关键要点

DOGE为何崩盘?

由于特朗普总统提出提高关税的建议,市场出现大范围调整,狗狗币的价格随之暴跌。

这是牛市的开始吗?

分析师认为,此类崩盘会引发牛市趋势,从而可能导致 DOGE 价格逆转。

唐纳德·特朗普总统在“真相社交”平台上的言论引发紧张局势,导致狗狗币[DOGE]价格暴跌。特朗普暗示将提高对中国的关税,这导致金融市场普遍崩溃。

狗狗币 (DOGE) 是过去 24 小时内跌幅最大的货币之一。所有市场都同步下跌,其中狗狗币 (DOGE) 市值蒸发约 60 亿美元。

DOGE价格暴跌!

从图表来看,狗狗币 (DOGE) 自该帖子发布以来下跌了超过 55%。该 memecoin 创下了年内新低,约为 0.09 美元。此前,狗狗币一直低于其年度高点。

狗狗币已跌破自 2 月中旬以来维持的价格区间。

在撰写本文时,它稳定在 0.20 美元以下,相对强弱指数 (RSI) 显示超卖读数为 34。

如果维持当前水平,狗狗币可能反弹突破0.28美元至0.30美元的阻力位。突破该阻力位后,狗狗币可能瞄准0.48美元至0.50美元区间,即此前牛市高点。

尽管如此,在此期间仍可能出现进一步下跌或盘整。然而,正如图表中110亿美元的交易量所示,此次下跌的买盘力度很大。

卖家仍然占主导地位

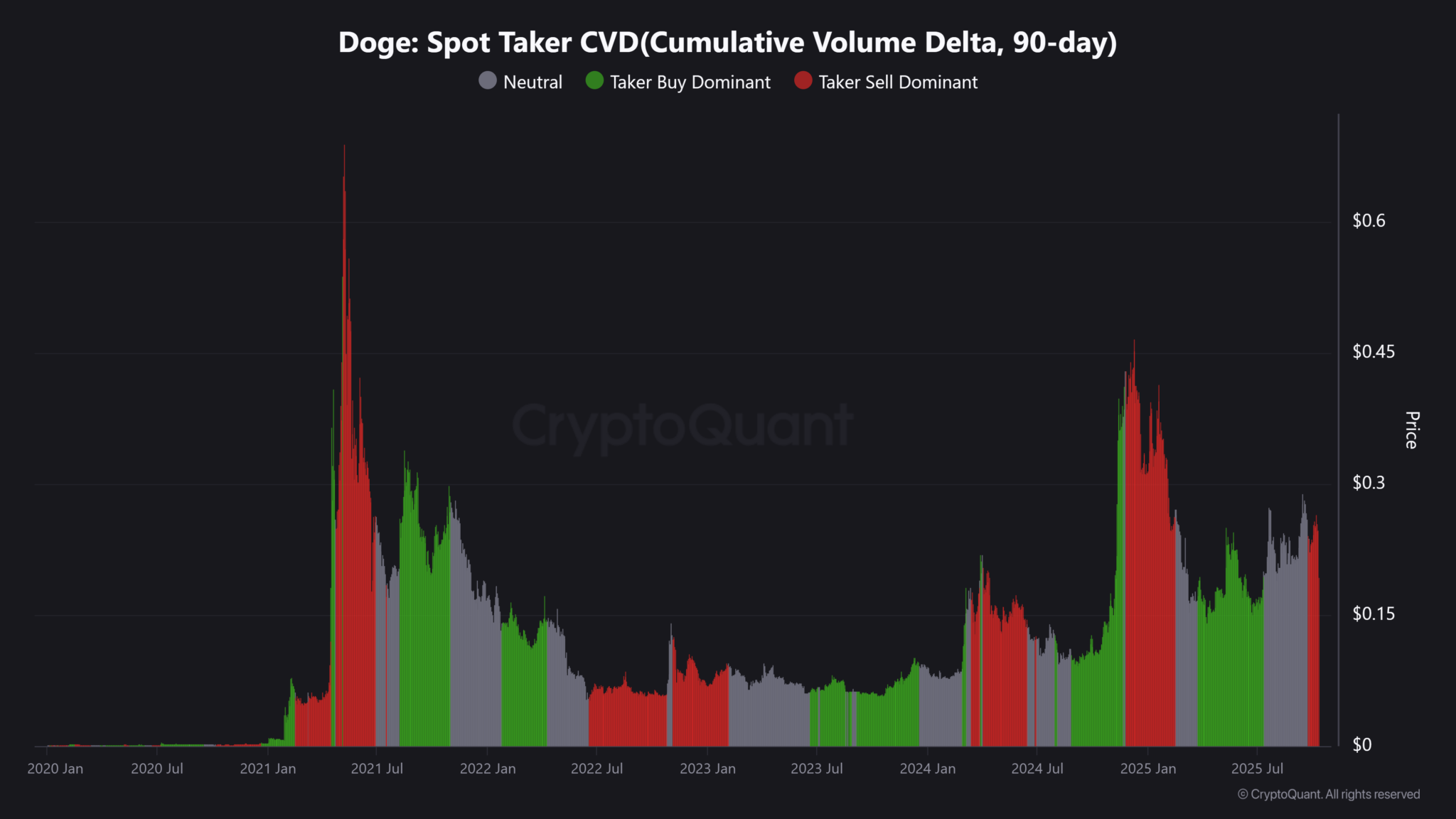

Spot Taker CVD 分析显示,卖家在 10 月的最后几天保持了控制力。

这表明,在出现逆转之前,短期内可能还会进一步下跌。然而,他们已经精疲力竭了。

但这种持续的抛售可能会促使买家触发其多头头寸,目前该头寸处于当前水平以下。

这是牛市的开始吗?

一些分析师认为,市场正准备迎来一轮牛市,就像去年一样。Cephii 在 X(原 Twitter)上发表的一篇文章也表达了类似的观点,他写道:

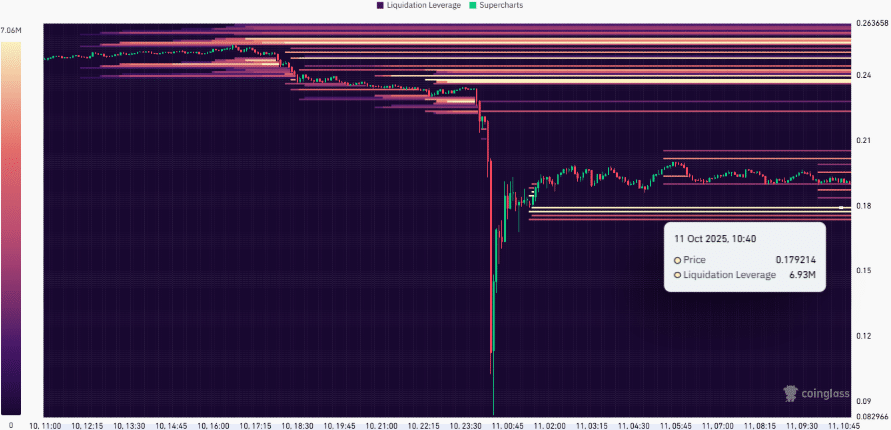

所有$DOGE多头仓位均已平仓。牛市通常就是这样开始的……

图表清楚地显示多头仓位已被消灭,DOGE 稳定在 0.18 美元附近。

由于大额订单集群位于 0.20 美元以下,尤其是在 0.179 美元左右,订单金额为 700 万美元,另有 674 万美元略低于该价格,因此价格可能会略微跌至 0.18 美元以下,然后可能出现逆转。

与此同时,流动性集群的最大集中度位于0.24美元以上。从狗狗币目前的市场前景来看,该区域是下一个也是最现实的目标。