kaloysterrrrr

2022/08/24 16:46

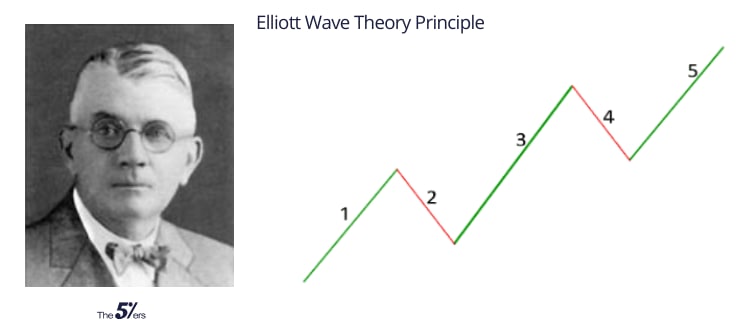

Elliot Wave Theory Rules

An impulse consists of 5 internal waves.

Wave 1 and 5 always have to be an impulse, or a diagonal (Leading for wave 1 – Ending for wave 5)

Wave 3 always has to be an impulse.

Wave 3 can never be the shortest wave

It can be shorter than wave 1 or 5, but never the shortest

Wave 2 cannot retrace more than 100% of wave 1

Wave 2 can be any corrective pattern

Except a triangle

Wave 4 can be any corrective pattern

Wave 4 can never move beyond the end of wave 1 (Otherwise it is a diagonal)

Guidelines:

Wave 1 is the least common wave to extend

Wave 5 should end with momentum divergence (RSI is the simplest oscillator to spot this)

Wave 5 can fail to go beyond the end of wave 3

This is called truncation, but it is not very common

Truncation gives warning of underlying weakness or strength in the market

Wave 3 usually has the greatest extension

Occasionally two waves will extend

Never will all three waves extend

When wave 3 extends, wave 5 tends to equal wave 1 in length

Waves 2 and 4 tend to create alternation between each other

See last page for more details on alternation

Wave 2 typically retraces to deeper levels of wave 1, than wave 4 does relative to wave 3

Wave 2 usually forms as a zigzag or double/triple zigzag

Wave 4 usually forms as a triangle, double/triple threes, or flat

Extended waves can contain exaggerated subdivisions within them

Usually two of waves 1, 3 & 5 exhibit a Fibonacci ratio

Channel lines and Fibonacci targets are inferior to the wave count

In most cases, wave 3 has the highest volume

If volume during the 5th wave is as high as the 3rd, an extended 5th wave is expected.

Here is another sample article from our icaris cronos camp where you need to invest knowledve before going against the market and be profitable. Credits to the telegram group on their non stop help to people who are starting their journey.

#How to make money in the bear market?

LikeShare

All Comments0LatestHot

No records