Just a week after announcing its $1.44 billion USD Reserve, Strategy has made a Bitcoin purchase of nearly $1 billion, one of the largest for 2025.

Strategy Has Made Its Ninth Largest Bitcoin Buy Of The Year

In a new post on X, Strategy co-founder and chairman Michael Saylor has shared info related to the latest routine Monday Bitcoin purchase made by the treasury company.

While the timing of the buy is routine, its scale is not. In total, Strategy has added 10,624 BTC to its holdings with the acquisition. This is the biggest purchase since July’s 21,021 BTC mega-buy.

The new acquisition has cost the firm $90,615 per token or $962.7 million in total. In USD terms, this is the ninth largest addition to the company’s Bitcoin reserves.

This big purchase has come a week after Strategy announced a new shift for the company with its $1.44 billion USD reserve. Saylor said that the reserve will better position the firm to navigate short-term volatility.

The announcement was also accompanied by the usual Monday Bitcoin buy, but at just 130 tokens, it was a relatively small one. If the latest acquisition is to go by, however, the USD reserve doesn’t seem to be stopping Strategy in hoarding more of the cryptocurrency.

According to the filing with the US Securities and Exchange Commission, the new buy, which occurred in the period between December 1st and 7th, was funded using sales of the firm’s STRD and MSTR at-the-market (ATM) stock offerings.

Strategy now holds a total of 660,624 BTC, with an average cost basis of $74,696 per coin or total investment of $49.35 billion. At the current price of the asset, the Bitcoin treasury company’s holdings are worth about $59.68 billion, which means that it’s sitting on a profit of nearly 21% right now.

In some other news, while Strategy has continued its Bitcoin accumulation, the same hasn’t been true for another side of the sector: the spot exchange-traded funds (ETFs).

The spot ETFs refer to investment vehicles that allow investors to gain indirect exposure to BTC. That is, the funds hold the cryptocurrency on behalf of the investors, enabling them to invest into the asset without having to bother with the on-chain side of things.

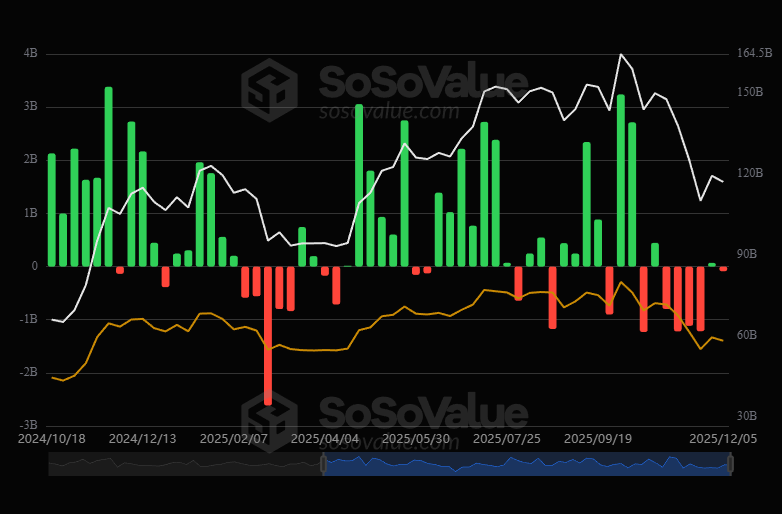

Since mid-October, the US Bitcoin spot ETFs have mostly faced waves of net outflows as the cryptocurrency’s price has followed a bearish trajectory. The last week of November registered a small positive netflow, however, breaking a streak of four consecutive weeks of outflows.

This turnaround didn’t last, though, with the latest week once again ending with net outflows, as the below chart from SoSoValue shows.

The trend in the weekly netflow of the US BTC spot ETFs | Source: SoSoValue

The outflows were only modest, coming out at about $87.8 million, but still indicate lingering pessimism in the market.

BTC Price

Bitcoin broke above $92,000 earlier in the day, but the coin has since faced a pullback as it’s now back at $89,900.

Looks like the price of the coin has retraced its latest recovery | Source: BTCUSDT on TradingView