Zoye

09/02 11:21

Bitcoin bulls gain key “oversold” print Bitcoin s

Bitcoin bulls gain key “oversold” print

Bitcoin speculators have reached a key profit threshold as BTC/USD fell to its lowest levels since the start of July.

The aggregate cost basis or realized price of the short-term holder (STH) cohort — entities hodling for up to six months — now corresponds to the spot price.

That level tends to act as support during Bitcoin bull market corrections, but losing it conversely can lead to lengthy periods of BTC price weakness.

A leading indicator, Market Value to Realized Value (MVRV), measures the value of hodled coins to the price at which they last moved onchain.

1000063282

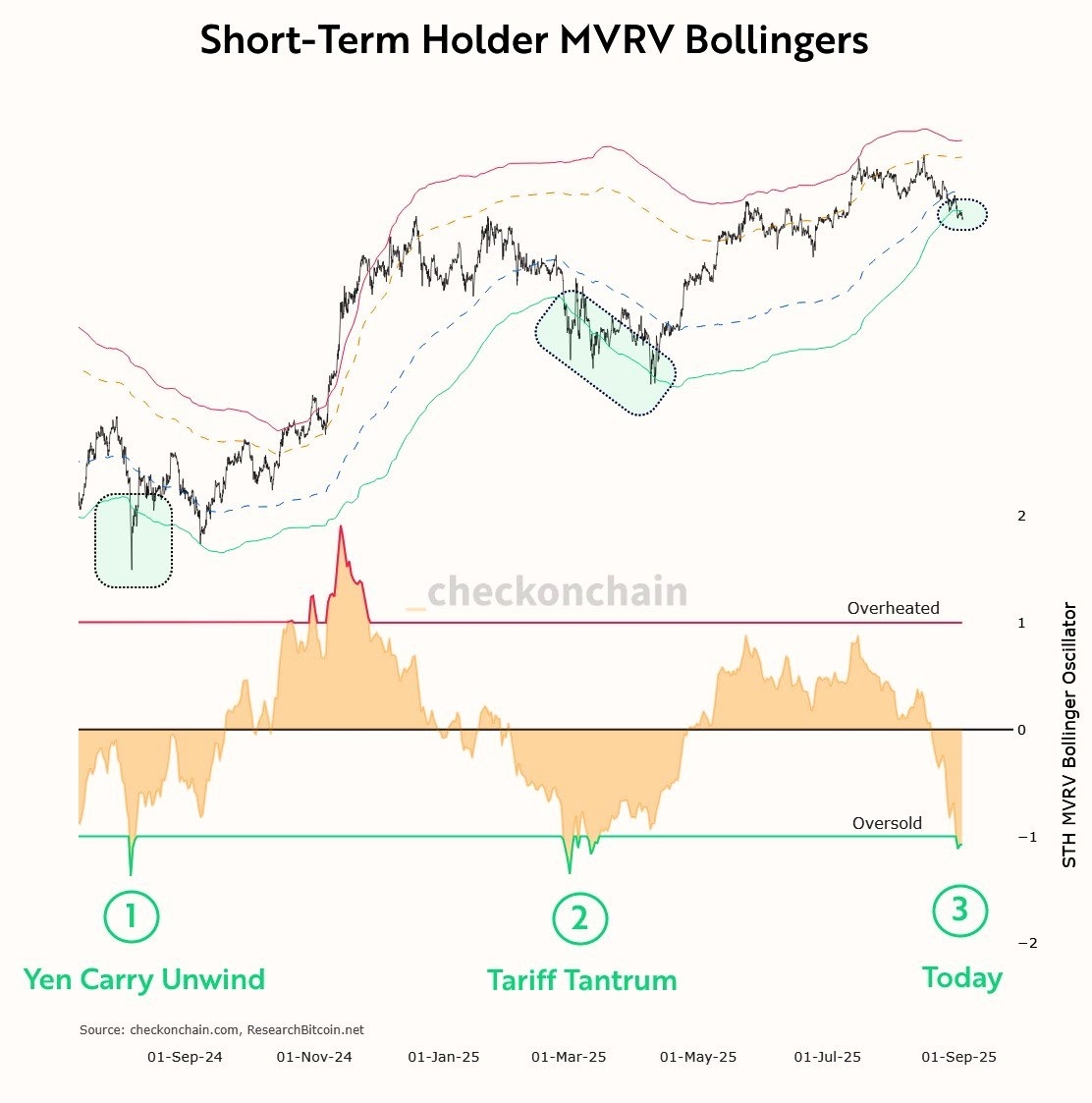

At current prices, MVRV for the STH cohort is at breakeven. As Fetter noted, however, adding the Bollinger Bands volatility indicator to the mix delivers a key “oversold” signal.

“Officially got the Oversold print on the short-term holder MVRV Bollinger Bands,” he confirmed.

The bands, themselves a leading price indicator, offer standard deviation levels that allow observers to gauge how rare given levels are, in this case, STH-MVRV values.

Fetter said that downside deviation on STH-MVRV has only occurred twice in the past year.

In August 2024, when the Japanese yen carry trade unwound, STH-MVRV fell below the lower Bollinger Band standard deviation line. The same thing occurred in April this year, when US trade tariffs caused BTC/USD to drop below $75,000.

1000063283

#Post To Earn Bonus#HTX community ✖ SUNPUMP Creator Championship#Check In Daily, Win Prizes Daily — Join the Fun!#Buy Bitcoin’s dip,’ says Eric Trump#HTX Crypto Gifts Carnival Is Live!

6Condividi

Tutti i commenti0RecentePopolare

Nessuno storico