Crypto Express

08/09 13:28

Muted stock response amid industry shifts

Even though CleanSpark posted record earnings,its share price dipped following the announcement. After-hours trading showed a modest uptick of less than 1%.

Despite the dip, CleanSpark’s stock is up 16.4% year-to-date—outperforming MARA Holdings, which is down 7%, though still trailing Riot Platforms’ recent surge.

These results come amid a 32% rise in Bitcoin’s price between April and June, boosting miner revenues across the industry.

Meanwhile, the broader mining landscape remains complex. Chinese-origin capital, hardware, and expertise continue to drive an estimated 55%–65% of global mining activity, despite Beijing’s 2021 ban.

In contrast, the U.S. hashrate share has climbed from just 4% in 2019 to 38% today. Iran, on the other hand, has warned that crypto mining may be responsible for up to 20% of its national energy imbalance.

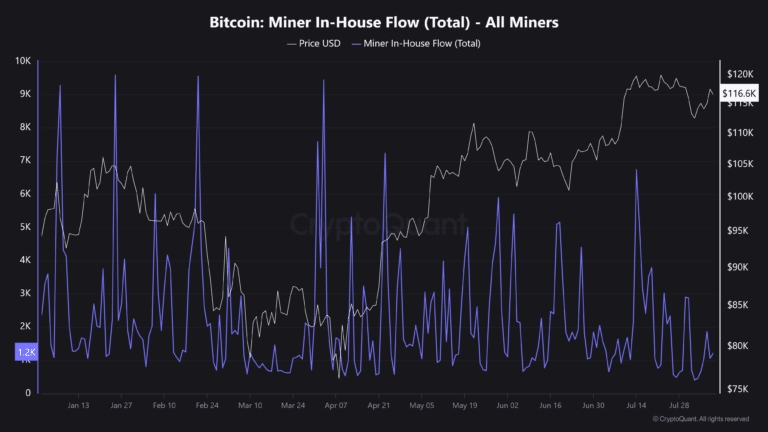

Bitcoin miner reserves hold steady as selling staIn-house flow data, tracking movements within miner wallets, shows brief spikes linked to routine operations rather than big exchange sales.

With reserves stable and selling limited to periods of price strength, miners appear to be following a “hold-first” strategy.

This approach likely supported Q3 profits across the industry, even as rising network difficulty and energy costs continue to pressure operations.

#Post To Earn Bonus#Claim1,200 USDT in the Monthly Creation Challenge#Focus on NFT#Buy Bitcoin’s dip,’ says Eric Trump#Whose “child” is ES — Solana or Ethereum?

88分享

全部评论0最新最热

暂无记录