Habiba

08/13 02:49

Alameda’s SOL unstake raises stakes for bulls At

Alameda’s SOL unstake raises stakes for bulls

At first glance, Solana’s 2.35% weekly pullback looks small compared to other assets, likely driven by a broader market risk-on rotation rather than anything specific to Solana.

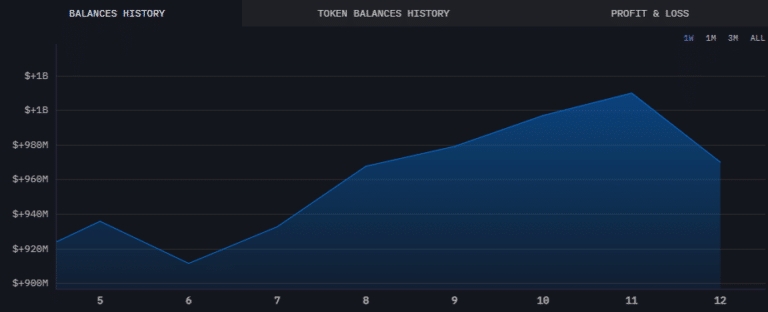

However, deeper forces were at play. One Alameda Research wallet unstaked $35 million in SOL, locked since late 2020 when worth $350K — a 100x gain.

Still, SOL’s Net Position remains positive, supporting price consolidation above $170. That’s a notable divergence from previous risk-off periods, where Net Position flipped negative and capitulation set in.

The $170 line in the sand

This sets SOL at a critical inflection point. Buy-side depth hasn’t collapsed yet, but selling pressure is clearly building. The sync between large whale sell-offs and unstaking activity points to coordinated distribution.

If $170 doesn’t hold as support, expect increased downside risk, making Solana a must-watch for short-term momentum shifts.

Tutti i commenti0RecentePopolare

Nessuno storico