原文作者:@CodeNightOwl

一、全自动撸毛总体流程说明

(限于篇幅,只说每个环节原理,细分只能后续独立开篇,部分补充就在回复里吧)。

1.电脑来电自动开机(只需设置bios来电启动)

2.全自动运行脚本任务,机器停电或异常重启(只需将总控程序随系统启动)

3.脚本异常重启(比如使用指纹浏览器,2000个用户id,单机启动多少个浏览器)完成所有任务后,汇报进度到tg,日志写入数据库,方便查看板统计。

这里大致说下思路,如果某些浏览器因为代理原理,项目方网站等原因产生了异常,那么就等待几分钟后再重试,先做下一个浏览器,如果这个浏览器id连续错误达到设定比如5次,就不再重复,而是2000个做完后,tg,wx汇报异常,由人工查看。为什么要这么自动?那既然都说自动化撸毛了,你看完下面的就知道:对,就得唯快不破,要卷只卷自己。

好吧:先上2年前的初始架构图,相对简陋,但太近也不便给你看不是:

二、硬件方便的配置,如何自动化运维

1.廉价机集群的搭建,如图比如搭建一个便宜的e5集群,建立资源池,一键克隆几百个机器来备用。

用途(仅简单描述,多了一是不好懂,二是几小时也说不完):

1.1 做管理机,可手动处理一些小任务,临时处理某些项目,统一管理,自己电脑不会乱,也更加安全;

1.2 用来执行单任务,一些只需要单开浏览器的,纯图色模拟,ocr识别模拟,这样每次只开一个浏览器,根据任务时间,计算一天的总量,单机一天做几百个浏览器, 例如单虚拟机一天200个浏览器,要做2000,克隆10台即可。

1.3 用来领水,虽然购买2cpacha,CapSolver这样的可以解决临时领水问题,但是每1-2k就是一个猪脚饭了,如果一ip一天又能领取3次,领取半年那消耗就不少,项目多了消耗也大,既然我们都是撸毛了,能节约自然毛都不想给。怎么领? 但指纹浏览器模拟点击cloudfare这样的主流的就过了,至于其他变态的就不解释了,除了tw这样的,都有解决办法,因为一般领水也不会有。

1.4 搭建局域网文件服务器,数据库服服务器,代理机,即时通讯等(不解释)。

1.5 用来搭建一些节点,一鱼多吃啥的,你买云服务器,那个内存,cpu很是心酸,用你本地的,只需要解决带宽就好,内存比白菜都便宜。配个图吧:

2.高端机器配置,比如最新的i9+3060+显卡+64内存,得有个几台吧

用途(仅简单描述...):

2.1 用来多开浏览器,这时候需要吃内存,也吃硬盘,带点游戏的项目吃显卡,这样的好处比如单机40开浏览器,可以快速完成2K号的任务,做4K号怎么办?克隆几台就好了,可预装好系统,git同步,连接局域网数据库。 你也可跟网吧一样,ghost多播等。

就不配图了,可能陆续就能看到我其他推文的截图。

2.2 用来临时打手动,都自动化了,还有手动吗?自然,因为就几个小时的任务你写上自动化的时间手都打完了.

三、如何实现脚本的自动化?

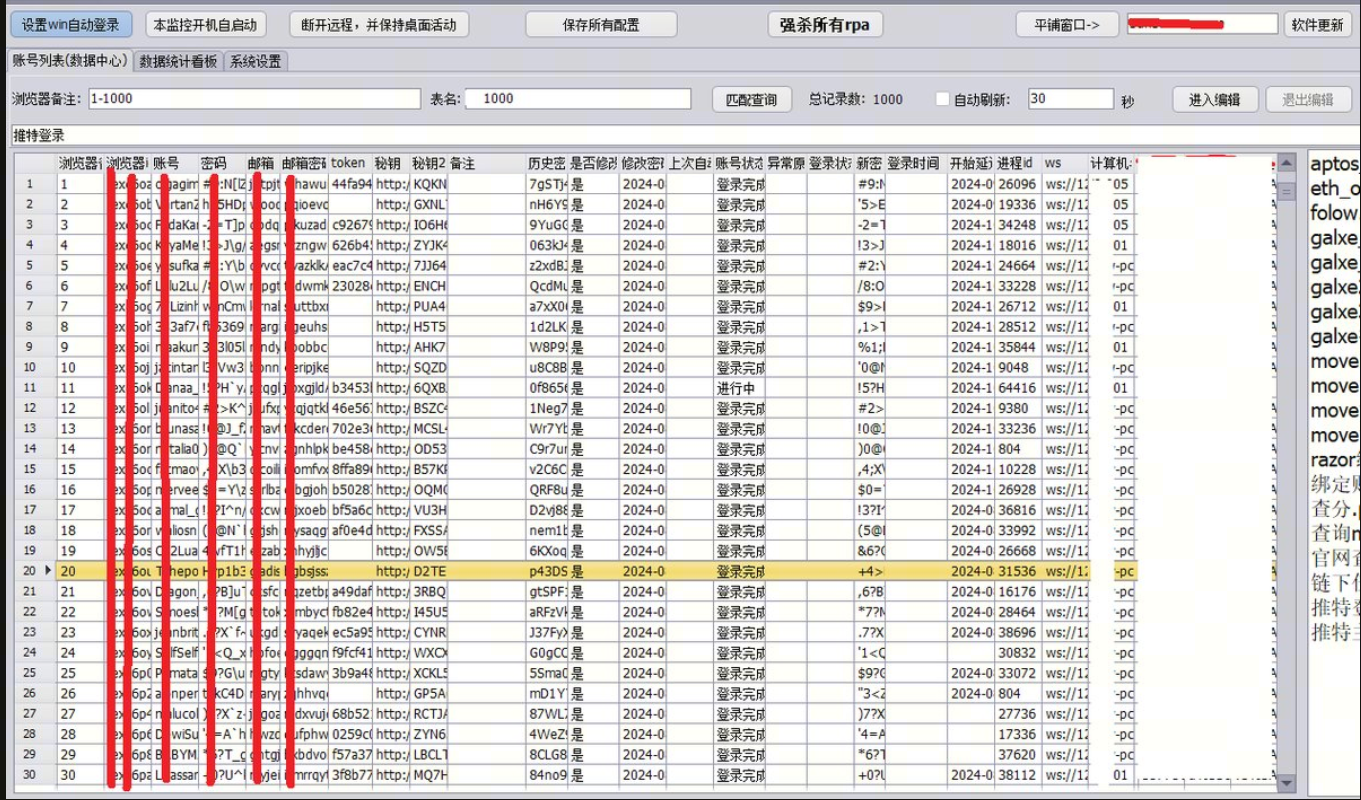

1.实现一个主监控,查询数据库,看板,配置参数(比如异常几次,单机开多少个浏览器),全局管理这一台机就看主监控了,配置好主控后,他就会启动启动主脚本控制程序。如图:

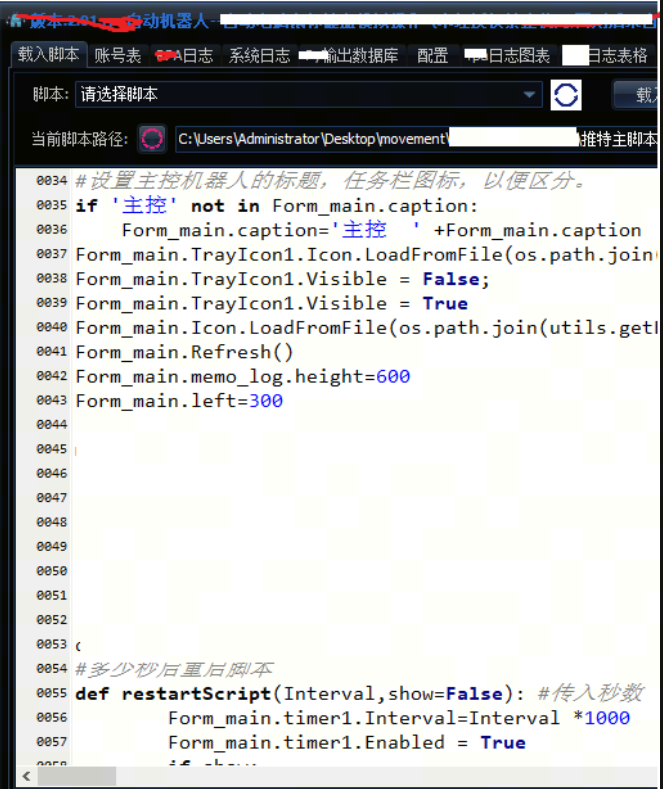

2.实现一个脚本控制程序,用于启动浏览器执行脚本, 如果是多开浏览器,是用多线程吗?不,我建议是多进程,这样万一脚本卡主只影响这一个浏览器,就跟chrome一样道理。此程序需要执行脚本执行,就看根据各位语言选择,比如选择js,还是python,lua,或者pascal之类,为什么要用脚本?就是自动git了就执行,不然你得重新编译,项目很多都是短平快,甚至几十种交互,需要修改的,自然就没有效率。如果你不具备构建这些能力,你就会使用一点python,好吧,前面这些就当没说了,思路只是借鉴,你独立执行python就可以了。

如图:

3.是否一定要中心数据库? 是的,你要快,这是必然的,不然局域网这么多机器怎么全自动启动就知道干什么,因为他们都读取数据库配置啊,对应的机器名称,或者他主监控配置,根据读取数据库就知道各自去干什么了,通常我们都没显示器。 当然你就是要跑单机,一个个去处理下又怎么样呢?是的,闲着也是闲着,开心就好。但我们的口号是能机器尽量不人工。

4.还没说到怎么怎么具体跑浏览器自动化? 这个就需要各位根据自己的能力去找对应的解决方案了,搜索下一堆,js在网页是一等公民, python当然因为他的库天下第一,所以建议就这两个,加上需要做脚本载入,自然也他们两个更合适。框架诸如Selenium,Puppeteer,Playwright等。

四、跑协议(脱机),跑合约?

这个方面,链上基本都是对接rpc,其他需要网页调试,就不展开说,大多时候是一个可选项,或者辅助项,当然你就用这一项完成任务,那么ok,前面的都不用看了,你也似乎没必要看到这里来了。

五、如上自动化怎么对抗女巫的简单说明

1.模拟,加入随机,自然是安全度最高的,鼠标移动,点击按下弹起的时间,输入的速度,这些函数都经过封装后,通常很难被检测的。

脚本的随机时间,因为指纹浏览器每个启动都有一个独立的id,所以每次启动的时候随机启动,其实连自己都不知道规律在哪里,比人工自然随机得多。

2.跑协议,只能凭运气,如果项目方前端检测,因为他的网站是后台更新的,他只要加入一个简单的隐藏参数或者检测,某一天网站更新了,你还在用老版网站数据来交互,但是他也让你协议能正常交互通过,那这时候你该明白么? 再举个例:就好比他多一个v2接口新网站交互,你一直用v1,请问他网站都更新了,你怎么去打开的v1? 也有一些库,他会检测你的鼠标,键盘的行为,然后提交,所以你协议中并没模拟这个数据,但是你也能交互,最后是否决定你女巫就看项目方了。 再举例:个人认为movment这样的不容易女巫的原因,是因为除了领水你很多交互都是在各自项目方或者galxe这样三方平台上的。

六、安全的问题

1.机器运维安全,首先每台机器防火墙配置,对外不开放端口,保持基本工作在局域网内,

2.代码内不能有敏感数据,比如私钥,钱包密码等,都需要是加密的。

3.如果你有员工,觉得钱包能到处私钥怎么办,我觉得疑人不用是最好的,不然都很难。 有的工作室修改钱包插件来防止员工,但他要真懂卸载重新导入一个插件,或者替换下插件里的钱包文件也是能恢复的,若他真不懂,那心思也就小。 当然你可以用堡垒机,全程录制,用于追溯,但事实上长期跑起来你要防自己人,个人认为多半是不现实的,百密一疏 ,毕竟去中心化零容错,不能像交易所你改个密码就好了。而且丢了不仅是钱,丢了他会很长时间恶心你,比如你还继续撸吗?

4.聊天工具被监控,你做什么在现在大数据时代就不多解释了吧,不中毒都有人能看到,因为隐私问题只是民事, 不起诉都没事,聊天内容审查很多人都有权限看, 甚至普通员工,因为他上面约束的只是法律,懂的都懂。你发出私钥他查看信息,对屏幕拍个照就行。

5.安全总是开始会觉得很注意,一段时间之后一定就松懈了,毕竟要安全就麻烦。

就到这里吧,确实不能用这么一点文字就能表达出太多,就当先抛砖引玉吧。