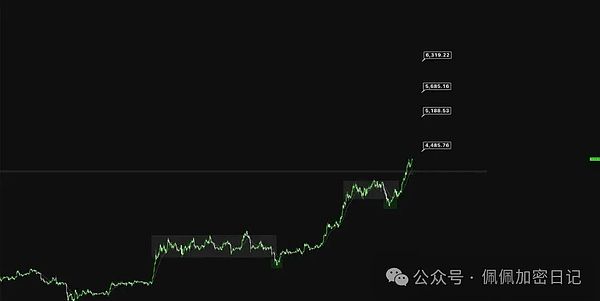

比特币暴涨12万,一夜暴涨6000点!以太坊暴涨4300,距离历史前高,只差一步之遥!佩佩7月底暴跌抄底比特币1121000,3386以太坊,一直在手里拿着,按照佩佩文章策略抄底的粉丝可谓是赚麻了,比特币多单暴赚884%,以太坊多单也在手里拿着。

比特币

目前比特币震荡通道,假跌破真突破,周线比特币收于11.8万美元以上,几乎吞没前一周阴线,显示出强劲势头,突破12.3万美元将是关键信号。日线级别呈现典型的AMD派发形态,此前跌破11.6万美元为机构压盘吸筹,随后回升确认支撑。目前行情已进入派发尾声,非追多良机。

比特币前高附近短线波段可以考虑部分止盈再赌突破,日内多头追龙入场的潜在关键位置。

日内小级别回调 120.3-120.8k

突破前高 123.3K 回踩 下一个阶段目标123.4k (等距目标)

多单:跟着佩佩从112100抄底的粉丝开业一直拿着,没有多单的,的BTC CME 在 118,405 美元 到 119,110 美元的缺口。这个缺口补上的概率还是蛮大的,可以关注一下,入一点。

空单:想做空btc,这月接空点上移到:125000(短空)、129600(高空)

ETH

ETH 每次盘整假跌破后开启拉升,不分析了,就是涨。用斐波那契扩展大法量了一下后面一些关键数字。作为目标参考吧。个人阶段目标4500。

目前以太坊从强势的单边上涨,进入了上升箱体当中。目前这段 1H 上涨行情的结束关键,个人认为是在价格有效跌破 4150 区域后,并且在下方做第一个下跌箱体出来。

如果是要进行波段短多的话,入场机会在于价格继续回踩 4150 区域后的有效反弹,第一目标自然是重新回到箱体上边界:4325区域

第二目标就是突破这个箱体后咯,按照箱体高度来说,可能会在 4490 这一块吧。

SOL

从日线级别来看,K线6连阳,呈现V型底反攻,已成功突破所有均线压制,重回上升通道之中,其MACD也开始拐头向上,有形成零上金叉的趋势,一旦形成,后续将会开启新一波上攻,再去冲击200压力位

山寨

比特币暴涨12万、以太坊暴涨4300,目前币圈的主叙事就是ETF牛,谁有ETF谁牛。ETF牛市特征

①:有ETF的链就是金字塔顶端(BTC、ETH),先吃最稳的大资金流入。

②:接下来资金可能会顺着ETF主链往生态流淌(ETH ETF → DEFI/L2/meme),并不是均匀分布,而是优先找标杆性资产(比如UNI、ARB、热门meme)。

towns:

这个币玩了好几次,终于开始起飞了,价格处于低位,随时一根大阳线,上周五还在提示拿好这个币呢,包括vip都是在价格0.033u附近入手的多,现在开始启动了,至于还在持有的小伙伴自己把握利润哦,后续不在跟踪了!

LDO:LDO价格刚刚有效突破 $1.12–$1.15 的关键阻力区(红色区间),这是过去 2024–2025 年多次冲击失败的位置,本次突破伴随放量,确认趋势转多。 MACD:形成周线级别金叉,并且柱状图正向放大,这种形态通常意味着未来几周还有进一步拉升的空间。

成交量:本周成交量明显放大,是自 2024 年初以来最大的一次买盘量,表明资金正在集中进场。 上方阻力:短期目标在 $1.48;若突破,则看向 $1.74 的重要高点,上破后有望冲击 $2.50–$3.00 区间。

swarms:

现在跌下来了,依然有二三十个点的利润 昨天0.21吹起冲锋号 随后一路暴涨最高涨到0.34 最高拉了50多个点,跟着佩佩一起赚钱的可以给佩佩一键三连。

SLERF

树懒官推来了一句会重启,这种情况大概率就是主力筹码收完了!同时日线级别也出量了,大周期周级别收筹码的行为也很明显! 同时市值只剩下3000来万,主力在此刻卖出没有任何价值!很容易出现爆破性的1-2倍的拉升阳线! 这个我也囤入了一些,这里性价比确实不错。