Mastering Crypto

2023/12/29 05:03

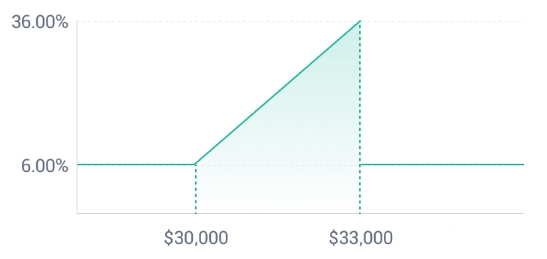

My Shark Fin Investment on HTX

In the ever-evolving landscape of cryptocurrency investments, the term "shark fin" has gained traction, describing a high-risk, high-reward trading strategy that aims to capitalize on short-term market fluctuations. This strategy, reminiscent of the sharp peaks of a shark fin in a price chart, comes with its own set of challenges and potential pitfalls.

**Understanding Shark Fin Investments:**

The shark fin investment strategy involves making quick and often leveraged trades based on short-term price movements. Traders utilizing this approach seek to exploit rapid market fluctuations, entering and exiting positions swiftly to capture profits. While the potential for substantial gains exists, so does the risk of significant losses due to the volatile nature of cryptocurrency markets.

**The Allure of Quick Profits:**

One of the primary attractions of shark fin investments in crypto is the prospect of quick profits. Cryptocurrencies, known for their price volatility, can experience sharp price swings within short time frames. Traders employing the shark fin strategy aim to capitalize on these price movements, often relying on technical analysis and market timing to make rapid decisions.

**Risks Associated with Shark Fin Investments:**

1. **Market Volatility:** Cryptocurrency markets are notoriously volatile, and attempting to time short-term fluctuations can be akin to navigating treacherous waters. Sudden and unexpected price movements can lead to significant losses.

2. **Leverage Amplifies Risk:** Many shark fin traders use leverage to magnify their positions, potentially increasing both gains and losses. While leverage can enhance returns, it also heightens the risk of liquidation if the market moves against the trader.

3. **Emotional Stress:** Constant monitoring and quick decision-making characterize shark fin trading. The emotional toll of navigating rapid market changes can lead to stress and anxiety, affecting the trader's ability to make rational decisions.

4. **Lack of Fundamental Analysis:** Shark fin trading often relies heavily on technical analysis, neglecting the fundamentals of the underlying assets. Ignoring the broader market context can lead to misguided decisions.

**Mitigating Risks and Responsible Trading:**

1. **Risk Management:** Implement robust risk management strategies, including setting stop-loss orders to limit potential losses. Establishing clear risk-reward ratios is crucial in mitigating the inherent risks associated with shark fin trading.

2. **Continuous Learning:** Stay informed about market trends, news, and technological developments. Continuous learning and adaptability are essential in the fast-paced world of cryptocurrency.

3. **Avoiding Over-leveraging:** While leverage can amplify gains, it also amplifies losses. Exercise caution and avoid excessive leverage to prevent the risk of liquidation.

4. **Balancing with Long-Term Investments:** Consider balancing shark fin trading with a more traditional, long-term investment approach. Diversifying your portfolio can help spread risk and provide stability.

In conclusion, shark fin investments in crypto can be a double-edged sword, offering both opportunities and risks. Traders must approach this strategy with caution, employing effective risk management practices and staying vigilant in the face of market volatility. While the potential for quick profits exists, it is crucial to strike a balance between risk and reward and to navigate the waters of cryptocurrency investments with a measured and informed approach.

#MUSIC x HTX Year-end Creation#Share Your Shark Fin Subscriptions#HTX SmartEarn Debuts

18Condividi

Tutti i commenti0RecentePopolare

Nessuno storico