Crypto 349

07/23 17:56

Ethereum ETFs: Reaching the Third-Highest Daily Hi

Ethereum ETFs: Reaching the Third-Highest Daily High

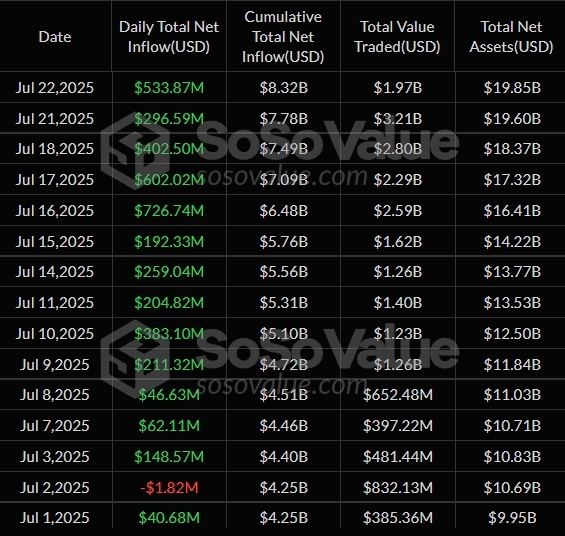

On Tuesday, the funds recorded inflows of $533.87 million – the third highest ever.

The current ATH is $726.74 million, seen on 16 July, followed by $602.02 million the very next day.

Additionally, Tuesday marked the thirteenth consecutive day of positive flows for the funds combined.

The streak follows a day of minor outflows: $1.82 million on 2 July.

Moreover, as the chart above shows, the value of total net assets continued to rise in July. It hit an all-time high on Tuesday at $19.85 billion.Sosovalue-ETH-etf-data-history.png

Meanwhile, not every one of the nine trades the same, or sees any flows at all, depending on the day. BlackRock commonly leads the list with the highest flows, be they positive or negative.

On Tuesday, three funds saw positive flows, while the others recorded no flows at all. BlackRock took in $426.22 million. It’s followed by Grayscale’s $72.64 million and Fidelity’s $35.01 million.

In comparison, on 16 July, when the ETFs hit their ATH, BlackRock recorded $499.25 million. Fidelity took in $113.31 million. Six other funds saw inflows.

Katherine Wu, the COO of ENS Labs, the organization behind the open-source blockchain naming protocol, Ethereum Name Service (ENS), commented that “these are massive numbers that speak volumes: institutions aren’t just paying attention, they’re allocating.”

#Claim1,200 USDT in the Monthly Creation Challenge#HTX 12th-Anniversary Carnival#ETH price breaks through $4,600, buy or sell?#Do you think DELOREAN is promising?#HTX DAO Listing Governance is LIVE!

16分享

全部评论0最新最热

暂无记录