BITStar2

09/01 15:20

September kicks off with a packed economic calenda

September kicks off with a packed economic calendar set to move markets.

We’ve got ISM manufacturing PMI and employment, initial jobless claims, trade balance, nonfarm payrolls, and the unemployment rate, all set to be released in the first week of BTC’s historically bearish month.

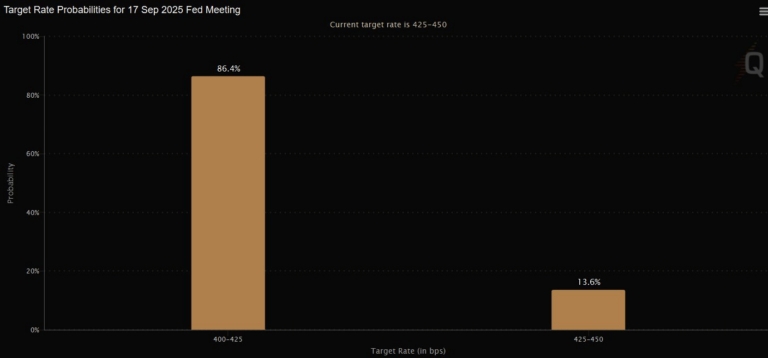

All eyes, however, are on the 17th of September FOMC, where markets are largely pricing in easing. 86.4% chance of a rate cut, 13.6% no change, and 0% hike, making this week’s releases key for BTC bull run.

Simply put, the U.S. macro backdrop is key to backing MSTR’s BTC bet.

The logic is simple: July’s headline CPI held at 2.7%, just under the 2.8% forecast, while core CPI ticked up 0.3% as “expected”, its sharpest monthly gain in six months, keeping inflation dynamics in check.

The result? The FOMC held rates unchanged. Bitcoin bottomed, sparking a $124k ATH in the prior BTC bull run. Now the question is whether current macro conditions can trigger a similar BTC rally, backing MSTR’s stance.

#Post To Earn Bonus#HTX community ✖ SUNPUMP Creator Championship#HTX 12th-Anniversary Carnival

3Condividi

Tutti i commenti0RecentePopolare

Nessuno storico