Bit360

10/18 11:09

Decoding Bitcoin’s 4-day price drop – Is BTC’s

Decoding Bitcoin’s 4-day price drop – Is BTC’s $100K at risk?

Is Bitcoin’s recent dip signaling capitulation?

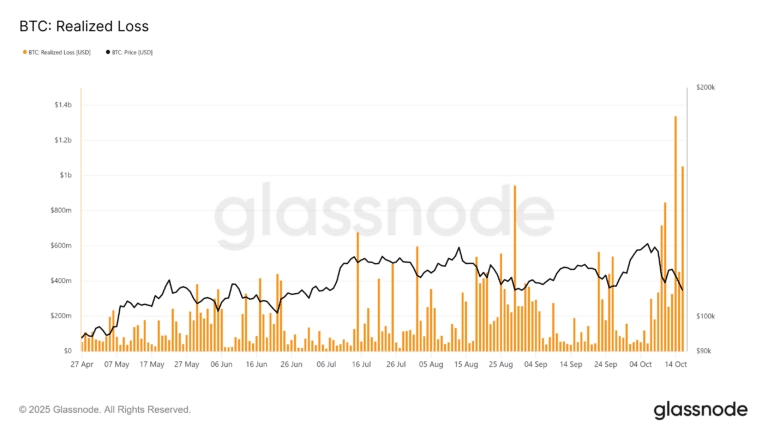

Bitcoin’s on-chain metrics and $2.75 billion in realized losses suggest weak hands are folding, pointing to a bear-controlled shakeout.

Could the $110k bounce be trusted?

Low spot demand and thinning bids turned it into a bull trap, making a breakdown below $100k increasingly plausible.

In crypto, every “dip” is usually an opportunity. However, that doesn’t seem to be the case for Bitcoin [BTC]. After four straight days of losses, BTC looks on track to retest the $100k level for the first time in four months.

On-chain data is flashing full-blown capitulation signals. Short-Term Holders (holding > 155 days) are now breaking even/capitulating after BTC slipped below their cost basis of $113k on the 14th of October.

The move suggests weak hands are starting to fold. Bitcoin’s Net Realized Profit/Loss (NRPL) flipped red this week, while total realized losses surged to $2.75 billion within just 72 hours, marking the steepest spike since April.

In short, Bitcoin is deep in a shakeout phase.

Notably, this exit liquidity is now feeding into BTC’s price action. Last week’s flash crash sparked a 4% bounce that briefly held $110k as support, but the subsequent 8% weekly pullback highlights thinning bid depth.

In simple terms, BTC is firmly in a bear-controlled market. Supply is rebuilding, yet the bid wall is struggling to absorb it, keeping downward pressure on price. Given this context, is Bitcoin now in full FUD territory?

All Comments0LatestHot

No records