BTC31011

11/15 03:40

Trusted editorial content, vetted by leading indus

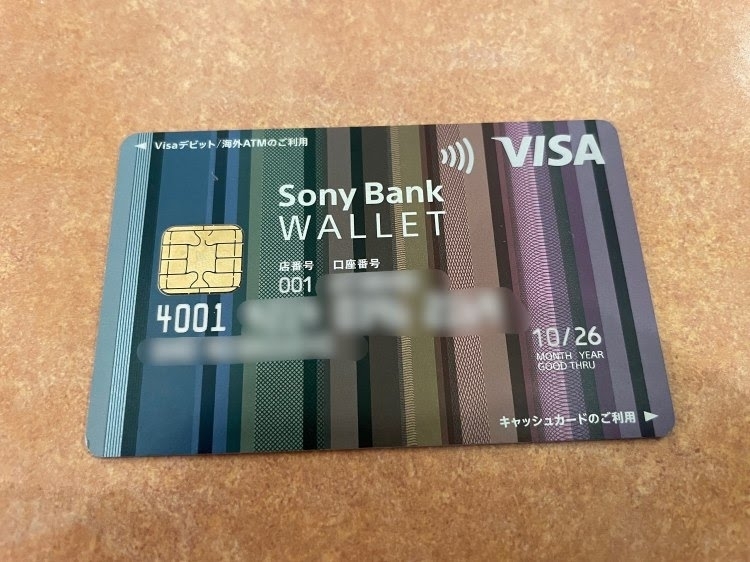

Trusted editorial content, vetted by leading industry experts and seasoned editors. Advertising Disclosure The Office of the Comptroller of the Currency (OCC) has come under pressure to reject Sony Bank's application to enter the crypto banking industry in the US. Letters from banking and advocacy groups, filed in early November, reportedly sparked strong opposition to the plan and its potential implications. Read also: Visa Uses Stablecoins to Eliminate Payment Delays for Content Creators and Gig Workers Sony Bank's Plan Sony Bank has applied to create a national trust bank called Connectia Trust, according to documents and public filings. The plan would allow Connectia to manage reserves for a stablecoin pegged to the US dollar and offer custody and asset management services for digital tokens. In March 2025, the OCC issued Interpretive Letter 1183, which clarified that national banks could conduct certain crypto activities as long as they adhere to risk controls. However, trust banks do not accept FDIC-insured deposits, and this distinction is central to the debate. Supporters say this structure fits within the narrow framework outlined by the OCC in Letter 1183. Critics say it does not. Source: OCC. Questions include how reserves will be established, how redemptions will be handled in stressed situations, and what will happen to depository assets if the trust is placed into receivership. Community banking groups and consumer advocates want clearer and more public explanations of these mechanisms. Banking groups are resisting. On November 6, 2025, the Independent Community Bankers of America (ICBA) sent a formal letter urging the OCC to reject the application. The ICBA's main argument is that the trust charter could allow a large corporate owner to offer a product that appears to be a deposit but lacks deposit insurance and typical banking obligations. They called it a form of regulatory arbitrage and warned that it could create unfair competition for smaller banks. The National Community Reinvestment Coalition also filed a counter-argument, arguing that the OCC lacks authority to treat a stablecoin issuer like a traditional bank and calling for stronger consumer protections. The BTC/USD pair is currently trading at $97,220. Chart: TradingView These groups focused on three practical concerns: consumer confusion about what is and isn't insured, unclear reserve transparency, and the lack of proven tools for resolving a trust bank holding crypto assets. The letters highlight the potential impact of a run on large stablecoins and the difficulty of liquidating tokens in a crisis. Image: Saiga NAK Related: Singapore Sounds the Alarm: Are Stablecoins the Next Financial Threat? Systemic and Consumer Risks: If a federally registered trust issues a widely used stablecoin, it could set a legal precedent that other tech or financial companies could follow. This is why some documents argue that the OCC should proceed slowly and require stricter conditions. The reports raise concerns that retail users could treat the token like a bank deposit, lacking FDIC protection. The risks are not merely theoretical. Under stress, reserve assets could be quickly sold, and digital assets may be difficult to transfer within an asset management system designed for traditional assets. Image from Wikimedia Commons, chart from TradingView. Bitcoinist's editorial process is dedicated to providing well-researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page is thoroughly reviewed by our team of leading technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

#HTX's Double 11 Carnival Month Kicks Off#BEAT Token: Utility and Governance#Planck: The Base Layer Power Grid for AI#From Upshot to ALLO#Do you think 4 is promising?

61Bagikan

Semua Komentar0TerkiniHangat

Tidak ada catatan