Source: Jiqizhixin

Unexpectedly, the pace for AI startup listings has accelerated so rapidly.

News on Sunday night revealed that the renowned domestic AI startup MiniMax (XiYu Technology) has published its post-hearing information pack (PHIP) version of the prospectus on the Hong Kong Stock Exchange, marking a critical sprint phase in its listing process.

MiniMax was established in December 2021, headquartered in Shanghai, and founded by former SenseTime executive Yan Junjie and others. It focuses on researching and developing general artificial intelligence (AGI) technology that integrates text, speech, and visual multimodal capabilities. The company is well-known for its MiniMax M1 and M2 foundation models, as well as AI-native products like MiniMax Voice, Hailuo AI, and Xingye.

The company is poised to set a record as the AI company with the shortest time from founding to IPO.

As a leading global full-modal large model company, MiniMax's prospectus systematically discloses its business layout, user scale, financial data, and future strategy for the first time, demonstrating its strong momentum and unique positioning in the global AI race.

Over 200 Million Users, Overseas Revenue Exceeds 70%

MiniMax is a dual-wheel driven company centered on "Large Models + AI-Native Applications". The company states that its open platform has become "one of the world's largest enterprise and developer open platforms," supporting rapid deployment across industries such as smart devices, healthcare, culture and tourism, and finance.

The prospectus shows that as of September 30, 2025, MiniMax has over 212 million individual users from more than 200 countries and regions, and over 100,000 enterprises and developers from more than 100 countries. The average monthly active users (MAU) of its AI-native products grew rapidly from 3.144 million in 2023 to 27.622 million in the first nine months of 2025, demonstrating strong user stickiness and growth momentum.

This vast user base is distributed across the globe: MiniMax's prospectus discloses that overseas markets contribute over 70% of its revenue, highlighting its significant success in international expansion and cross-market commercialization.

Financial data shows that MiniMax achieved revenue of $53.437 million USD in the first nine months of 2025, an increase of approximately 174.7% year-on-year, indicating rapid growth. Revenue primarily comes from two segments: subscriptions and in-app purchases for AI-native products, and the open platform & enterprise services.

Adopting a "Model as Product" philosophy, efficient operations have led to a healthy financial cycle: its accounts receivable days outstanding is only 38 days, significantly lower than the AI or SaaS industry average of 60-90 days, showcasing excellent cash flow recovery capabilities and operational efficiency.

On the To C side, MiniMax directly serves global users through native products like Hailuo AI, Xingye / Talkie (AI social), and MiniMax Voice. As of September 30, To C revenue grew 181% year-on-year, and the number of paying users surged 15-fold in less than two years.

On the To B side, MiniMax empowers various industries through its open platform, providing leading model capabilities via API to enterprises and developers. Its open platform processes over trillions of token requests daily. To B revenue achieved 160% high growth during the same period, with a gross margin as high as 69.4%, indicating strong profitability.

MiniMax has also established cooperative ecosystems with leading domestic and international tech companies. Overseas, its models are available on the global AI platforms of Amazon, Google, and Microsoft's cloud services; it provides video and voice technology to companies like LinkedIn and Monks (a digital creative agency). Domestically, MiniMax's technology serves core products of giants like Alibaba, Tencent, ByteDance, Xiaomi, and Kingsoft Office, and provides human-like interaction capabilities for humanoid robots like Zhiyuan Robotics. This broad and deep industry integration proves the practicality and reliability of its technology.

The prospectus content shows that MiniMax's adjusted net loss for 2025 was nearly flat compared to the same period last year, achieving effective narrowing of losses amidst rapid growth. This is attributed to a diversified revenue model and efficient cost investment — as of September 2025, the company's R&D expenses increased by 30% year-on-year, while sales and marketing expenses decreased by 26%.

Full-Modal AI Technology Layout

MiniMax's success is built on a clear and efficient path: its forward-looking "full-modal" technology matrix forms a solid underlying competitiveness.

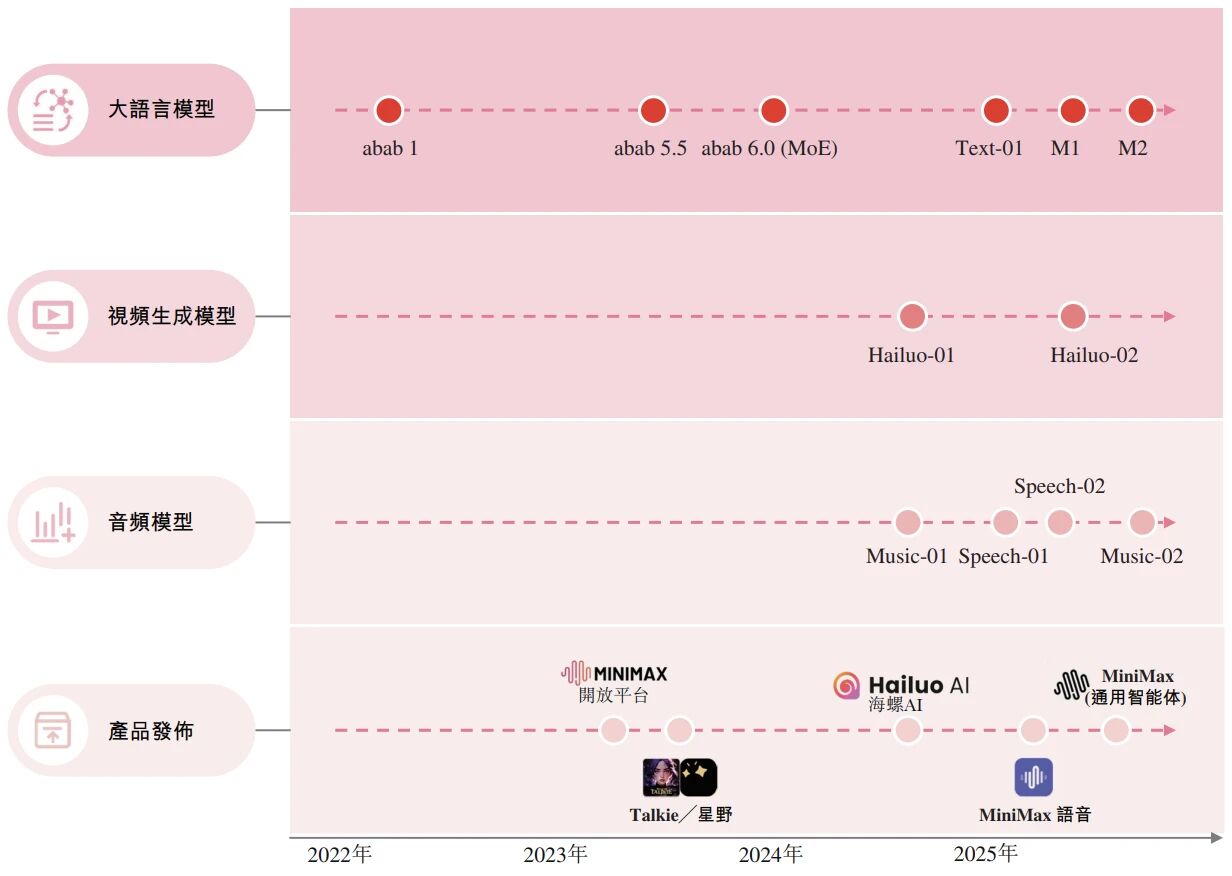

MiniMax is one of the few large model companies that has focused on full-modal model R&D since its inception. Since its establishment, MiniMax has undergone intensive technological iterations, achieving breakthrough progress in speech, video, and text models, often garnering attention within the tech industry.

-

Starting in 2023, MiniMax launched China's first Transformer architecture-based speech large model, Speech 01, and an upgraded version, Speech 02, in 2024, ranking first in comprehensive performance. To date, MiniMax speech models have helped users generate over 220 million cumulative hours of speech.

-

In August 2024, MiniMax released the video generation model Video 01 and the video generation product Hailuo AI. In June 2025, it launched the upgraded version Hailuo 02, ranking second in the AA Video Arena rankings. To date, MiniMax video models have helped creators generate over 590 million videos.

-

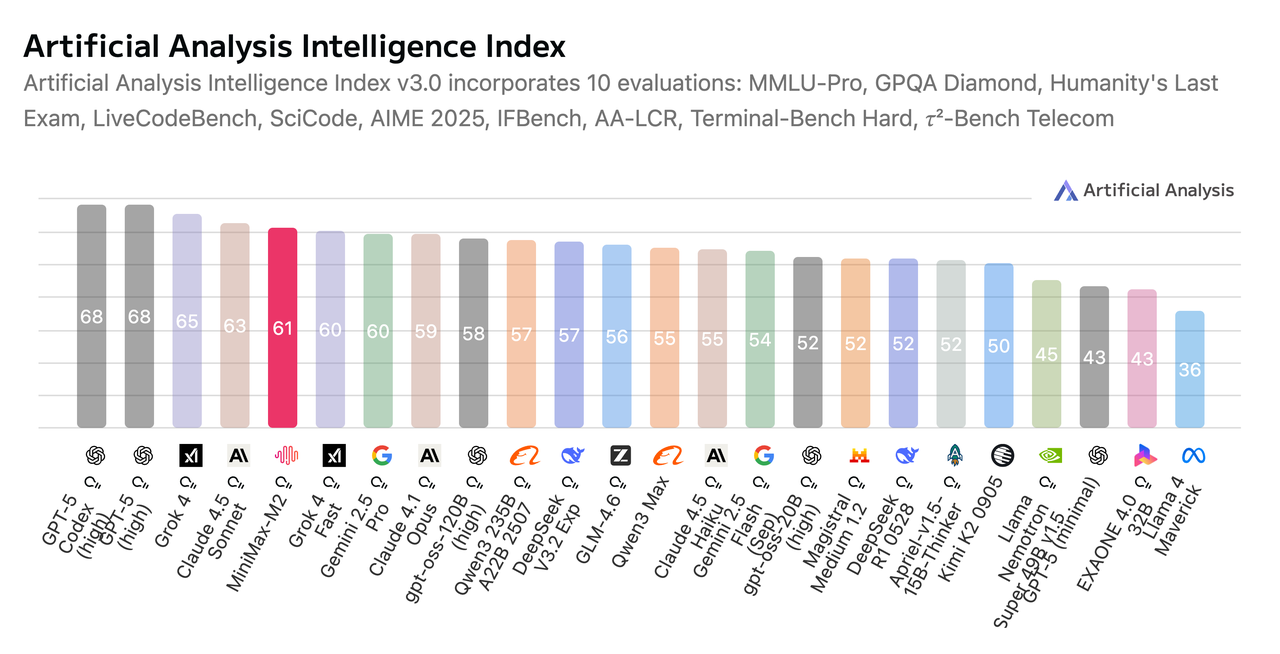

In October 2025, MiniMax released and open-sourced its new-generation text large model MiniMax M2, ranking among the global top five (and first among open-source models) on Artificial Analysis leaderboard, marking the first time a Chinese open-source large model entered the global top five on this list.

Evidently, its R&D is not about single breakthroughs but systematically advances across four key modalities — text, video, speech, and music — forming a complete and synergistic technology matrix.

Among these, the new-generation text large model MiniMax-M2, released and open-sourced on October 27th this year, is particularly noteworthy.

This large model's inference speed is nearly twice that of Claude Sonnet 4.5, with comparable performance but at only 8% of the cost. At the AWS re:Invent 2025 held in December, Amazon announced that its fully managed generative AI cloud service, Amazon Bedrock, had incorporated MiniMax-M2 as a representative domestic model.

MiniMax-M2 can not only excellently plan and stably execute long-chain tool invocation tasks but also coordinate calls to Shell, browsers, Python code interpreters, and various MCP tools.

The key technology employed by MiniMax M2, "Interleaved Thinking," has been widely discussed in overseas AI research communities. This technology enables the model to continuously accumulate contextual understanding within a "Think-Act-Reflect" loop and adjust strategies in real-time based on feedback. This approach, closer to how real engineers work, significantly enhances MiniMax M2's Agent execution capabilities, providing stronger planning, higher execution robustness, and more reliable self-correction in complex tasks, forming its most distinctive core advantage.

During the M2 model release period, it quickly climbed to the top spot for domestic model token usage on the global model aggregation platform OpenRouter and ranked third globally for token usage in programming scenarios.

Massive R&D Investment, Pursuit of Ultimate Efficiency

Similar to most AI large model companies, MiniMax is still in a phase of continuous high R&D investment, rapidly iterating its large models, and has not yet achieved profitability.

In the first nine months of 2025, the company's net loss reached $186 million USD (adjusted net loss, a Non-IFRS measure). While revenue achieved explosive growth of over 170%, the adjusted net loss only increased slightly by 8.6%. Losses were primarily attributable to R&D expenses, fair value changes of financial liabilities, and listing-related expenses.

Among these, R&D expenses in the first nine months of 2025 reached $180 million USD, equivalent to 337.4% of total revenue; the R&D expense ratio has decreased from over 2000% in 2023 to 337.4%. This change reflects both the operating leverage brought by rapidly expanding revenue scale and the company's continued investment in key areas like model iteration and infrastructure.

Notably, alongside massive R&D investment, the organizational and commercial efficiency demonstrated by MiniMax is exceptionally high.

The company's total workforce is approximately 385 people, with about 300 in the R&D team, accounting for nearly 80% of the total staff. Core members come from top global tech companies like Microsoft, Google, Meta, and Alibaba.

Its R&D and product teams are highly youthful, predominantly "post-95s" (born after 1995), and include a significant number of "post-00s" engineers. This structure highly aligns with the current AI R&D paradigm — possessing a natural understanding of new tools, automated processes, and Agent-based, AI-native working methods, significantly amplifying per capita output.

In terms of R&D model, the administrative hierarchy under the CEO is no more than 3 layers. Project-oriented and "minimalist" approaches drastically shorten the implementation path, allowing the company to maintain extremely high cost-effectiveness even in the highly compute and capital-intensive competition.

Since its founding until September 2025, MiniMax has cumulatively spent $500 million USD, achieving:

-

A leapfrog iteration from leading in a single modality to leading in full modalities.

-

Three modalities in the international first tier, with breakout products.

-

Breakthroughs every year, continuously reaching new levels.

The loss in the first nine months of this year ($186 million) is even less than the single-quarter user acquisition spending for some major internet companies' large models.

This efficiency advantage is also reflected in recent financial trends.

In the first nine months of 2025, the company's R&D expenses increased by only about 30% year-on-year, while revenue growth reached 174.7%, and sales and marketing expenses decreased by 26% year-on-year — which is uncommon for an AI company still pursuing rapid growth.

This "scissors difference" indicates that the core driver of growth is not simply "burning money for scale" — it stems more from improved model capabilities, product口碑 (word-of-mouth) diffusion, and released organizational efficiency, rather than relying on large-scale advertising and market subsidies.

"Post-95s" at the Helm

Judging from the information disclosed in the prospectus, the composition of MiniMax's board of directors is highly consistent with its "youthful, highly technology-driven" company characteristics.

The four executive directors have an average age of only 32 ("post-95s"), which is extremely rare in the history of Hong Kong-listed companies.

They are deeply embedded in the company's frontline R&D and business advancement, themselves being the direct responsible persons for relevant areas, including:

Founder & CEO Yan Junjie (36), COO Yun Yeyi (31), Head of Large Language Model Research and Engineering Zhao Pengyu (29), and Head of Visual Model Research and Engineering Zhou Yucong (32).

Non-executive directors and independent non-executive directors assume more roles in governance, supervision, and institutional checks and balances.

This board composition is highly suited to a young AI company still in a phase of rapid technological evolution, led by founders and the engineering system, and aligns with its overall strategy emphasizing long-term technology investment and high organizational efficiency.

MiniMax stated in its prospectus that the proceeds from this listing are intended to be used primarily for the following purposes:

-

Approximately 70% for R&D over the next five years, including large model upgrades and AI-native product development;

-

Approximately 30% for working capital and general corporate purposes.

The company stated it will continue to advance its vision of "continuously提升智能水平并人人可享" (continuously提升 intelligence level and making it accessible to everyone), enhancing social productivity and personal quality of life through technological普惠 (inclusiveness).

The AGI Story Should Be Young

MiniMax's sprint towards a Hong Kong listing signifies more than just the capitalization of another AI unicorn. It is telling a younger story about AGI.

Within this young team, a group of people are using AI-native thinking to create entirely new types of ventures, making their story bold enough — firmly betting on full modalities and globalization. This all-out race注定 (destines) challenges and opportunities to coexist, but it might also be the right way towards AGI.

As reflected in MiniMax's prospectus performance, with the continuous development of technology and business, this company will continue to break through upwards, fulfilling its long-term vision: Intelligence with Everyone.