B4Bit

09/03 05:56

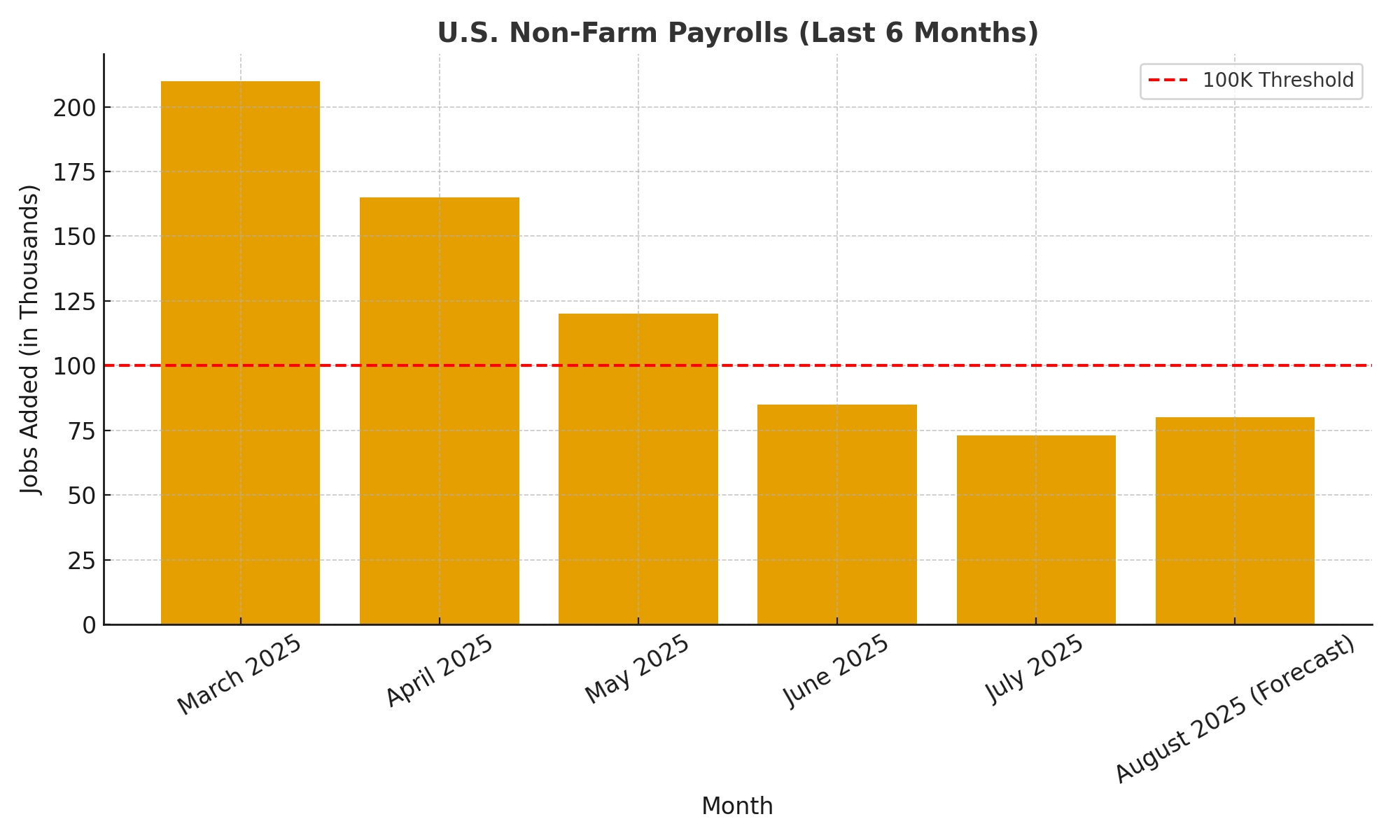

Will August’s Non-Farm Payrolls Exceed Expectation

The U.S. economy faces another pivotal test this Friday, September 5, 2025, when the Bureau of Labor Statistics (BLS) releases the highly anticipated August Non-Farm Payroll (NFP) report. Traders, economists, and policymakers alike will be watching closely, as the data is set to influence everything from Federal Reserve policy decisions to the direction of global markets.

Recent Performance: A Weakening Labor Market

The July jobs report was disappointing, showing only 73,000 new jobs—well below forecasts of around 110,000. Even more concerning were the sharp downward revisions to May and June, which cut a combined 258,000 jobs from the record. This brought the three-month average down to just 35,000 jobs per month, the weakest performance outside the pandemic years.

Such numbers have raised red flags about whether the labor market, once the backbone of America’s post-pandemic recovery, is now losing steam.

Market Forecasts for August :-

Analysts have issued a wide range of forecasts for the August report:

Consensus estimates: Most fall between 75,000–85,000 jobs, signaling only modest growth.

Optimistic projection: Markets.com has forecast as high as 120,000 jobs, though this is an outlier.

Cautious outlook: Several major banks, including Barclays, expect the number to hover around 75,000, barely above July’s figure.

In short, expectations are low, but there is room for a positive surprise.

Why This Report Matters :-

1. Federal Reserve Policy

The NFP is one of the most important indicators guiding the Fed’s decision on whether to cut rates at its September 16–17 meeting. A weaker report would strengthen the case for a 25 basis point cut, while a strong print could delay rate easing.

2. Market Reactions

Weak report → stocks may rally on rate-cut hopes, while the U.S. dollar could weaken.

Strong report → rate cuts may be postponed, creating volatility in equities and bonds.

3. Economic Confidence

With consumer spending slowing and inflation moderating, labor market health remains the biggest question mark for the U.S. economy heading into the final quarter of 2025.

Will It Exceed Expectations?

The answer leans toward no, unless there is a significant upside surprise. Recent downward revisions and the trend of weak job creation suggest that the August report will likely fall in line with or slightly below consensus estimates. For the NFP to truly “beat expectations,” it would need to approach or surpass the 120,000 mark—a scenario most analysts view as unlikely.

Final Thoughts :-

The August jobs report will set the tone for September’s Federal Reserve meeting and the broader economic outlook. If the data confirms a cooling labor market, the Fed may move ahead with rate cuts to support growth. On the other hand, any surprise strength could challenge the narrative of economic slowdown and complicate policy decisions.

Either way, this NFP release carries outsized importance, and market participants should be prepared for volatility across equities, bonds, currencies, and even crypto.

#火币社区_SUNPUMP全球创作者争霸赛#HTX community ✖ SUNPUMP Creator Championship#HTX 12th-Anniversary Carnival

40分享

全部評論0最新熱門

暫無記錄