Trading King

08/11 16:17

Bitcoin (BTC) Price Analysis – August 11, 2025

Bitcoin (BTC) Price Analysis – August 11, 2025

Current Overview

Bitcoin has rallied above $122,000, rising approximately 2.8–3% today and pressing against its all-time high of $122,838 recorded in mid-July. This robust move reflects strong bullish momentum.

Chart Interpretation

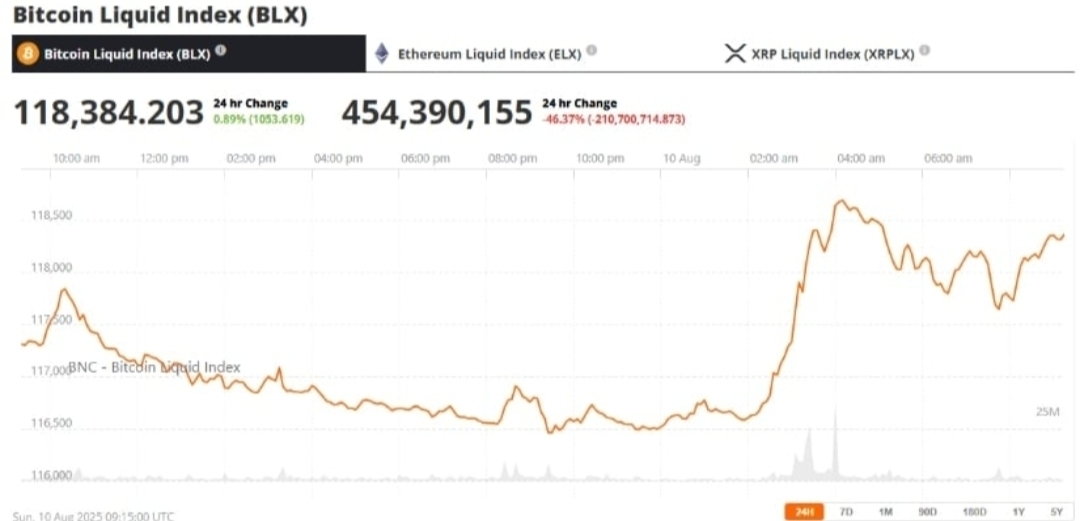

The chart above (via Brave New Coin) illustrates Bitcoin’s consolidation above $118,000, setting the stage for a breakout above $122,000. Technical indicators such as a confirmed bull-flag pattern signal tight upward momentum.

Key Drivers Behind the Rally

Institutional Demand & ETF Inflows: Strong buying pressure is evident, with record ETF inflows fueling the surge.

Favorable Macro Backdrop: Market expectations for upcoming Fed rate cuts are lending further bullish support.

Technical Spark: Bitcoin buyers are challenging the critical 1.618 Fibonacci retracement level at $122K, a historically significant resistance.

Technical Levels to Watch

Level Notes

Resistance: $122K–$123K Crucial breakout zone—crossing this could lead toward $130K–$140K.

Support: $118K Offers a base for the bull flag breakout; losing this level could prompt consolidation.

CME Futures Gap: ~$117K Gaps often get filled; Bitcoin may retrace here unless momentum remains strong.

Outlook

Short Term: If Bitcoin holds above $122K and clears $123K, a strong continuation toward $130K–$140K appears likely. Pullbacks to $118K may offer attractive re-entry points.

Mid to Long Term: The combination of institutional uptake, ETF flows, and macro tailwinds (like potential Fed easing) supports a bullish trajectory.

#Post To Earn Bonus#Win 200 USDT: Is ETH Kicking Off Altcoin Season? #Claim1,200 USDT in the Monthly Creation Challenge#Whose “child” is ES — Solana or Ethereum?#Do you think Tanssi is promising?

6공유

모든 코멘트0최신인기

기록 없음