Key takeaways:

ETH futures and options markets show hesitation despite spot ETF inflows and rising TVL figures.

Layer-2 growth and lower fees haven’t translated to increased demand for ETH or sustained price momentum.

Ether price rallied 13.5% over two days, reaching $3,000 on Thursday, but traders remain unconvinced about whether it will hold. Despite the recent bullish momentum, ETH derivatives markets show a lack of confidence, raising doubts among traders about the potential for further gains.

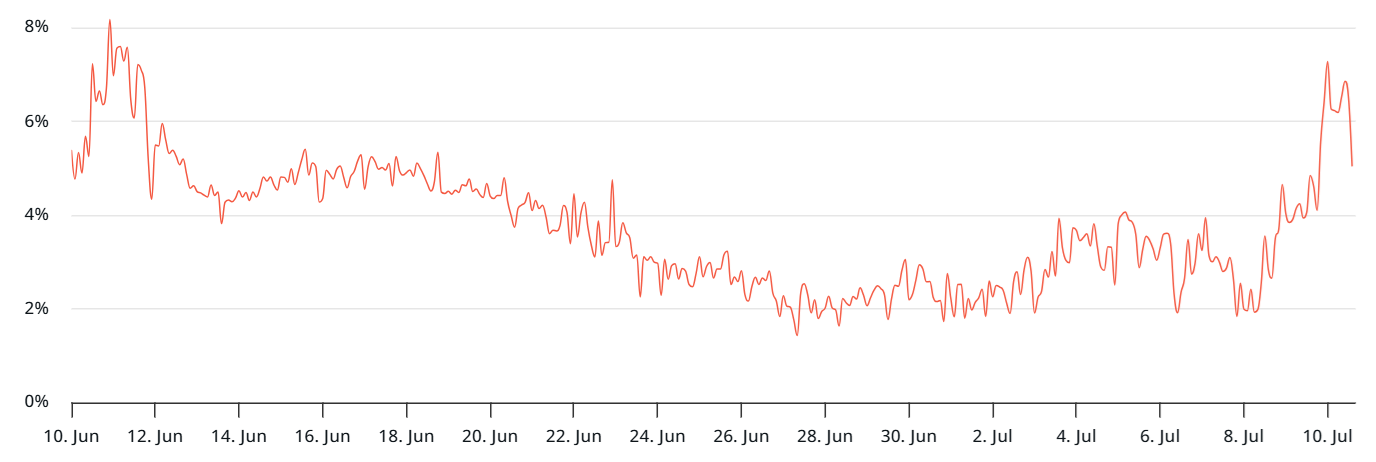

The Ether monthly futures premium currently stands at 5%, sitting on the edge between neutral and bearish territory. While that’s an improvement from the prior week’s 3.5% premium, the last notable bullish signal was on Jan. 23, when ETH traded above $3,300. Professional traders are less pessimistic now, but still far from confident in a sustained price rally.

Ethereum layer-2s thrive, but lower fees fail to boost ETH demand

ETH is still down 41% from its all-time high in November 2021, which partially explains the cautious outlook. More importantly, Ethereum network fees have declined, which reduces the burn rate of ETH. Since Ethereum’s built-in burn mechanism depends on network activity, lower usage means more ETH remains in circulation, putting downward pressure on price.

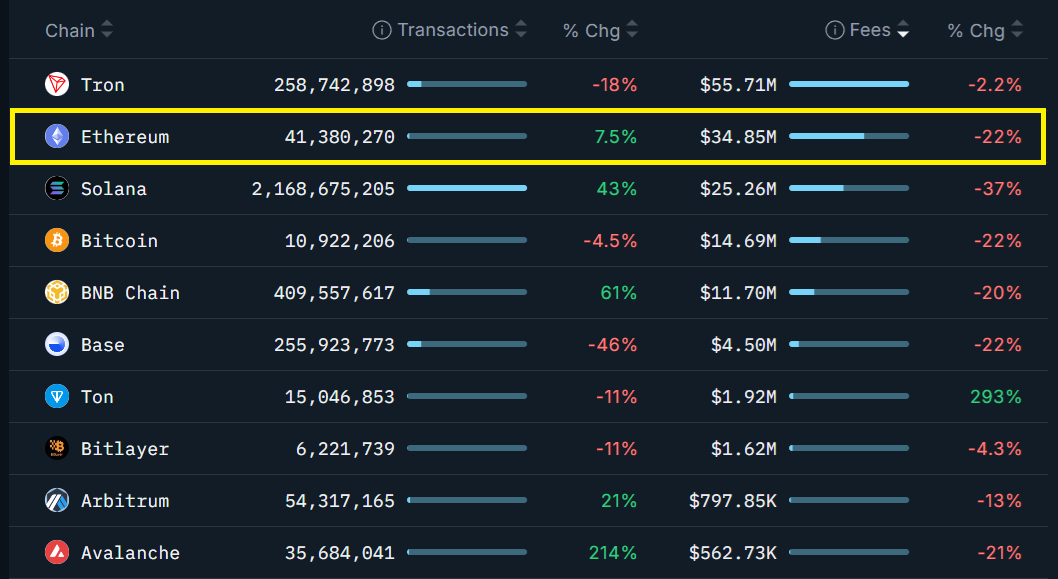

Over the past 30 days, Ethereum network fees fell 22% to $34.8 million, according to Nansen data. Although this trend has affected much of the blockchain sector, ETH investors have been particularly disappointed. That’s because the increase in total value locked (TVL) has not translated into a higher demand for ETH itself.

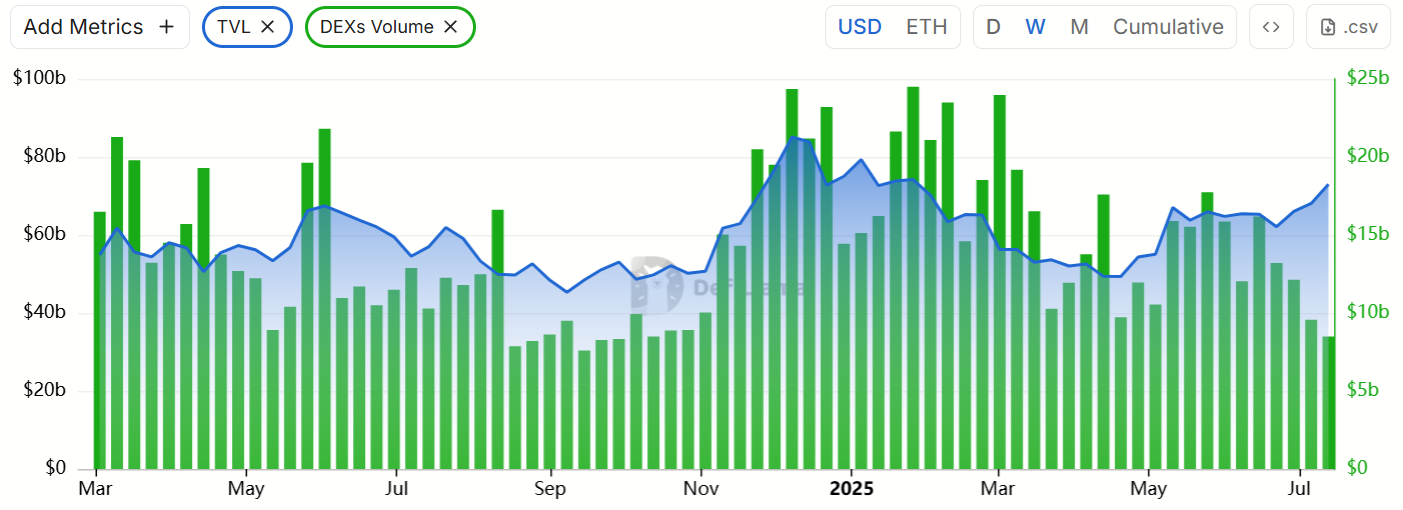

TVL on the Ethereum network rose to $73 billion as of Thursday from $50 billion three months ago. Still, trading volume on decentralized exchanges (DEXs) has dropped to a nine-month low. Even if the previous memecoin frenzy was unsustainable, many ETH investors had hoped the increased activity would persist longer.

Ethereum’s layer-2 ecosystem has performed better than expected, generating $58.6 billion in DEX volumes over the past 30 days. However, the move to lower rollup fees through data blobs hasn’t meaningfully boosted demand for ETH.

By comparison, Solana holds a TVL that is 86% less than Ethereum, but it managed to generate $25.3 million in network fees. Tron’s 30-day fees are also 60% higher than Ethereum’s.

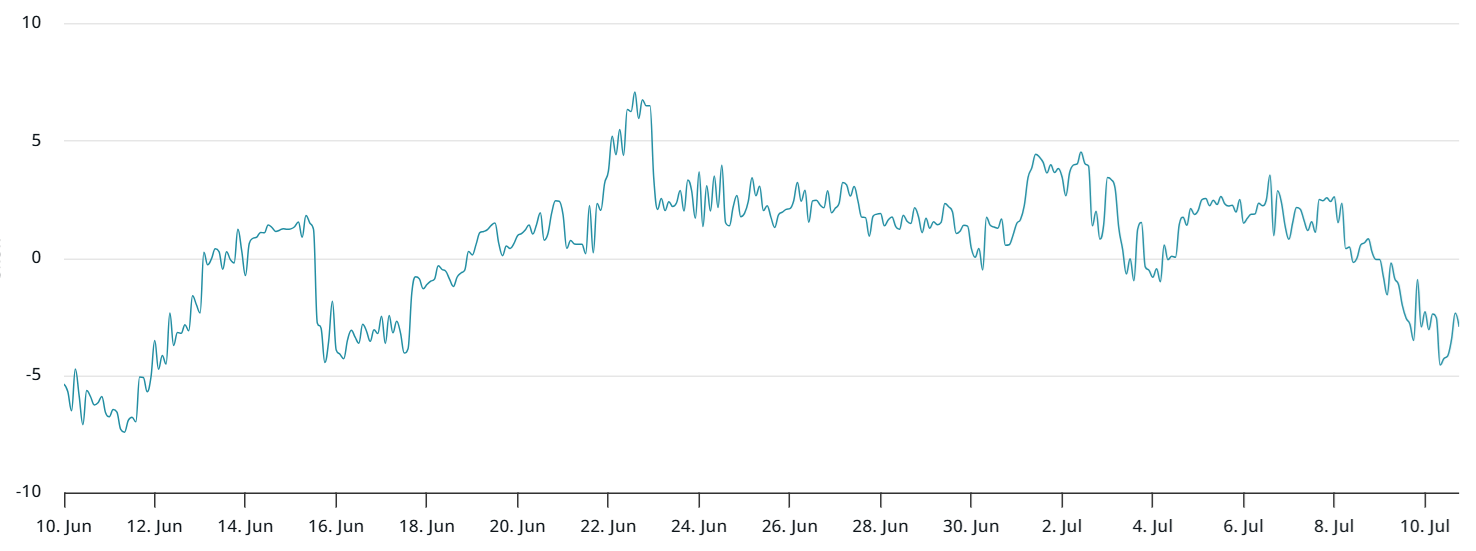

To determine whether this lack of confidence is specific to futures, it’s helpful to look at the options market. When traders seek upside exposure through call options, the delta skew typically drops below the neutral -5% to +5% range. Conversely, demand for downside protection pushes the metric higher.

Currently, the ETH options skew sits at -3%, suggesting balanced interest between bullish and bearish strategies. This has been the case for the past four weeks and represents a modest improvement from the prior week’s reading of +1%.

Recent ETH price gains appear largely driven by a four-day net inflow of $468 million into US-listed exchange-traded funds (ETFs). Additional supporting factors were ETH purchases by ShapLink Gaming (SBET) and Bit Digital (BTBT) as part of their treasury strategies.

Still, it remains unclear whether institutional demand will persist. For now, ETH derivatives reflect limited conviction in a sustained rally.