Original | Odaily Planet Daily (@OdailyChina)

Author | Golem (@web3_golem)

On December 8, Farcaster co-founder Dan Romero announced that the platform is abandoning its "social-first" strategy, upheld for four and a half years, and shifting to a wallet-centric growth model, hoping to attract more users by building an excellent wallet. This means Farcaster's future new features and product positioning will center around a consumer wallet, rather than a decentralized social graph.

Following the decline of friend.tech, Farcaster has been seen as the "standard-bearer" of SocialFi. Backed by top VCs (a16z, Paradigm) with $1 billion in funding, hyped by crypto celebrities (Vitalik, Coinbase founders, etc.), and with occasional wealth effects (Degen, Clanker, etc.), every hotspot could spark a new wave of user enthusiasm. However, after "three minutes," users quickly lose interest, and platform activity plummets.

This might be because Farcaster lacks genuine product-market fit. Long before the emergence of decentralized social applications, the crypto community was already deeply rooted in Web2 social apps like Twitter, Telegram, and Discord, which perfectly cover various social needs.

Farcaster's "social-first" strategy was essentially just imitating Twitter, which didn't provide enough incentive for users to migrate. Social products require real scenarios and differentiation. Crypto users have no reason to abandon the social graphs and relationship chains they've built on Web2 social platforms like Twitter and start from scratch on Farcaster (unless they are aspiring "future influencers" with no existing following).

Dan Romero himself probably knows the crux of the issue well: merely selling ideals like decentralization and data sovereignty cannot lock in users. So, rather than "grinding" in a hopeless area, it's better to change tack, seeking user growth and new product-market fit from the公认的 Web3入口—wallets.

But has Farcaster really given up on crypto social? In my view, no. Instead, this is a long-overdue course correction, four and a half years late.

Since existing social scenarios are already covered by Web2 social applications, we should create new crypto social scenarios. Dan Romero named this strategy "attract users with tools, retain them with the network." He chose to切入社交 from the wallet scenario, where users' on-chain transaction/payment scenarios naturally give rise to social needs. The decentralized social infrastructure that Farcaster previously built can then provide users with a smooth, one-stop experience.

However, Farcaster is late to the game. This "first build the social scenario, then develop the social application" approach has already been preempted by others—namely, CEXs.

Crypto Exchanges Enter the Social Platform Arena

Asset investment behavior is naturally related to social networks; after all, everyone is responsible for their own "bag." One could even say that the entire crypto circle's social needs (both public and private) are born from investment and trading scenarios. Therefore, under this logic, crypto exchanges that build trading scenarios for users have a natural advantage in developing social features, much like how WeChat integrated payment through its social network.

The first to successfully execute this was Binance. One day, as a Binance lead grew tired of constantly switching between Twitter and the Binance app, it suddenly hit them: why not build a social platform directly within the Binance main site? This would allow users to browse social feeds openly.

Thus, in October 2022, Binance launched the content aggregation platform Binance Feed, renaming it to Binance Square a year later. It also opened up UGC (User-Generated Content) and introduced a "content mining" feature.

So-called "content mining" means creators can add token tags (e.g., $BTC) to the content they publish on Binance Square (including short posts, articles, videos, polls, voice live streams, or chat rooms). Whenever a regular Binance user or VIP 1-2 user clicks on the token tag in the creator's content to execute a spot, leverage, or futures trade, the creator can receive up to 50% of the transaction fees as a rebate.

By 2023, Binance was already a top global exchange. The incentive mechanism of Binance Square was like a match thrown into dry tinder, instantly igniting a wildfire. By the end of 2023 (two months after launching "content mining"), the number of creators on Binance Square increased from 1,200 to 11,000. By the end of 2024, Binance Square's monthly active users had hit 35 million.

Today, in 2025, Binance maintains its position as the world's largest exchange, with 300 million registered users. This also means the user potential for Binance Square has reached 300 million. More importantly, these 300 million users are "refined" by Binance; they have a clear goal—to profit in crypto finance. Within the trading scenario Binance has created, they use Binance Square with a clear and specific purpose—to find trading signals or wealth codes.

Where there is demand, supply naturally emerges. The vast and high-quality user base, combined with the rebate incentives of "content mining," has not only prompted头部交易员, analysts, and KOLs to spontaneously migrate/synchronize from social platforms like Twitter to Binance Square but has also given birth to a large number of native crypto bloggers, gradually forming Binance Square's social "moat."

Binance Square Advertisement

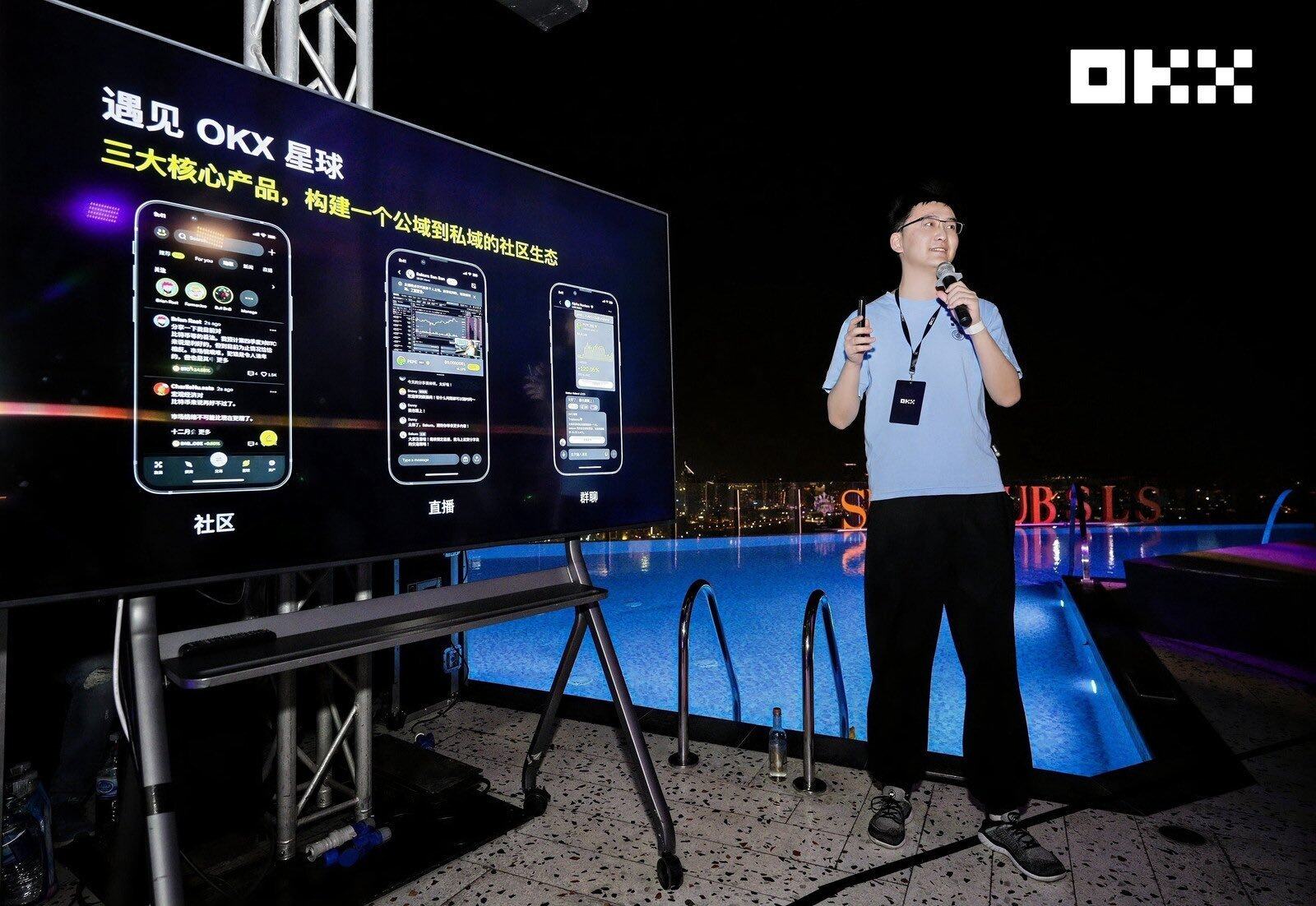

Following the huge success of Binance Square, other exchange peers have begun to follow suit. Last week, OKX announced in Dubai the upcoming launch of its exchange social platform—OKX Planet, including community, live streaming, and group chat features, openly benchmarking against Binance Square. Some KOLs even revealed that OKX当场向币安广场顶级创作者发出入驻邀请函 (on the spot extended invitations to top Binance Square creators to join).

Compared to OKX, other exchanges布局了内容广场功能 earlier—Gate established its content square since 2023, Huobi launched its content square in the second half of 2023......

Clearly, the war among crypto exchanges has spread to the social领域, but this also proves that exchange social platforms, exemplified by Binance Square, have a high degree of product-market fit.

Furthermore, for creators, another obvious advantage of exchange social platforms is greatly reduced account bans and compliance risks. Although governments are gradually relaxing crypto regulations, because the crypto industry is always associated with investment, money, and "grey" areas, crypto bloggers often face reports and bans on Web2 social media. On exchange social platforms, such risks are significantly lower. On one hand, the platform's content属性 naturally aligns with crypto bloggers as it's built within the crypto trading scenario; on the other hand, exchange users themselves are screened "优质韭菜" (quality leeks) and have a "相当高的包容度" (quite high tolerance) towards crypto bloggers.

This characteristic might become a core competitive advantage for exchange social products against Web2 social products like Twitter in the future. After all, the main阵地 for the Chinese-speaking crypto community was once domestic public media like Weibo, but they were forced to migrate en masse to Twitter due to regulatory crackdowns. So, perhaps such a large-scale migration could also happen to exchange social products someday.

Of course, although the above uses "Binance Square" as an example to illustrate the natural advantages exchanges have in developing social platforms, the core of an exchange remains its crypto trading business. Developing an exchange social platform is not advisable until the base of trading users reaches a certain scale.

What Kind of Social Product Does the Crypto Community Really Need?

Looking back at the history of crypto social product development, those products touting decentralization and SocialFi—Friend Tech, Lens, and Farcaster—have had their moments of glory, but in the end, they died or were wounded. What has consistently accompanied the crypto community are highly centralized Web2 social platforms like Twitter. Even the newly rising exchange social platforms, aside from being related to crypto trading, seem quite different from the Web3 social vision promoted by capital.

This naturally leads to a question worth pondering: what kind of social product does the crypto community really need?

First, it's essential to clarify that decentralization is a means to an end, not the end itself. When this means fails to achieve our goals, we should果断放弃 (decisively abandon it). In social interactions, users care most about information value, a sense of belonging, the ability to connect people, and entertainment—not whether it's decentralized. The same goes for crypto social.

Over the past five years, SocialFi has dragged crypto social into a Ponzi game, overemphasizing the "Fi" attribute of crypto social while neglecting the "Social" part. Short-term traffic and token frenzies can create temporary prosperity, but in the long run, they cannot沉淀出信任与任何优质内容 (foster trust or any quality content). Collapse is the only结局 (outcome) for SocialFi.

In my view, the crypto community merely needs social products that can connect crypto scenarios, facilitate meaningful exchanges, and在此基础上产生信任与协作 (generate trust and collaboration on this basis). This has nothing to do with whether it's decentralized or whether it has "Fi." It's simply about bringing crypto social back to the essence of social interaction—built for scenarios, existing to connect people.

Perhaps it can be stated more bluntly: we need more Binance Squares, not the Farcaster of the past.

Further Reading

SocialFi "Narrative Fails," Does Crypto Social Have a Future?