Crypto 350

07/28 02:31

Ethena converts USDe demand into ENA supply pressu

Ethena converts USDe demand into ENA supply pressure

As AMBCrypto pointed out, USDT and USDC earn yield from the U.S. Treasury holdings and rotate that income into Bitcoin as part of their reserve strategy.

Ethena plays a different game. It doesn’t rely on T-bills.

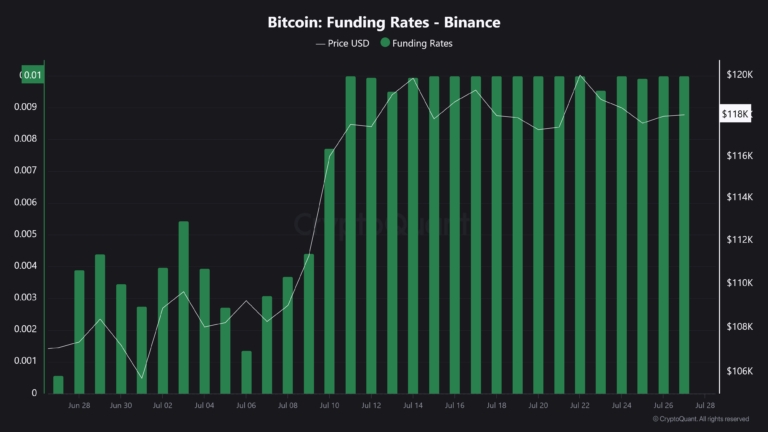

Instead, it leans into crypto market volatility, capturing Funding Premiums to generate on-chain yield.

Here’s how it works: When the market is bullish, Bitcoin traders go long on perpetual futures, and they have to pay a funding fee to those taking the opposite side (shorts).

Ethena takes the short side, collecting that funding as yield.

Consequently, that yield is then recycled into ENA buybacks, turning USDe growth into real, sustained demand for the native token.

In fact, between the 22nd and 25th of July alone, 83 million ENA (1.3% of the circulating supply) were scooped up across public venues, as part of the Foundation’s ongoing $260 million buyback initiative.

That’s why ENA’s 130% rally isn’t just market noise. At this rate, the $1 breakout isn’t hype, it’s just where the chart’s headed.

All Comments0LatestHot

No records