作者:Hotcoin Research

加密货币市场表现

当前,加密货币总市值为 3.86万亿美元,BTC占比 60%,为 2.3万亿美元。稳定币市值为 2698亿美元,最近7日增幅1.04%,其中USDT占比61.21%。

CoinMarketCap前200的项目中,大部分上涨小部分下跌,其中:MNT 7日涨幅41.91%,PENDLE 7日涨幅31.81%,PUMP 7日涨幅29.16%,MYX 7日涨幅1420.3%,TOSHI 7日涨幅22.52%。

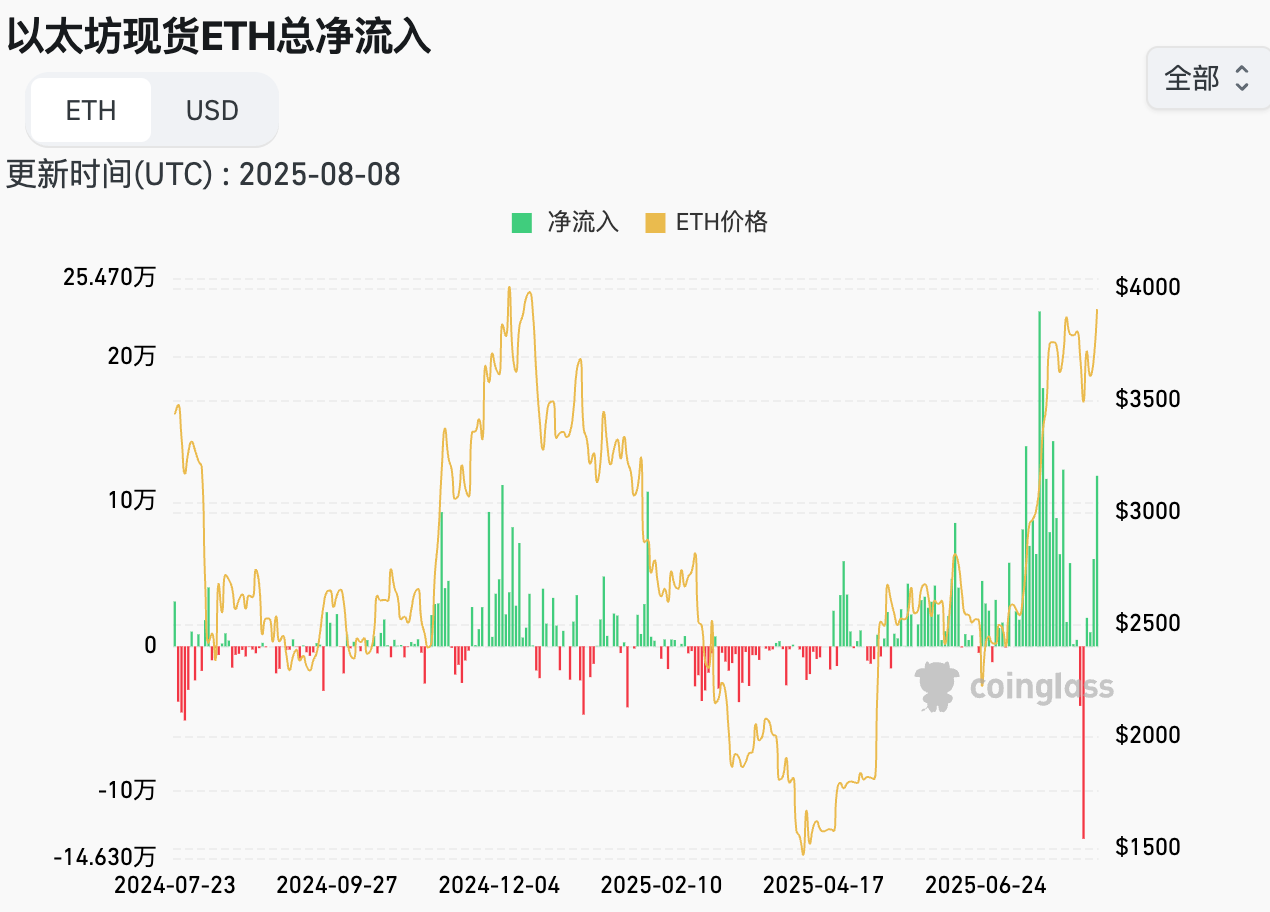

本周,美国比特币现货ETF净流入:2.536亿美元;美国以太坊现货ETF净流入:3.264亿美元。

市场预测(8月11日-8月15日):

本周稳定币持续增发,美国比特币、以太坊现货ETF持续净流入,以太坊在本周突破4000美金,表现亮眼。RSI指数为62.75,呈现超买。恐惧贪婪指数为68(指数高于上周)。

BTC:大概率在114,500-118,500美元区间震荡,突破方向将取决于美国CPI数据。若数据支持降息预期,有望测试120,000美元;若数据强劲,可能回落至112,500美元支撑;

ETH:表现可能继续强于BTC,主要波动区间3,750-4,200美元。SEC关于现货ETF的任何积极信号都可能推动ETH继续突破。

短期投资者:可采取区间交易策略,在支撑位附近买入,阻力位附近部分获利了结。

中长期投资者:应利用可能的回调机会分批建仓,重点关注BTC 112,500美元和ETH 3,300美元附近的强支撑区域。

了解现在

回顾一周大事件

1. 8 月 6 日,美国证券交易委员会发布关于流动性质押活动的声明,称流动性押活动不被视为证券;

2. 8 月 6 日,Base 发布宕机事故报告,其于 8 月 5 日出现了 33 分钟的区块生成中断,原因是其切换到了一个备份排序器,而该排序器未正确设置以处理交易;

3. 8 月 5 日,京东旗下京东币链表示,已关注到市场上的不实报道和谣言,京东币链特此回应,正在进行香港稳定币牌照申请的准备工作;

4. 8 月 7 日,据 Etherscan 数据,以太坊网络昨日日交易笔数升至 187 万笔,接近 2024 年 1 月 14 日创下的 196 万笔历史最高纪录;

5. 8 月 6 日,芝加哥期权交易所(CBOE)旗下 Cboe BZX 已向美国证券交易委员会提交 19b-4 文件,要求允许 VanEck 以太坊 ETF 通过受信任的质押提供商质押 ETH,以获得奖励作为收入;

6. 8 月 6 日,芝加哥期权交易所(CBOE)旗下 Cboe BZX 已向美国证券交易委员会提交 19b-4 文件,要求允许 VanEck 以太坊 ETF 通过受信任的质押提供商质押 ETH,以获得奖励作为收入。SEC与Ripple正式结束为期4年的法律战,维持一审判决;

7. 8 月 8 日,特朗普宣布提名「亲加密」官员Stephen Miran担任美联储理事。

宏观经济

1. 8 月 6 日,美国白宫表示,特朗普签署一项行政令,对来自印度的商品额外加征 25% 的关税,以回应印度继续购买俄罗斯石油。特朗普对印度出台新的关税后,油价短线走高,触及日内高点;

2. 8 月 7 日,英国央行降息 25 个基点,将基准利率从 4.25% 下调至 4%,为本轮降息周期的第五次降息,符合市场预期;

3. 8 月 7 日,美国至 8 月 2 日当周初请失业金人数 22.6 万人,预期 22.1 万人;

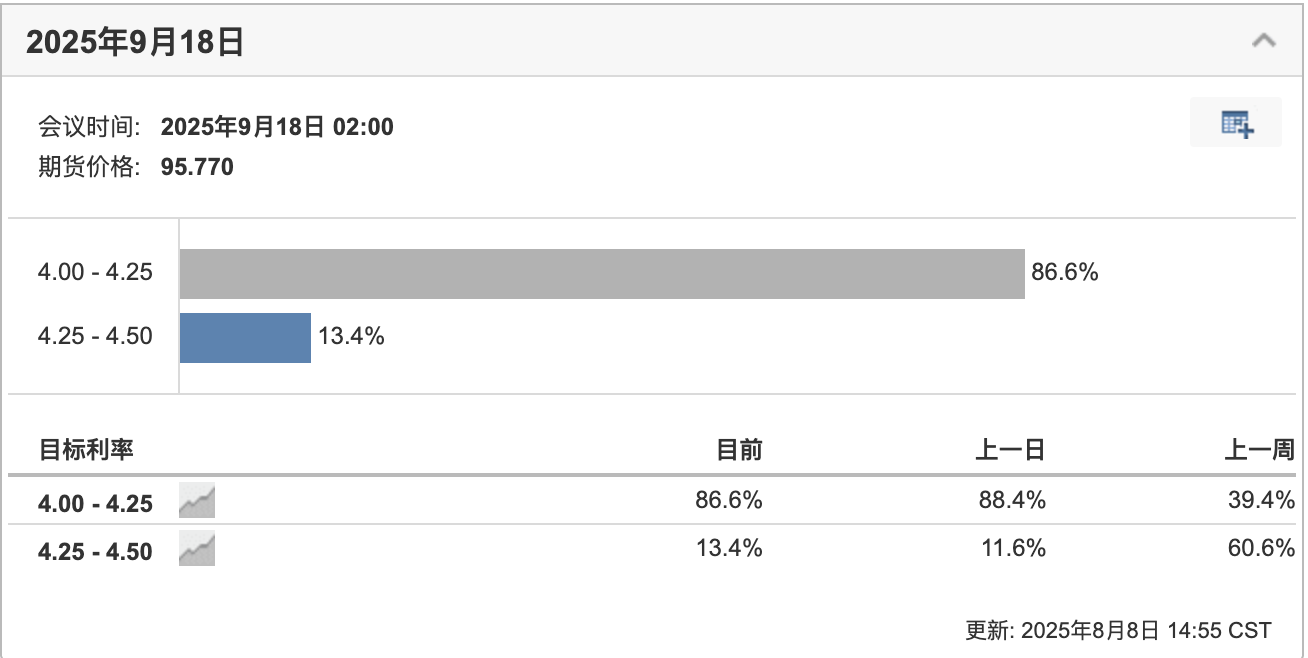

4. 8 月 8 日,据 CME「美联储观察」数据,9 月降息 25 个基点的概率为 92.7%,维持利率不变的概率为 7.3%。

ETF

据统计,在8月4日-8月8日期间,美国比特币现货ETF净流入:2.536亿美元;截止到8月8日,GBTC(灰度)共计流出:236.62亿美元,目前持有210.58亿美元,IBIT(贝莱德)目前持有859.56亿美元。美国比特币现货ETF总市值为:1520.24亿美元。

美国以太坊现货ETF净流入:3.264亿美元。

预见未来

活动预告

1. Coinfest Asia 2025 将于8 月 21 日至 22 日在印度尼西亚巴厘岛举办;

2. WebX Asia 2025 将于 8 月 25 日至 26 日在日本·东京举办;

3. Bitcoin Asia 2025 将于 8 月 28 日至 29 日在香港会议展览中心举办。

重要事件

1. 8月12日12:30,澳洲联储将公布利率决议;

2. 8月12日20:30,美国将公布 7月未季调CPI(年率);

3. 8月14日20:30,美国将公布 上周季调后初请失业金人数(千人)(至0809)。

代币解锁

1. Aptos(APT)将于8月12日解锁 1130万枚代币,价值5304万美元,占流通量的2.2%;

2. Avalanche(AVAX)将于8月15日解锁167万枚代币,价值约3914万美元,占流通量的0.33%;

3. Starknet(STRK)将于8月15日解锁1.26亿枚代币,价值1618万美元,占流通量的5.98%;

4. Sei(SEI)将于8月15日解锁5556万枚代币,价值约1712万美元,占流通量的1.21%;

5. Arbitrum(ARB)将于8月16日解锁9263万枚代币,价值约3911万美元,占流通量的2.04%。