加密货币最佳

07/11 17:53

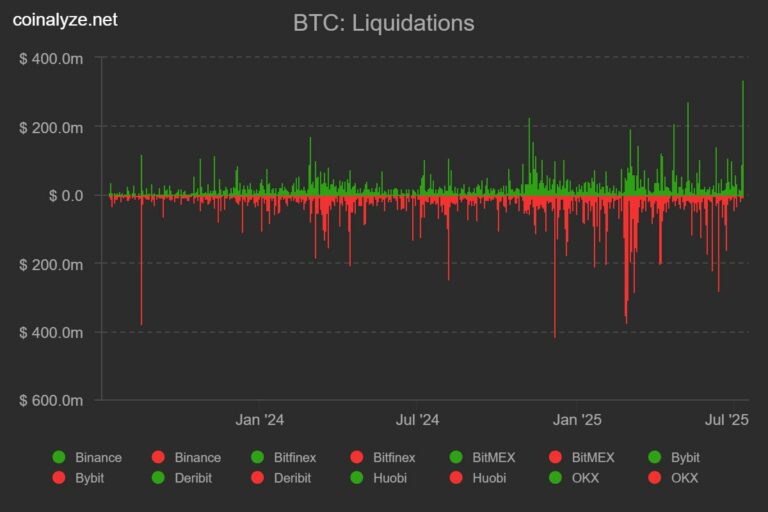

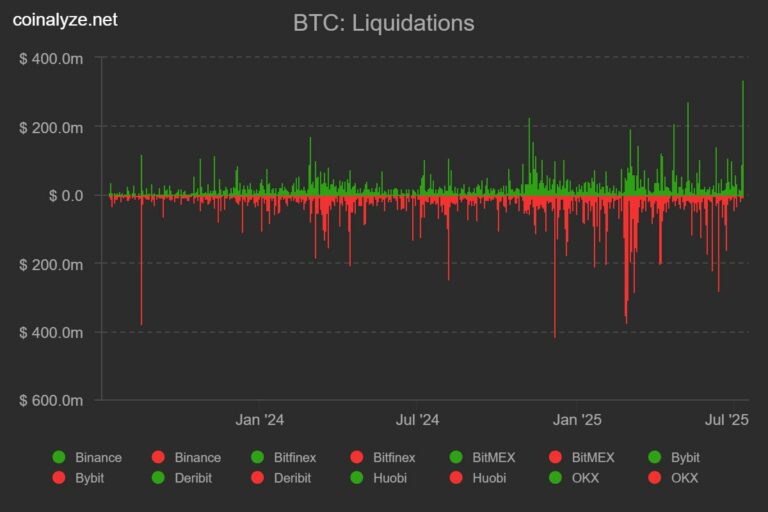

Record bitcoin liquidation

The mid-week rally began with a short squeeze following a massive wipeout of leveraged short positions that piled above $111k and stretched to $115k in the past few days.

These speculators were betting on muted price action and potential BTC retracement. But they were wrong and got burned.

Such liquidity pools on the derivatives always trigger a liquidity hunt and act as a price magnet.

CoinGlass data showed that over $1.2 billion positions were liquidated across the markets in the past 24 hours.

And BTC accounted for $655 million, with bears suffering a $635 million loss.

In fact, on an aggregated basis, BTC trader Byzantine General noted that this was a record liquidation in recent years.

In other words, this was a strong bullish cue for BTC on the derivatives market.

#Check In Daily, Win Prizes Daily — Join the Fun!#HTX 12th-Anniversary Carnival#Claim1,200 USDT in the Monthly Creation Challenge#Do you think SQD is promising?# Israel’s attack on Iran.

37Share

All Comments0LatestHot

No records