原创 | Odaily 星球日报(@OdailyChina)

作者 | Asher(@Asher_ 0210)

Aster:提供永续和现货交易的去中心化交易所

项目简介

Aster 是一个提供永续和现货交易的去中心化交易所,旨在为全球加密货币交易者提供一站式的链上交易场所,它由高性能且注重隐私的 L1 公链 Aster Chain 提供支持,并得到 YZi Labs 支持。

Aster 的特色包括无 MEV、简单模式下的一键执行。此外,专业模式增加了 24/7 股票永续合约、隐藏订单、和网格交易,可在 BNB Chain、Ethereum、Solana 和 Arbitrum 上使用。其独特优势在于能够使用流动性质押代币(asBNB)或生息稳定币(USDF)作为抵押品,释放资本效率。

昨日,Aster 宣布新的 Aster 第 2 阶段空投查询已上线,用户仍可选择领取空投或全额退还 S2 交易费。

对于没有参与第 2 阶段的用户,仍然可以参与 Aster Dawn 第三阶段活动。Aster Dawn 第三阶段于 10 月 6 日上线,仅持续到 11 月 9 日,共五周,用户可在 Aster Pro 交易获取 Rh 积分,用于第二阶段奖励,积分将按每周周期计算。

值得一提的是,Aster 于 10 月 11 日表示,已完成一轮 1 亿枚 ASTER 代币回购,所有购买的代币都保存在以下地址:0x02DCd5b2DdE0F6edb4B797DA468fBc52F23f49Dc。

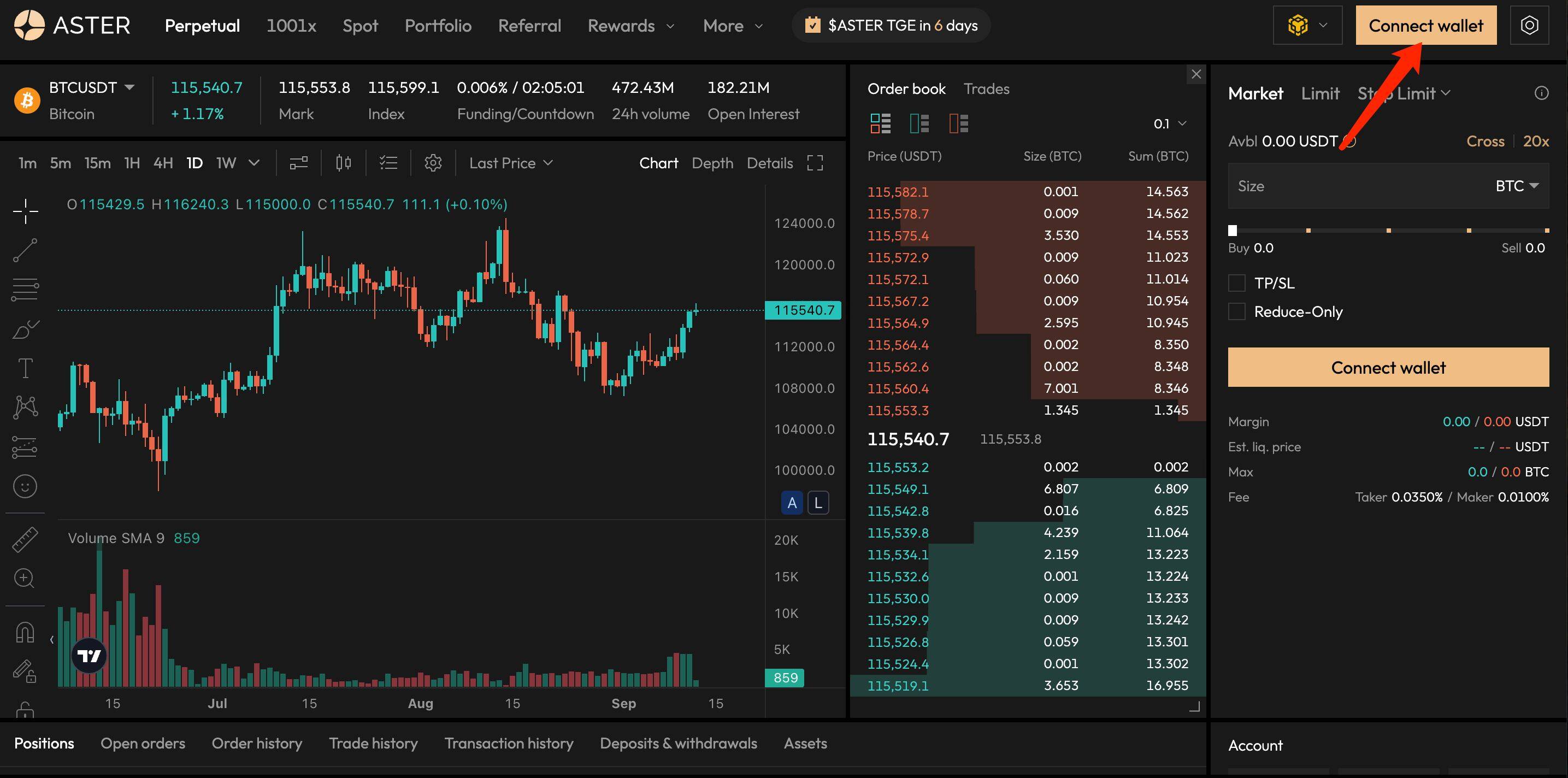

交互教程

STEP 1. 进入交互网站(链接:https://www.asterdex.com/),并连接钱包。

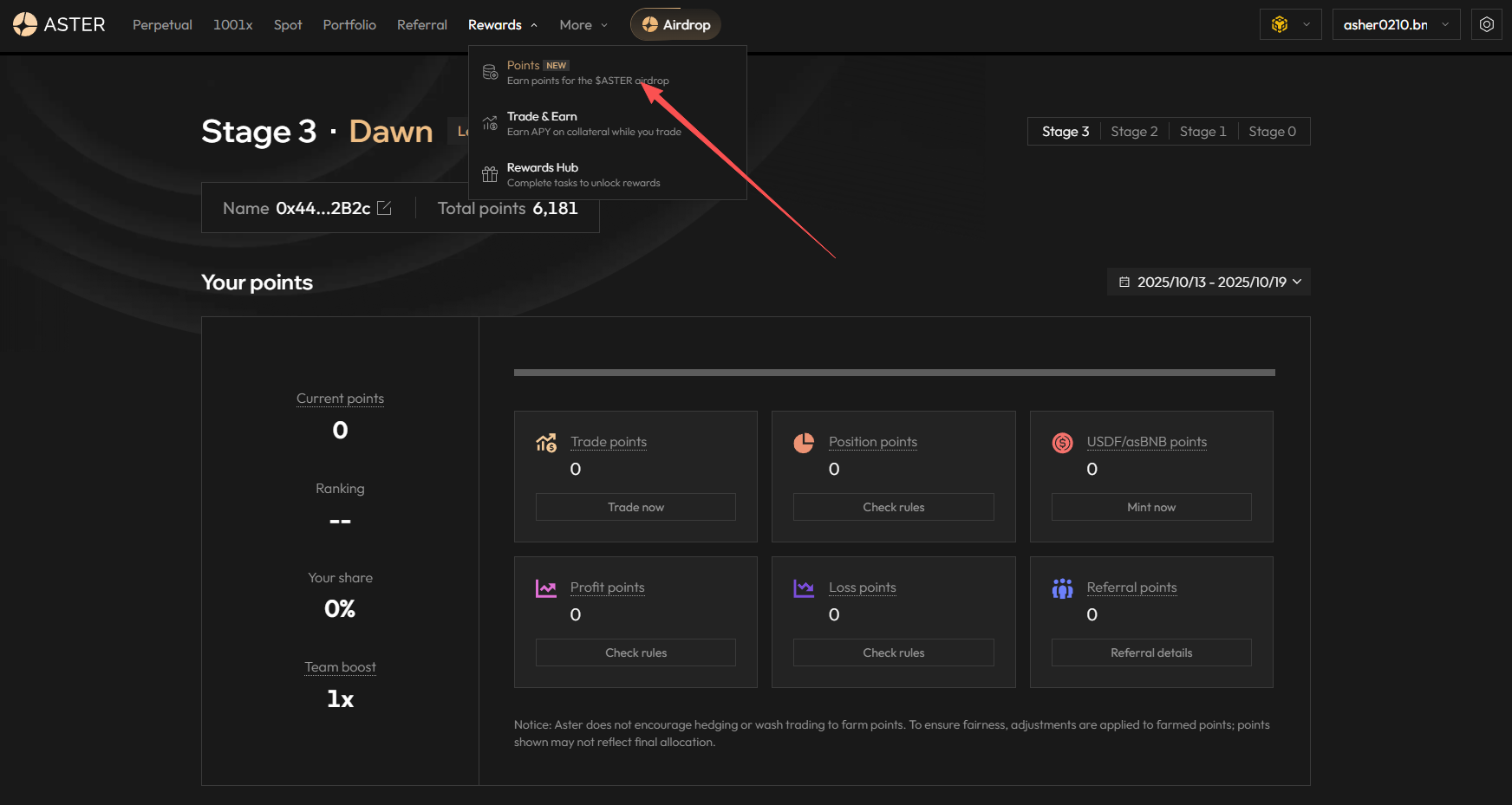

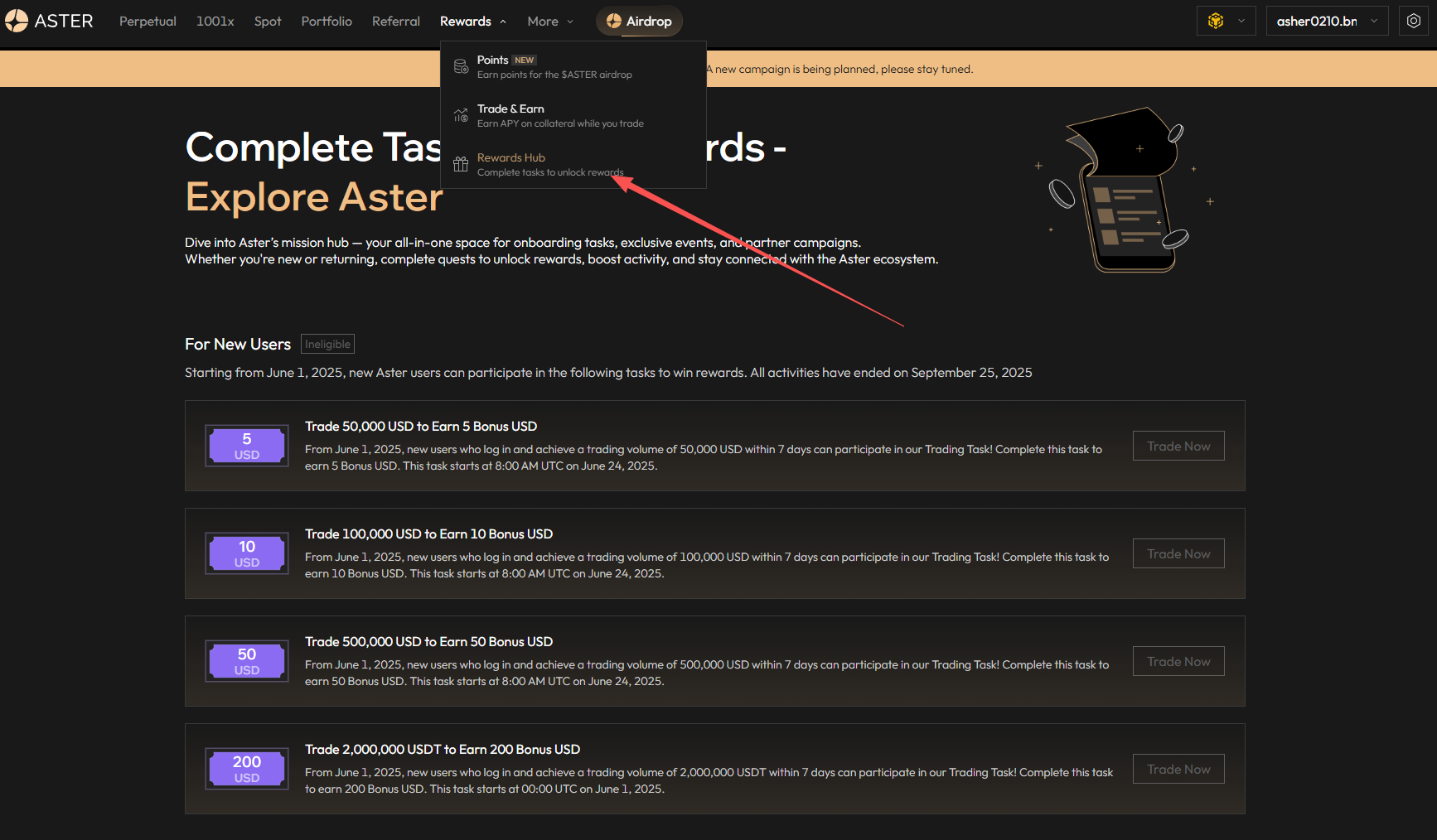

STEP 2. 点击“Rewards”后选择“Points”,可获得个人邀请链接,并查看账户的 Rh 积分数量。

STEP 3. 点击“Rewards”后选择“Rewards Hub”,完成对应交易任务获得对应奖励。

Rayls:兼容 EVM 的区块链生态系统

项目简介

Rayls 是一个兼容 EVM 的区块链生态系统,专为金融机构打造,兼顾企业级的隐私保护、可扩展性、互操作性与去中心化特性。通过 Rayls,金融机构可以将金融资产与现实世界资产(RWA)进行代币化,结合央行数字货币(CBDC)完成支付,并简化跨境外汇和机构内部的支付流程。

根据 ROOTDATA 数据显示,目前 Rayls 已完成两轮融资,总金额超 2500 万美元,其中:

- 2023 年 1 月,Rayls 宣布完成 1500 万美元种子轮融资,ParaFi Capital、Framework Ventures、L4 Venture Builder 参与投资;

- 2024 年 8 月,Rayls 宣布完成 1000 万美元 A 轮融资,ParaFi Capital 领投,Framework Ventures、L4 Venture Builder 和 Núclea 参投。

交互教程

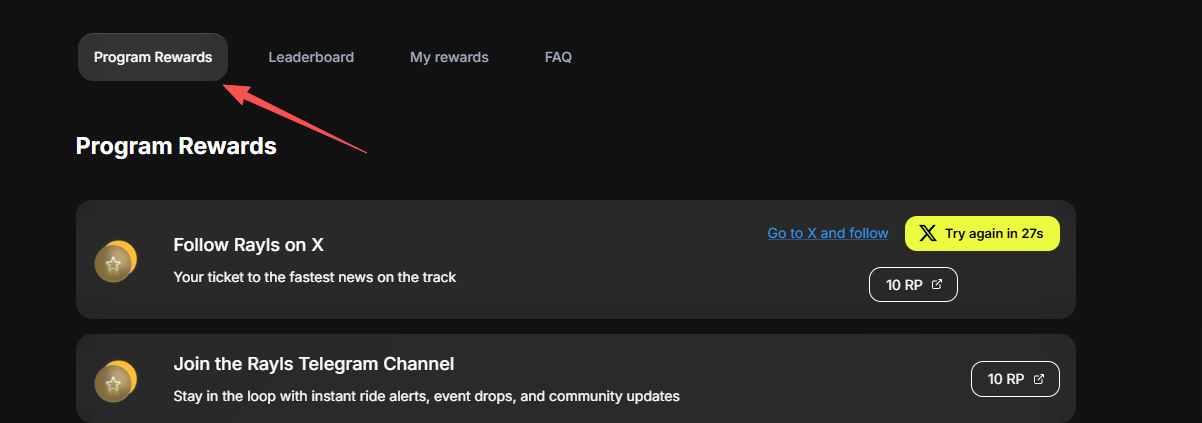

STEP 1. 进入交互网站(链接:https://app.fuul.xyz/landing/rayls-loyalty-rewards),通过 Web3 钱包进行账号登录,任务一绑定 X 账号后,关注官方账号即可获得 10 RP 积分;任务二加入官方 TG 社群也可获得 10 RP 积分。

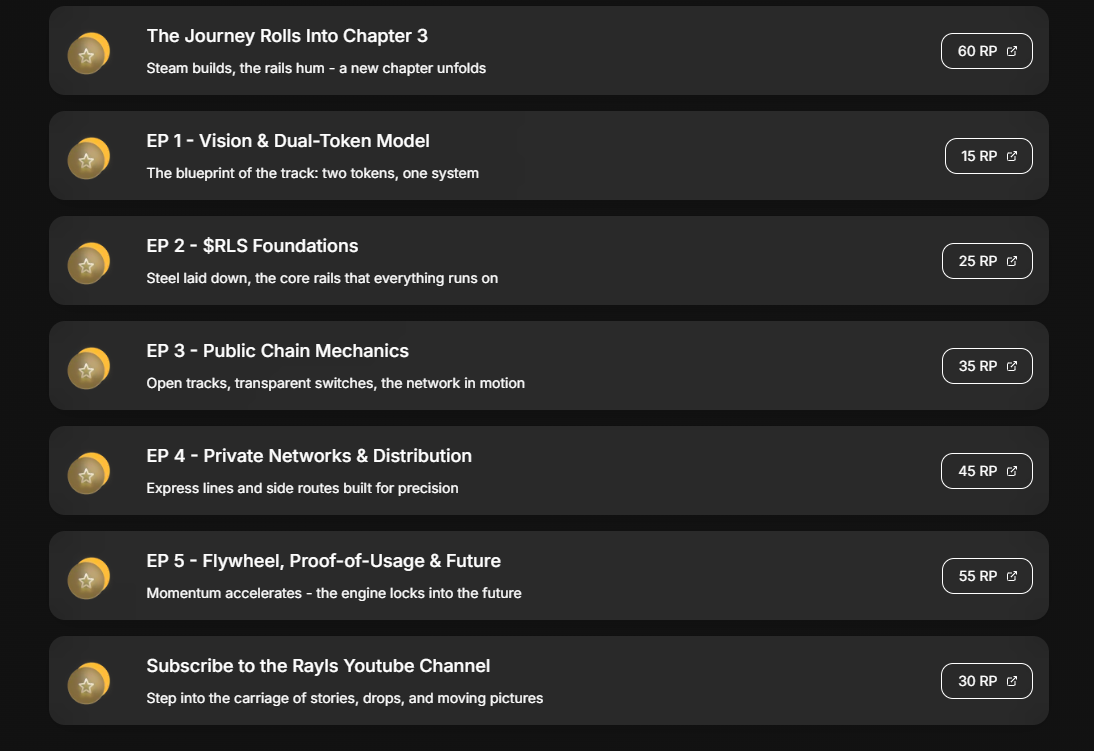

STEP 2. 如下图,以下任务会跳转至 Galxe 平台,任务答案分别为:

EP 1 - Vision & Dual-Token Model:B、B、C、C、C;

EP 2 - Foundations $RLS:B、C、D、C;

EP 3 - Public Chain Mechanics:B、B、C、B、A;

EP 4 - Private Networks & Distribution:C、B、A、C、A;

EP 5 - Flywheel, Proof-of-Usage & Future:B、B、B、B、A。

Fanable:Web 3 收藏品平台

项目简介

Fanable 是一个 Web 3 收藏品平台。10 月 10 日,Fanable 宣布获得 1150 万美元支持,投资方包括 Michael Rubin 旗下 Fanatics、Ripple、Steel Perlot、Polygon、Borderless、Morningstar 等。

Fanable 称已达成超 2 万笔交易、月增速 100%,将用于平台迭代与全球扩张。其与 Collect Foundation 合作上线 COLLECT 代币积分挖矿,代币将用于社区奖励、交易激励与治理。Fanable 与 Brinks 合作,支持全球以加密货币与法币买卖交易宝可梦等卡牌,覆盖 iOS、Android 与网页版。

交互教程

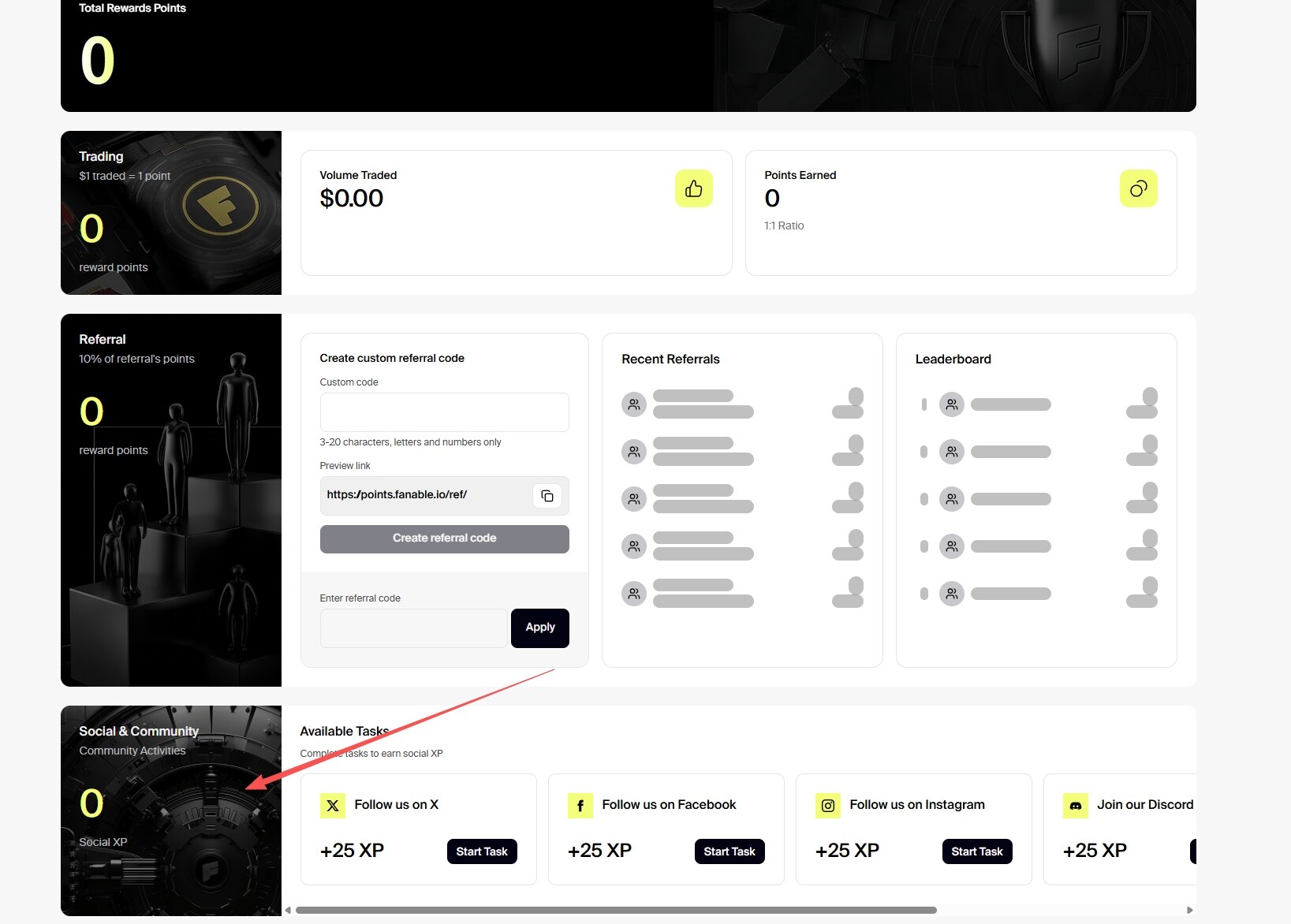

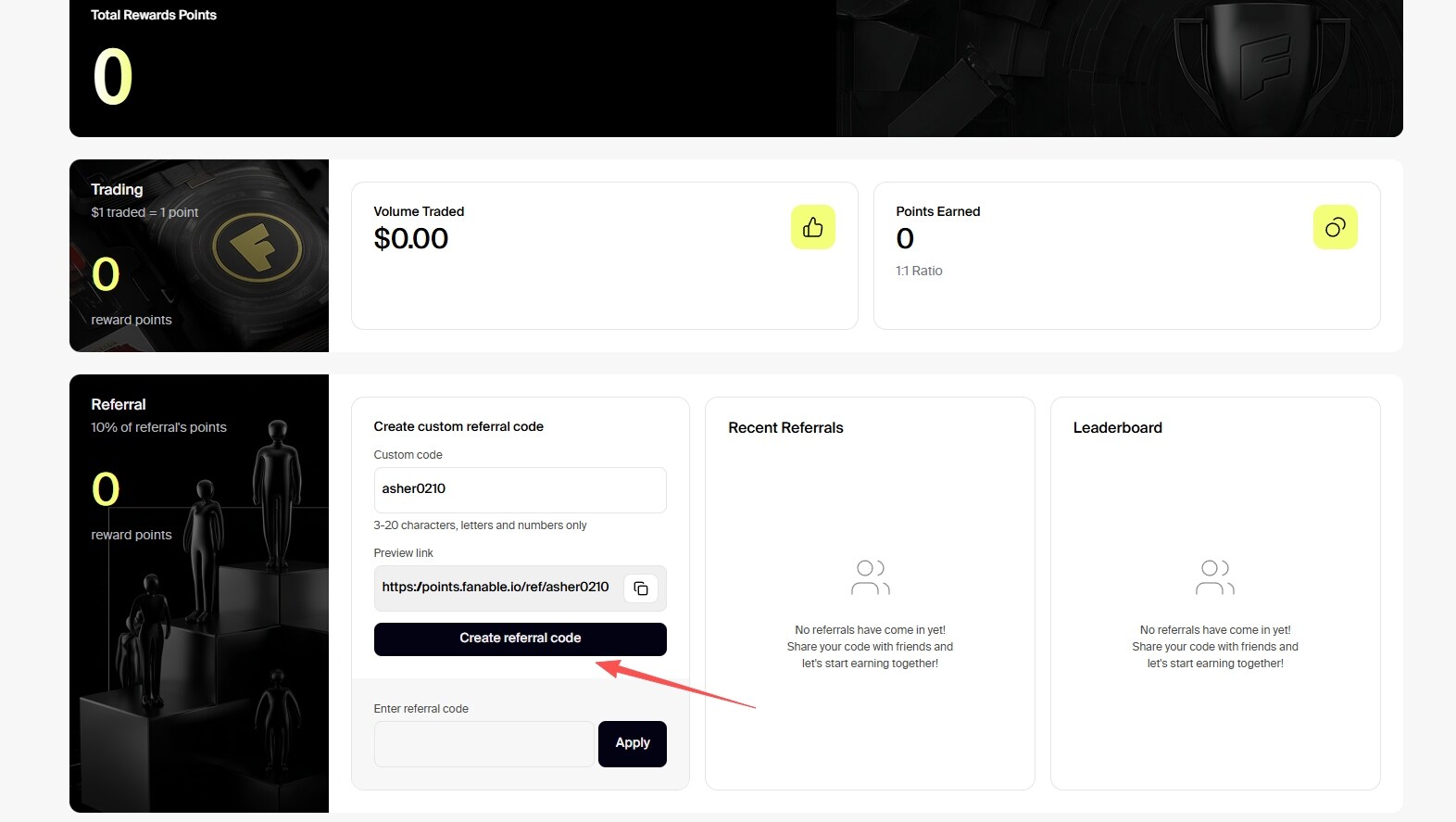

STEP 1. 进入交互网站(链接:https://points.fanable.io/),连接钱包,完成 5 个社交任务,可获得 125 XP 积分。

STEP 2. 如下图生成个人邀请连接,通过邀请好友也可获得额外 XP 积分。

STEP 3. 通过在 Fanable 市场交易获得 XP 积分(官网链接:https://fanable.io/)。