撰文:Cryptocito,Stakecito 联创

编译:Aelx Liu,Foresight News

我看到 Solend 和 Suilend 的联创 Rooter 的一条推文,里面问:「为什么 Cosmos 从未像 Solana 那样受到关注?」下面是我的想法:

1. Cosmos 不等于 Cosmos Hub

Cosmos 常常被人们误以为只是 Cosmos Hub,这意味着只要 ATOM 的价格表现不佳,Cosmos 就「失败了」。

而事实上,Cosmos 生态系统非常多样化,并且主导着整个垂直行业,或者说至少在各个领域都有强有力的竞争者。

Fetch、Cronos、Injective、dYdX、Thorchain、MANTRA、Akash Network、Celestia、Saga、Dymension、Sei 等都在各自专长的领域受到极大关注。

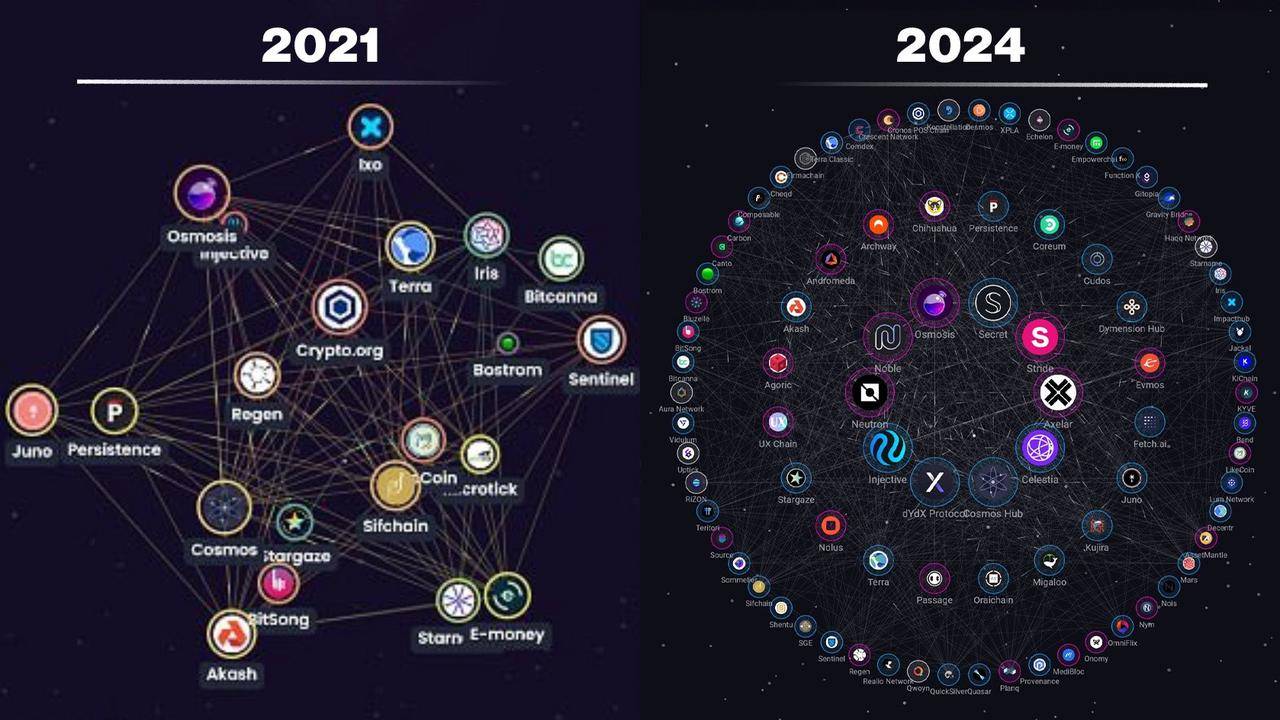

Cosmos 生态项目演进

以上都是 Cosmos 链。不同之处在于,它们是可以自治的主权链,拥有自己的生态系统、基金会、营销策略、品牌等。

甚至像 Polygon 或 BNB 链这样更大的链也部分采用了 Cosmos 的技术。(译者注:Polygon PoS 采用 Tendermint 共识,BSC 使用了 Cosmos SDK。)

还有一些即将推出的大项目,例如 Babylon、Berachain 或 Nillion,它们也使用了 Cosmos 技术。其中一些项目被更公开地认定为 「Cosmos 项目」,而另一些则不然,但也没关系。(译者注:尽管 Berachain 使用了 Cosmos SDK 构建,但其一直反对被称为「Cosmos 项目」)

因此,关于为什么 Cosmos 被认为没有吸引力的第一点是,它仍然经常被认为是 Cosmos Hub 和 ATOM 的代名词。

2. Interchain 基金会不作为

其次,与 Solana 基金会或以太坊基金会等组织不同,Interchain 基金会在协调市场营销、开发人员入职、社区倡议和开发方面不发挥核心作用 —— 至少现在不是。

这样做的优点是对单一组织的依赖极低,但缺点是缺乏一致性、难以协调、愿景分散和责任难划分。

得益于 Solana 基金会,Solana 的行动非常迅速。Solana 基金会采取了非常积极主动的方式,举办了像 Breakpoint 这样的大型会议,为全球的 Superteam 提供资金,并战略性地激励所有市场参与者加入并接受有关 Solana 的教育。

这太棒了,事实上,我们正在努力为 Cosmos 生态系统复制该模型。如果没有资金,这是非常具有挑战性的。

3.生态没有「统一货币」

第三,值得注意的是,Cosmos 的核心在于链在保证主权的同时具备互操作性,这意味着没有一种「统一货币」可以统治所有这些链。

整个生态系统没有单一的基础链或代币作为支撑,这并不是因为他们「忘记」了它,是因为这就是 Cosmos 的本质。

2019 年 ATOM 推出时我不在场,但有人告诉我,这是一个有意识的设计决定 —— 不直接将 IBC 的采用与 ATOM 的价值挂钩,而是让市场来决定。

Cosmos 的原则使其具有很强的适应能力,这对于长期可持续发展很有帮助,但对于短期炒作来说就不那么重要了。

Terra(译者注:Terra(LUNA) 使用 Cosmos SDK 开发,其 22 年的崩溃给 Cosmos 生态造成了极大打击) 在极端情况下证明了应用链理论。 Tendermint,现在的 Comet BFT,已经存在很长时间并且被广泛采用。 IBC 被证明具有灵活性,从未被黑客攻击,并且被非常多项目集成。

话虽如此,我仍然希望 ATOM 表现良好并站稳脚跟,因为它帮助了这个 300 亿美元生态系统的起步发展,并证明了其技术,同时代币存在的 5 年后,仍然保持在市值前 40 名。

我认为需要改进的地方是:

-

将 Cosmos 品牌重塑为「 Interchain」

-

改进开发人员 onbording 流程;

-

复制 Solana Superteam 的模型

-

Interchain 基金会应发挥更加积极主动的作用

Interchain 基金会目前正在经历一些结构性变化,并且从现在开始可能会采取更多措施。

还有很多事情需要考虑,很多方面还有待弄清楚,但这是我的总体意见。