Crypto Express

08/09 13:36

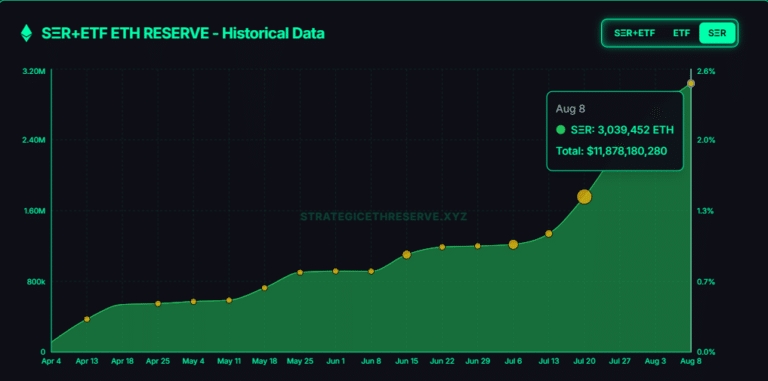

ETH treasury holdings hit $11B

As of press time, over 60 players had acquired 3 million ETH, valued at $11.8 billion, translating to 2.5% of the total supply.

BitMine Immersion Technologies (BMNR) led the camp with 833.1K ETH, worth about $3.26 billion.

SharpLinK Gaming (SBET) ranked second with 521.9K ETH (worth $2 billion) while The Ether Machine (DYNX) had $1.35 billion ETH.

Since June, treasury demand has rivaled ETF, with the Standard Chartered noting that both avenues acquired 1.6% of ETH overall supply.

In fact, the bank said treasury stocks are better investments than ETH ETFs. They offer exposure to staking rewards and yields.

Meanwhile, mNAV (market price to net asset value) dropped for most firms, indicating fair value. This decline suggests a discounted buying opportunity for investors.

#Post To Earn Bonus#Claim1,200 USDT in the Monthly Creation Challenge#Focus on NFT

82分享

全部评论0最新最热

暂无记录