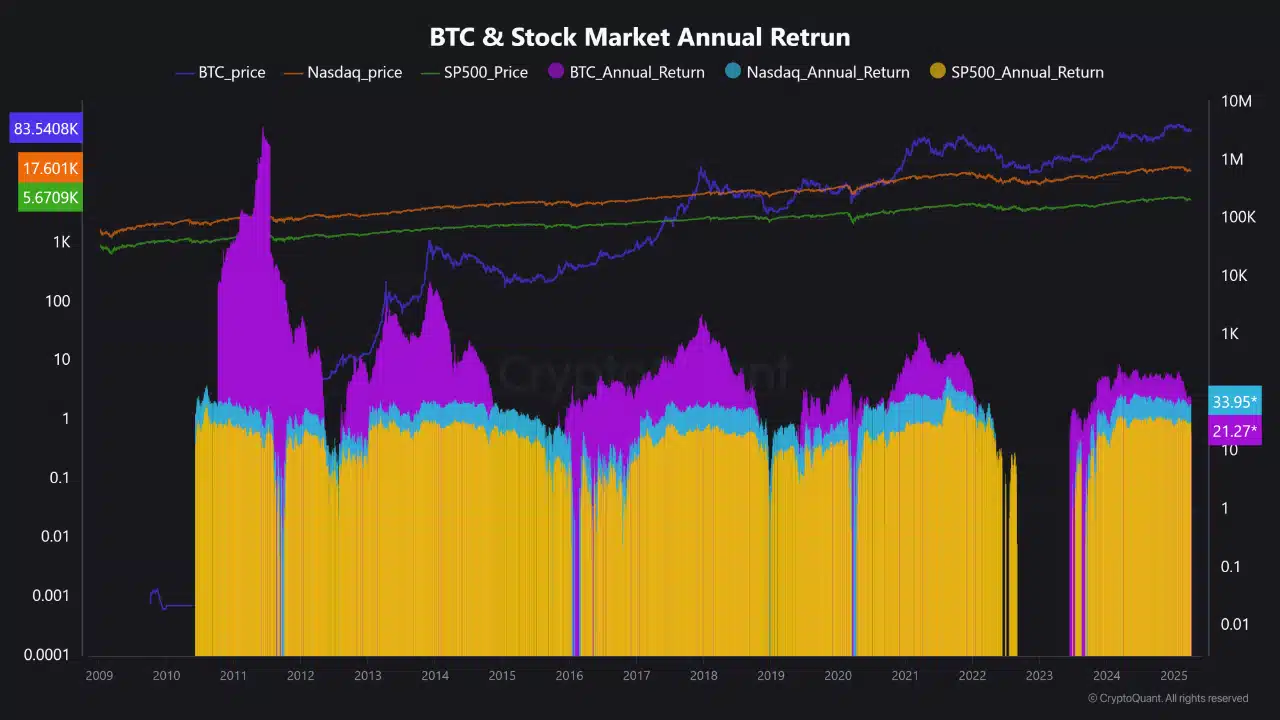

For the first time since its 2023-2024 rally, Bitcoin [BTC] has slipped below gold, the S&P 500, and the Nasdaq in annual returns – A stark sign that the wild ride may be over. This shift marks the end of Bitcoin’s speculative bubble and signals its gradual maturation, as it begins to behave less like a rogue asset and more like its traditional counterparts.

Could this be the beginning of a new, steadier chapter for BTC? Or is the market bracing for a larger correction? Either way, the days of 100% gains might be behind us.

Rally that was and the cooldown that followed

Since early 2025, Bitcoin has shown signs of decoupling from risk assets. However, unlike the narrative that this signals BTC’s impending return to $100k, the divergence might mark the start of something quieter – The end of the explosive cycles that defined its past.

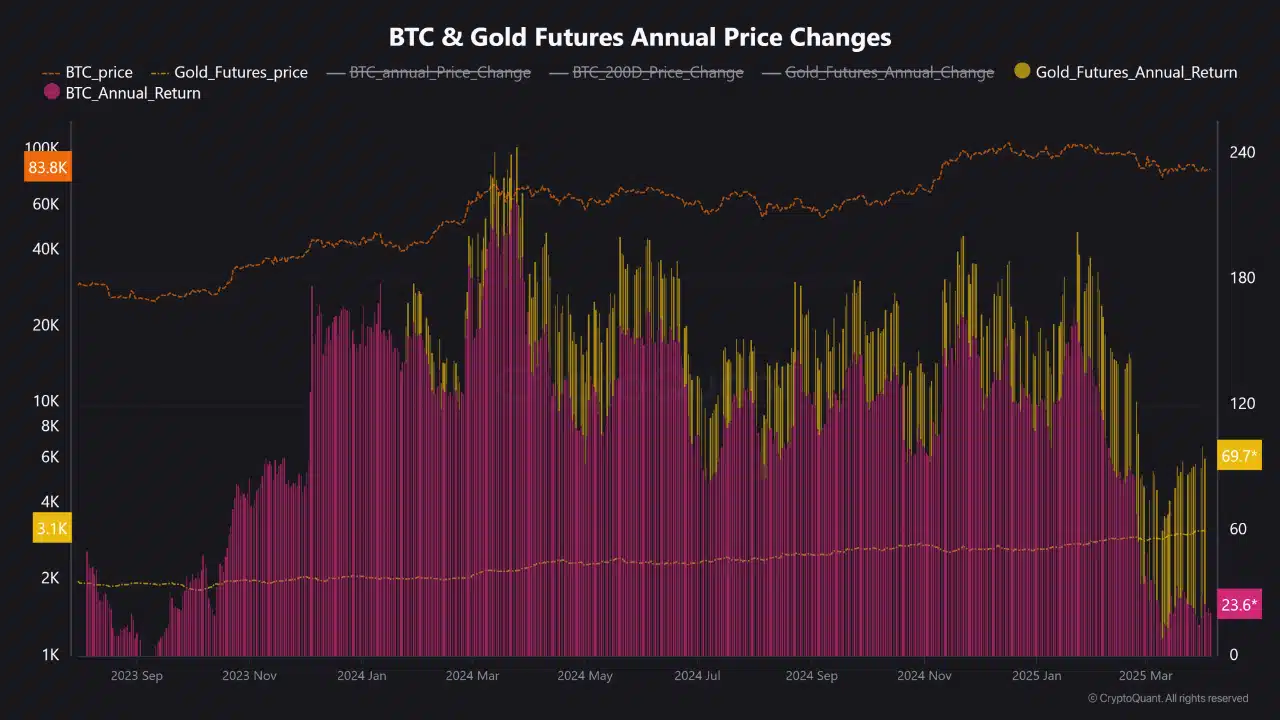

According to on-chain data, Bitcoin’s 1-year returns have now dropped to 23.6%, underperforming –

Nasdaq Composite: 33.5%

S&P 500: 33.9%

Gold Futures: 69.7%

This is the first time in this post-halving cycle that Bitcoin has lagged all three – A meaningful change that alludes to a broader cooldown, rather than an imminent leg up.

What does the data say?

AMBCrypto recently reported that Bitcoin’s relative resilience, compared to equities and gold, is evidence of “haven status” returning, and that it could soon catalyze BTC’s move towards $100k.

However, the data painted a more tempered picture.

While the S&P 500 and Nasdaq remain firmly in the green and gold rallies on safe-haven demand, BTC’s return curve has flattened. Volatility is compressing. The annual return bars – once towering during bull runs – are now shorter, tighter, and more frequent, underlining a retreat from extreme price moves.

If Bitcoin still behaves like a high-risk, high-reward asset, it would have likely outpaced equities in this volatile macro cycle. Instead, it’s underperforming them.

The maturation of Bitcoin – A risk or an opportunity?

Bitcoin’s modest returns don’t necessarily signal weakness. They may indicate evolution. Rather than breaking away from traditional markets in defiance, Bitcoin may finally be aligning with them – Behaving more like a long-term portfolio asset than a short-term speculation vehicle.

Its underperformance could be a cleansing mechanism – Flushing out excess leverage, dialing down euphoric expectations, and recalibrating investor timeframes. Short-term traders may find less excitement here, but long-term holders could find renewed conviction. This is less about BTC proving itself as a crisis hedge and more about BTC growing into a new asset class – Less explosive, more stable, and perhaps… a little boring.

The question now isn’t whether Bitcoin will hit $100k tomorrow. It’s whether the market is ready for a version of Bitcoin that behaves less like a rocket, and more like a rock.