Crypto Express

07/21 02:33

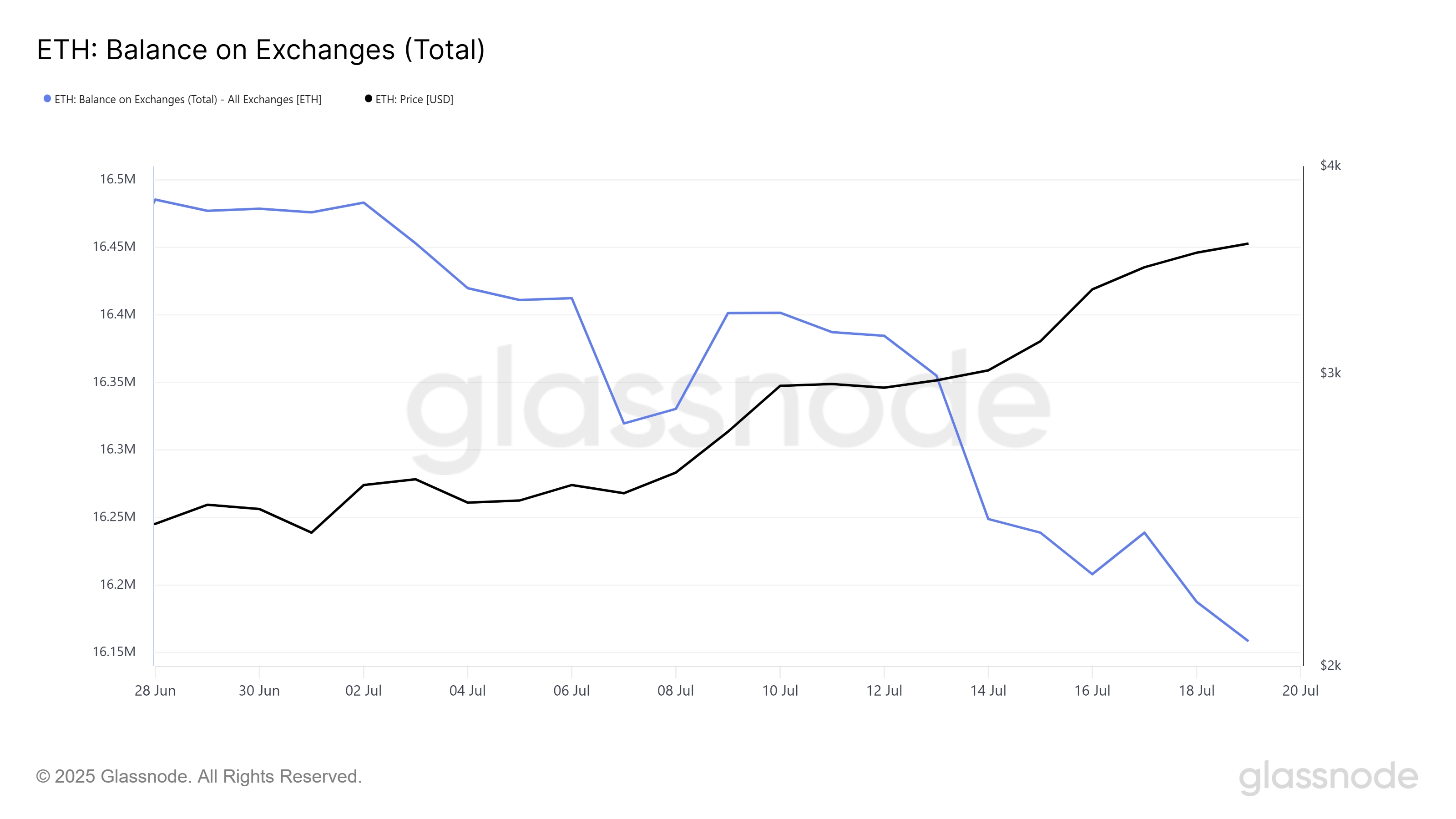

Ethereum Investors Accumulate Heavily

Since the start of July, the balance of Ethereum on exchanges has dropped by over 317,000 ETH. This amount, valued at more than $1.18 billion, reflects the scale at which investors are withdrawing their holdings, reducing available supply.

The decline indicates strong confidence that the price will continue rising.

This accumulation trend is driving the rally, as demand outweighs supply. Such aggressive behavior suggests that many market participants believe ETH could soon breach $4,000, adding more bullish pressure to its price trajectory.

Ethereum’s Network Value to Transactions (NUPL) ratio is now approaching the “Belief-Denial” zone. This metric signals whether investors are in profit and helps identify potential reversal zones.

Historically, whenever NUPL entered this area, Ethereum’s price experienced a short-term correction.

The belief-denial level often acts as a saturation point where optimistic investors begin to secure profits. If Ethereum crosses $4,000, this psychological level may trigger significant selling pressure.

This pattern has repeated over the last 16 months and could repeat if ETH’s bullish run continues without correction.

#Check In Daily, Win Prizes Daily — Join the Fun!#Claim1,200 USDT in the Monthly Creation Challenge#Focus on NFT

68分享

全部評論0最新熱門

暫無記錄