CryptoDangers8888

07/20 03:00

Derivatives dominate ETH volume Ethereum’s 24-hou

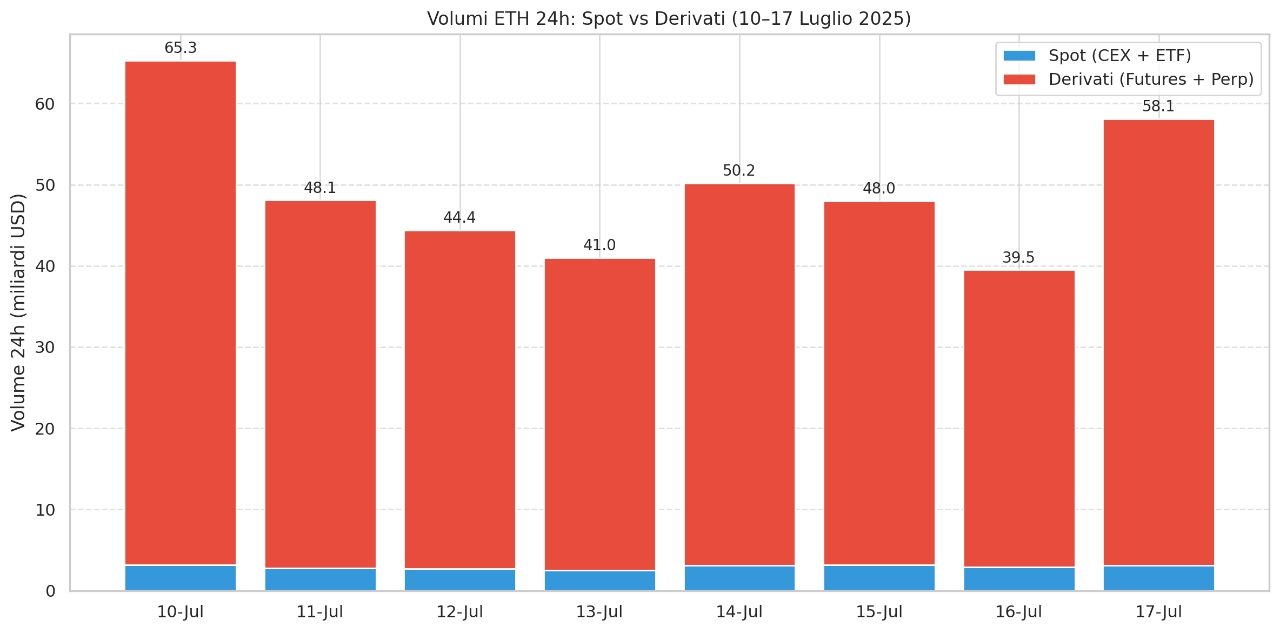

Derivatives dominate ETH volume

Ethereum’s 24-hour trading volume shows that derivatives are still doing the heavy lifting.

Between the 10th and 17th of July, daily futures and perpetuals trading ranged from $39.5 billion to a massive $65.3 billion, completely overshadowing spot volumes, which barely nudged above $3 billion.

Even on the 17th of July, with ETF-driven interest spiking, spot activity remained a small slice of the total market action.

This persistent imbalance shows how little actual buying is backing ETH’s rally. The overwhelming share of volume is speculative, likely driven by short-term traders and arbitrage desks.

Until the spot component grows meaningfully, the rally’s structure remains vulnerable to sudden unwinding by over-leveraged participants.

全部評論0最新熱門

暫無記錄