原文作者:Frank,Foresight News

「我是以太坊杀手,打钱」,伴随着 2018 年 - 2020 年新公链们轻松圈地、融资、炒作的时代一去不复返,近些年来已鲜少有人提及「以太坊杀手」的大额融资叙事。

但 3 月 12 日,财富杂志援引消息人士披露,由 Jump Trading 前研究负责人 Keone Hon 创立的 EVM 兼容区块链项目 Monad Labs 却正在谈判以 30 亿美元估值筹集超 2 亿美元资金,且 Paradigm 或将领投,表示计划投入 1.5 亿美元。

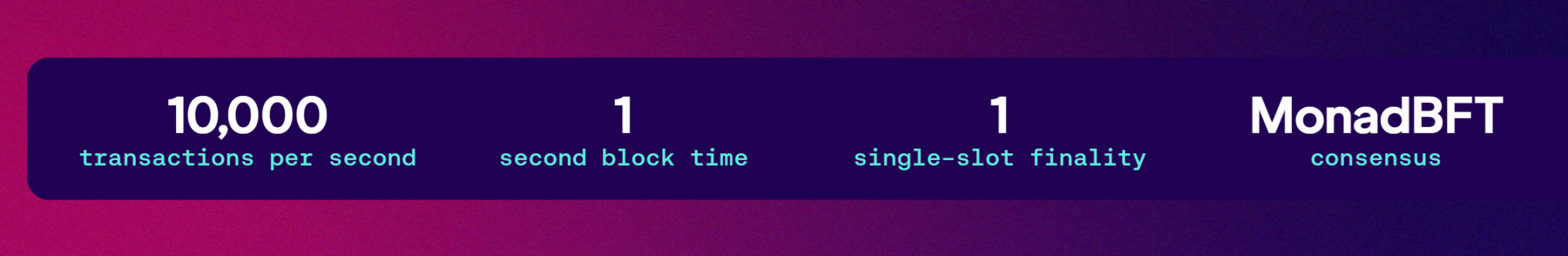

昨夜 Monad 也正式上线 Devnet,表示「在 EVM 上实现了 1 万的真实 TPS」,在 Dencun 升级让以太坊 /L2 叙事看起来似乎再度性感的当下,听起来无疑有点让人晃神儿。

那作为曾经的 Crypto 风投巨子,Paradigm 敢于如此大手笔押注的 Monad Labs 究竟是一个怎样的区块链项目,「EVM 兼容区块链」又与其它兼容 EVM 网络有何特别之处?Monad 又会是新生代的「以太坊杀手」种子选手么?

Monad Labs:兼容以太坊的高性能 L1

Monad 官方文档将自己定义为采用 PoS 机制的「兼容 EVM 的高性能 L1」,旨在通过以太坊交易的流水线执行来开创新的公链可能性范式。

其中前半句的「兼容以太坊」,是指 Monad 为应用程序开发人员(完全兼容 EVM)和用户(兼容以太坊 RPC API)都提供了无缝兼容性,支持所有以太坊操作码,任何在以太坊上部署的合约都直接适用于 Monad。

因此现有的以太坊工具和密码学环境可以无缝插入 Monad,同时相比在以太坊上运行,又可受益于改进的吞吐量和运行成本,总的来看,这种适用范围包括:

应用程序(任何为以太坊构建的 DApp);

开发工具(例如 Hardhat、Apeworx、Foundry 等);

钱包(例如 MetaMask 等任何 EVM 兼容钱包)

分析 / 索引(例如 Etherscan、Dune 等);

而后半句的「高性能 L1」,究竟又有多高性能?「 1 万 TPS」,即每天 10 亿笔交易(作为对比,以太坊目前每天处理大约 100 万笔交易),这也是 Monad Labs 官网给人印象最深的标签化信息。

在此基础上,Monad 还提供 1 秒的区块时间和 1 秒的单个 slot 实现(single slot finality),从而支持比现有区块链更多的用户和更好的互动体验,同时提供更便宜的每笔交易成本。

如何实现「 1 万 TPS」?

具体来说,Monad 主要是通过在 EVM 中引入「并行执行」(Parallel Execution)和「超标量流水线」(superscalar pipelining),来实现「 1 万 TPS」的超高性能。

并行执行

「并行执行」并非新概念,此前的 Solana、Sui、Aptos 等都采取了并行化策略,最大的优势便是允许单个区块链系统同时处理大量的交易,且多个交易可以并行独立运行,从而提高整体性能。

简单举例的话,以太坊就像是只有一条闸机通道的高速收费站,只能挨个上高速,一旦遇到客流高峰就会发生拥堵;而采用并行执行的区块链网络,则可以类比为有多条闸机通道的高速收费站,使其能够同时处理 N 辆汽车的上高速需求,加快了处理速度。

不过不同于 Solana、Sui、Aptos,Monad 则是目前唯一在 EVM L1 引入并行架构的区块链网络。

超标量流水线

「超标量流水线」指创建不同的工作阶段,同时并行处理不同阶段的做法,说白了就是具有两条或两条以上并行工作的流水线,以此来优化交易处理,进一步提升网络性能。

简单理解的话,就是在烧水的同时,完成打扫卫生、做饭的「同时做多件事」的逻辑,而 Monad 将该逻辑引入了状态存储、交易处理和分布式共识等部分,以来解决现有的性能瓶颈。

具体来说,是在四个主要领域引入了超标量流水线的优化逻辑:

延迟执行:将交易执行与共识部分分开;

MonadBFT:用 Rust 构建的高性能共识机制,专注于共识部分;

并行执行:专注于交易执行部分,能同时处理大量的交易;

MonadDb:高性能状态后端,所有活动状态都存储在 MonadDb 中;

简言之,Monad 将执行和共识放入单独的流水线,允许节点首先就交易排序达成一致,然后再执行它们,这样通过分开共识和执行,为实际交易处理分配更多时间,从而提高了性能。

此外 MonadBFT 源于 Hot Stuff 共识机制,强调线性通信,与另一种流行的共识机制 Tendermint 相比,Monad BFT 的通信复杂性更低,允许更大的网络规模。

以上的设计综合提高了 EVM 的性能和吞吐量,使 Monad 每秒可提供高达 1 万笔交易,不过需要注意的是,这也使得搭建 Monad 完整节点的硬件要求较高(建议使用 2 TB SSD、 16 核 CPU、 32 GB RAM、 100 M 带宽),比以太坊主链大一倍。

从这个角度看,或许可以将其视为「速度更快、成本更低,但硬件门槛更高的以太坊」。

投融资与项目团队

Monad Labs 首席执行官兼联合创始人 Keone Hon 在 2021 年加入 Jump Trading(Jump Crypto 母公司)担任量化分析师,专注于高频交易(HFT)领域,并于 2022 年初离开 Jump Trading,与另外两人联合创立 Monad Labs(其中一人亦有 Jump 背景)。

也正因此 Monad 被不少人视为「Jump 黑帮」的成员之一,不过据财富披露, 2023 年初 Do Kwon 被起诉后,Jump Trading 就逐步退出了加密领域,包括终止了与 Robinhood 的合作关系、退出现货比特币 ETF,并切断了与加密孵化项目的联系(Pyth、Wormhole 和 Monad 等)。

或许也正因如此,Paradigm 作为新的白马王子登场,且如果文初财富披露的 2 亿美元融资顺利完成,无疑将是 2024 年迄今为止最大的加密融资事件之一,在 Web3 的投融资史上也较为罕见。

而一年之前的 2023 年 2 月,Monad Labs 完成 1900 万美元种子轮融资,Dragonfly Capital 领投,其他 70 位投资方参投,包括 Placeholder Capital、Lemniscap、Shima Capital、Finality Capital、天使投资人 Naval Ravikant、Cobie 和 Hasu 等。

未来路线图

正如文初所言,目前 Monad 首个测试网已上线,不过官方表示只是「一个内部私有环境」,主要使用最近的以太坊历史记录对 1 万 TPS 进行基准测试,「是迈向开放公共测试网的第一步」,主网上线还没有具体的路线图。

总的来看,在市场对实用的兴趣逐步压倒纯粹高性能叙事的大背景下,Monad 兼容 EVM、 1 万 TPS 的「更好以太坊」的远景,确实令人期待,至于最终到底到底是新解法还是翻烧饼,值得期待。