Crypto Driver

08/07 01:18

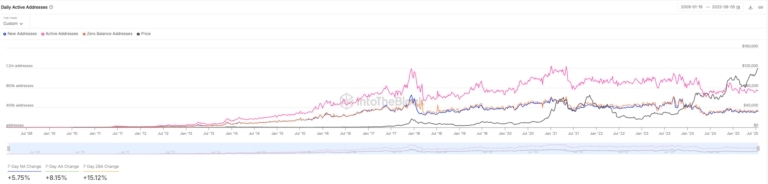

Expanding demand across the network On-chain data

Expanding demand across the network

On-chain data shows a consistent rise in address activity. Over the past seven days, new addresses rose by 5.75%, while active addresses climbed by 8.15%.

Zero-balance addresses also surged 15.12%, possibly indicating wallet reorganization or increased transfer activity.

This broad growth suggests rising user participation and expanding network utility. These trends are often early signals of demand-side strength, especially when paired with accumulation patterns.

Therefore, the uptick in address metrics could serve as a foundational pillar for a stronger bullish case.

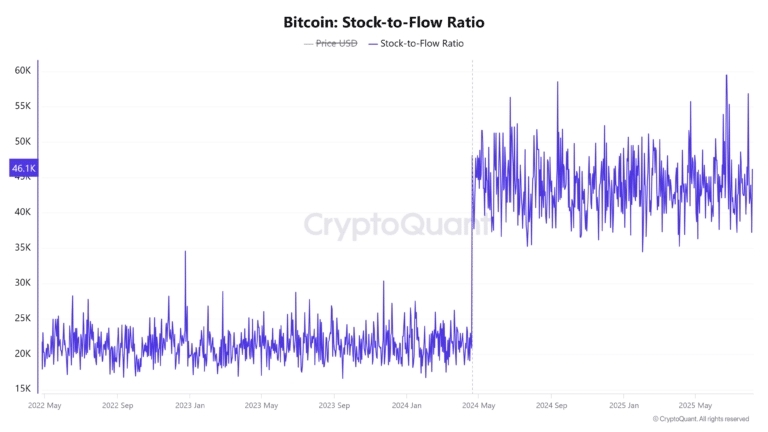

Bitcoin’s long-term scarcity narrative boosted

The Stock-to-Flow (S2F) ratio surged by over 66% to reach 1.0614M, indicating heightened scarcity relative to supply issuance.

A rising S2F metric historically aligns with bullish long-term price trajectories, particularly when supply tightens amid rising interest.

While this metric doesn’t predict short-term price action, it supports Bitcoin’s value narrative as digital gold.

Coupled with address growth and ongoing accumulation, the jump in S2F bolsters the view that BTC’s long-term fundamentals remain strong.

All Comments0LatestHot

No records