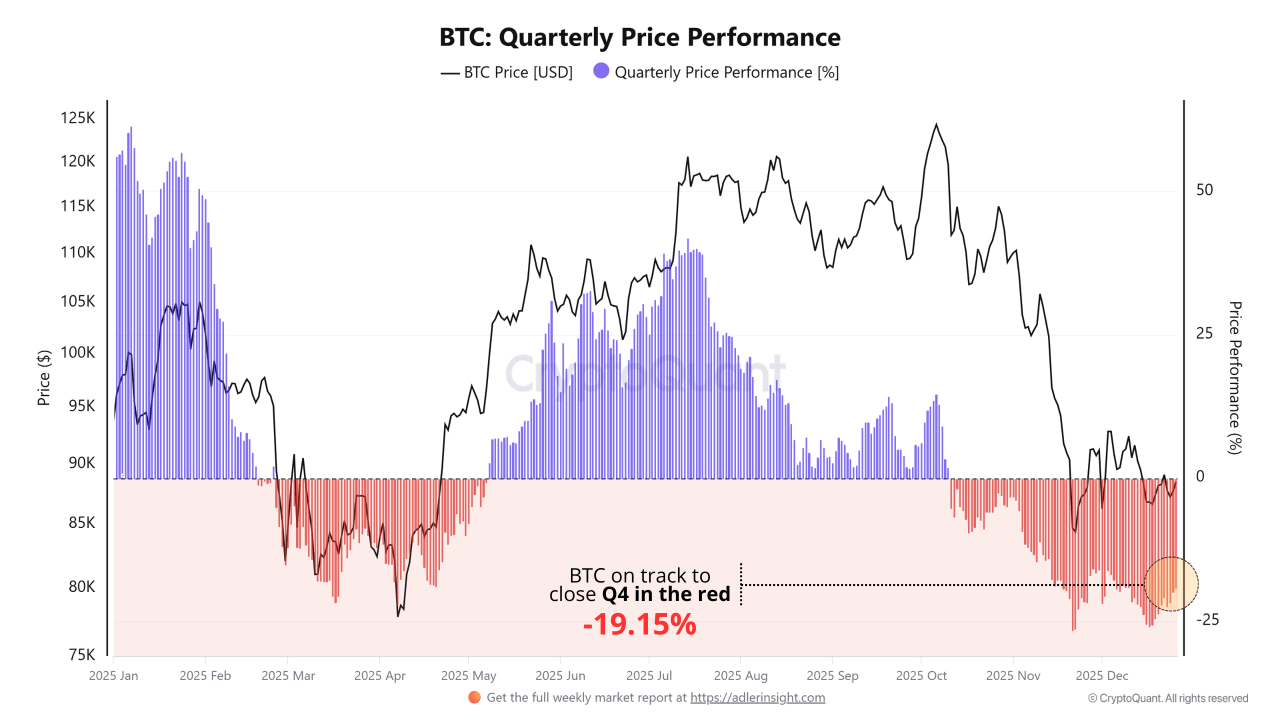

According to GugaOnChain in the QuickTake post on Friday, the BTC: Quarterly Price Performance indicator reports a negative Q4 performance of -19.15%, which serves as the foundation of this bearish outlook. Furthermore, several key capitulation indicators also suggest that the market is unprepared for any form of bullish revival.

For example, the Spent Output Profit Ratio (SOPR) currently sits below 1 at 0.99, indicating that investors are selling Bitcoin at a loss, a common feature of bear market phases. Similarly, the Short-Term Holder MVRV (MVRV-STH) remains below 1 at 0.87, signaling that short-term holders are deeply underwater and more prone to capitulation at the moment.

Further reinforcing this narrative, GugaOnChain points to the elevated percentage of Bitcoin supply in loss, currently standing at 35.66%, pushing more BTC holders into significant loss positions, thereby reducing confidence and driving market stress. In addition to these metrics, the Fear & Greed Index has dropped into the “extreme fear” zone at 20, suggesting widespread pessimism and risk aversion among participants.

Bear Market Confirmation Indicators

Beyond capitulation metrics, GugaOnChain highlights additional confirmation indicators that suggest that downside risks will remain dominant in the near term. One of these indicators, the Market Cap Growth Rate, measured by the 30-day versus 365-day moving average gap ratio, is firmly negative at -11.65%, pointing to contracting market growth rather than expansion.

Institutional flows also reflect waning confidence. US Bitcoin spot ETFs recorded $825.7 million in net outflows between December 18 and December 24, 2025, highlighting reduced institutional appetite as the Q4 price struggles persist. Meanwhile, the Coinbase Premium Gap has remained negative at –66.11, signaling weaker demand from US-based investors compared to offshore markets.

In assessing these several metrics together, GugaOnChain concludes the crypto market is likely to remain in a bear phase for the next two to three months. Therefore, investors should anticipate further corrections in the first quarter of 2026 until the capitulation signals ease and demand is stabilized.

At press time, Bitcoin trades at $87,436, reflecting a slight market loss of 0.42% in the last day.