Ayesha

2 giờ trước

Near-Term Outlook Currently (November 2024 onward

Near-Term Outlook

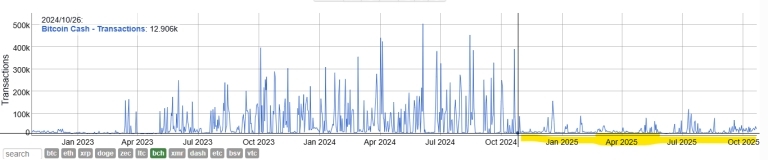

Currently (November 2024 onwards), daily transactions have consistently remained under 100,000, suggesting that smart money is neither actively buying nor selling. The price recovery to above 600 in Q3 2025 is built primarily on retail-based transactions.

1000030998

https://d1x7dwosqaosdj.cloudfront.net/images/2025-12/801b5183912d4fea97150260b140c979.jpeg

However, given this historical pattern, there are high odds that significant buying could be seen soon. When large players return, high-magnitude fluctuations in the transaction chart will signal their entry, confirming genuine demandIf this smart money buying materializes, BCH could initiate a strong recovery starting with $689, followed by targets at $1,200 and $1,597 by year-end. This momentum could extend into the first half of 2026, potentially hitting $2,532 and even retesting the prior all-time high of $4,300. Should the major buying activity fail to appear, BCH is expected to consolidate around the $450 level for the remainder of 2025

#HTX Trading Challenge#Post To Earn Bonus#Predict BTC's Year-End Price & Win 200 USDT#TSLAX: Tesla Ecosystem Token#HTX New Asset Trading Contest Now Live

2Chia sẻ

Tất cả bình luận0Mới nhấtPhổ biến

Không có hồ sơ