crypto Queen Abrash

07/20 11:14

Ethereum in the driver’s seat, but for how long?

Ethereum in the driver’s seat, but for how long?

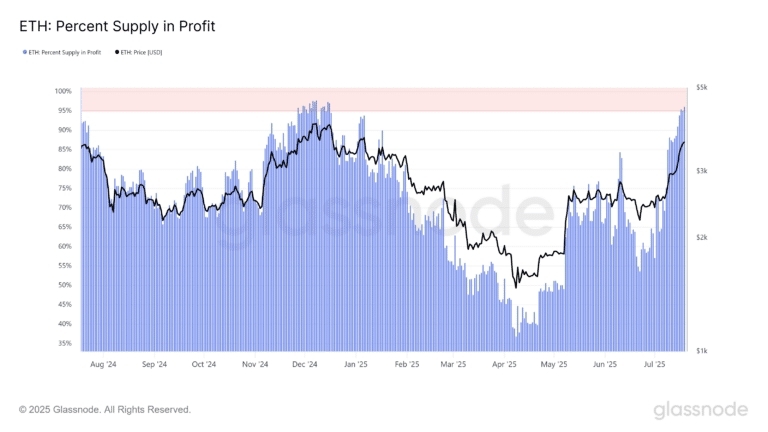

Beyond the overheated ROI and stretched momentum, Ethereum’s % supply in profit adds another layer to the setup.

With ETH pushing toward $3.7k, over 95% of the supply is now in the green, entering a historically saturated zone that’s typically marked by distribution.

We’ve seen this play out before.

Similar spikes into the 95–100% range (highlighted by the red band), particularly in late December 2024 and early January 2025, lined up with ETH’s sharp Q1 reversal, as profit-taking pressure kicked in.

However, it looks like smart money might be getting ahead of that risk.

Lookonchain tracked two fresh whale wallets, scooping up 58,268 ETH at an average cost basis of $3,680, roughly $212 million in size. That adds to the $18 billion+ in large transfers flowing through the Ethereum network.

But is that enough to lock in a bottom? Not just yet. ETH’s approaching a key inflection zone, and if past cycles are anything to go by, a shakeout or reset could be on the cards before $4k becomes a clean target again.

Todos os comentários0Mais recentePopular

Sem registos