silosili

07/29 05:04

Stablecoins are minting but not moving - Is crypto

Stablecoins are minting but not moving - Is crypto liquidity drying up?8 billion minted, 5.7 billion gone: Is crypto entering risk-off mode?

Stablecoins surged in supply but failed to deploy, with $8 billion in new USDT minted yet $5.7 billion yanked from exchanges. Sidelined capital stayed parked, reinforcing a broader risk-off tilt.

Tether [USDT] didn’t sit out July’s turbulence. In fact, it mirrored the market’s pulse. Its market cap jumped to $163.60 billion, tagging on nearly $8 billion in fresh supply.

That’s a 3.72% gain for the month, marking the sharpest 30-day climb since November’s 10.89% surge, when risk appetite kicked into gear. Simply put, Bitcoin’s [BTC] run to $123k didn’t happen in a vacuum. Instead, it tracked closely with the stablecoin liquidity rotating into the system. And yet, $5.7 billion stablecoins were yanked from exchanges, creating a significant imbalance.

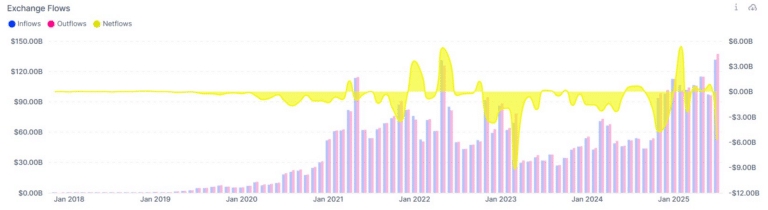

As illustrated in the chart above, in July 2025, stablecoin outflows (pink) surged, while inflows (blue) held relatively flat, marking one of the largest monthly outflow spikes since early 2022.

When you stack that against the $8 billion in fresh USDT minted, it paints a lopsided picture: Supply’s ramping, but actual risk deployment is lagging.

The result? A liquidity-deficient environment where capital might be circulating, but it’s not hitting the order books. Does this behavior point to a broader risk-off skew, capping “market-wide” upside?

全部评论0最新最热

暂无记录