ali****@gmail.com

2025/01/24 15:42

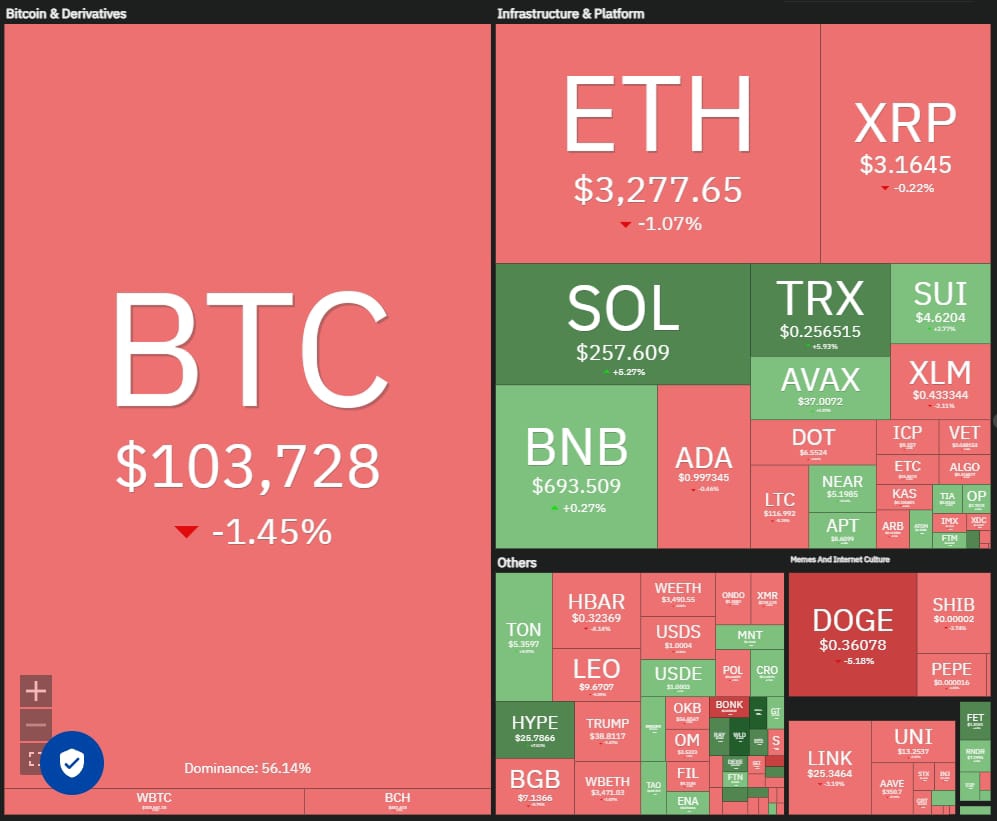

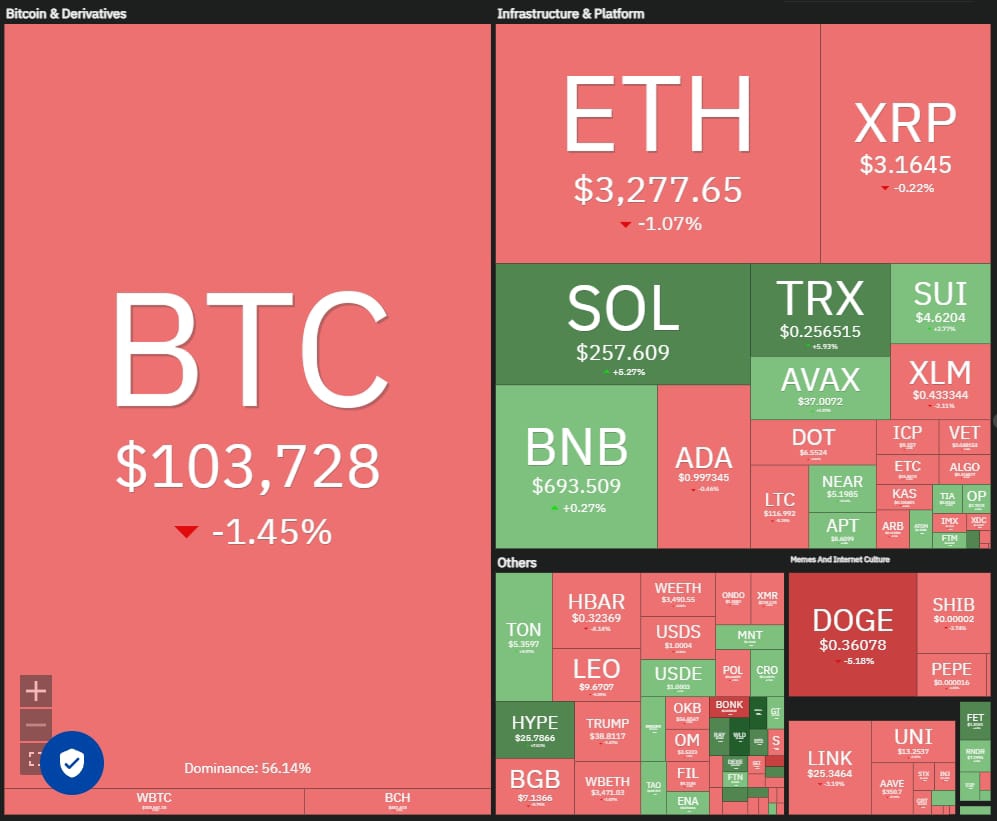

Price Analysis January 22 BTC, ETH, XRP, SOL, DOG

Price Analysis January 22

BTC, ETH, XRP, SOL, DOGE, AVAX, SUI

Bitcoin price analysis

Bitcoin turned down from $109,588 on Jan. 20 but took support at the 20-day exponential moving average ($99,946). This suggests that the sentiment remains positive, and traders are buying on dips.

The upsloping 20-day EMA and the relative strength index (RSI) in the positive territory indicate the path of least resistance to the upside. If buyers drive and maintain the price above $108,353, the BTC/USDT pair could surge toward $126,706.

If bears want to prevent the upside, they will have to swiftly pull the price below the moving averages. That could keep the pair stuck between $109,588 and $90,000 for some time. A short-term trend change will be signaled on a break below $85,000.

Ether price analysis

Ether has been trading between the 50-day simple moving average ($3,522) and the neckline of the head-and-shoulders (H&S) pattern for the past few days.

The 20-day EMA ($3,345) is sloping down gradually, and the RSI is just below the midpoint, indicating a slight advantage for the bears. If the price breaks below the neckline, the ETH/USDT pair could plummet to $2,850. The bulls will try to arrest the decline at $2,850 because if they fail in their endeavor, the pair may sink to $2,400.

On the upside, a break and close above the 50-day SMA will suggest that buyers are back in the game. The pair may rise to $3,745, which is an important level to keep an eye on.

XRP price analysis

XRP attempted to rise above the $3.40 overhead resistance on Jan. 20, but the bears held their ground.

This suggests the XRP/USDT pair may consolidate between $2.91 and $3.40 for some time. If buyers hold the $2.91 support, it will increase the possibility of a break above $3.40. That could start an upmove to $4 and, after that, to $4.84.

The 20-day EMA ($2.81) is the critical support to watch out for on the downside. If this support cracks, the pair may drop to the 50-day SMA ($2.48). Buyers are expected to defend the 50-day SMA aggressively because a break below it may sink the pair to $2.

Solana price analysis

Solana’s pullback bounced off the 50% Fibonacci retracement level of $232, indicating that the bulls are active at lower levels.

The bullish momentum could pick up if buyers maintain the price above $260. That opens the doors for a retest of the all-time high at $295. Sellers are expected to mount a strong defense at $295, but if the bulls prevail, the SOL/USDT pair could skyrocket to $375.

The zone between $232 and the 20-day EMA ($221) is the important support to watch out for on the downside. If this zone breaks down, the pair could plunge to the next major support at $169.

Dogecoin price analysis

Dogecoin bulls pushed the price above the moving averages on Jan. 21, but the long wick on the candlestick shows selling at higher levels.

The flattish moving averages and the RSI near the midpoint suggest a balance between supply and demand. If the price skids below the moving averages, the bears will try to sink the DOGE/USDT pair below the ascending channel. If they can pull it off, the pair could drop to the 61.8% Fibonacci retracement level of $0.27.

Instead, if the price turns up and closes above the moving averages, the bulls will again try to push the pair to the channel’s resistance line.

Avalanche price analysis

Avalanche has been range-bound between $32.31 and $45.05, indicating buying on dips and selling on rallies.

The 20-day EMA ($38.24) is sloping down, and the RSI is just below the midpoint, indicating a slight edge to the bears. If the price slips below $34.50, the AVAX/USDT pair could retest the $32.31 support.

The next trending move is expected to begin on a close above $45.05 or below $32.31. If the $45.05 level is taken out, the pair could soar to $56. On the other hand, a break below $32.31 could sink the pair to $30 and later to $27.

Sui price analysis

Sui has been falling inside a descending channel pattern, indicating that the rallies are being sold into.

The bears will try to sink the price to the channel’s support line, where the buyers are expected to step in. A solid bounce off the support line will suggest that the SUI/USDT pair may extend its stay inside the channel for some more time.

The bulls will be back in control on a close above the channel. The pair may rise to $5.37 and eventually to $5.82. Conversely, a break and close below the channel could start a deeper correction to $3.50 and then $3.

#Tariffs Crash Crypto#Share Your Thoughts on Popular Assets in March#Win 400 USDT: Share Your Crypto Loans Trades

1Share

All Comments0LatestHot

No records