Crypto Express

07/17 05:48

Are Bitcoin ETFs becoming the new whale class?

Are Bitcoin ETFs becoming the new whale class?

Speculation that Bitcoin may have topped has been fueled by clear signs of whale selling.

As noted by CryptoQuant, the Bin@nce Whale Activity Score jumped sharply right after BTC’s recent peak. Roughly 1,800 BTC were deposited to Bin@nce.

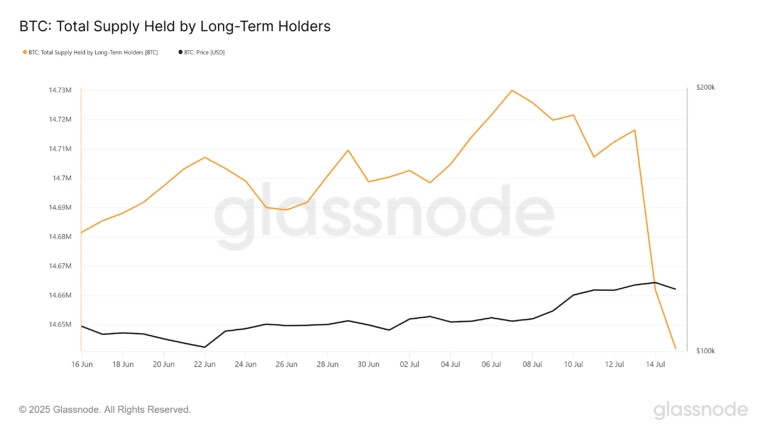

On-chain data seemed to back this up too – BTC’s LTH supply dropped by 75,000 BTC in just under three days, reinforcing the idea that BTC’s drop was a well-timed strategic unwind by major players.

Interestingly, this selling pressure coincided with nearly $700 million in net inflows into Bitcoin ETFs, with IBIT alone pulling in close to $800 million gross. That’s more than 4x the estimated whale sell-side volume.

It’s a clear sign that Bitcoin ETFs are not just accumulating, but also soaking up liquidity during key volatility windows.

This appeared to mark a structural divergence from earlier cycles – Something that risk managers, and macro-focused investors should be watching closely.

#BTC price hits a new high of $120,000! #Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge

79分享

全部評論0最新熱門

暫無記錄