Crypto Express

07/11 04:45

Derivatives traders tip the scale:

Derivatives traders tip the scale: Can long positions drive the next surge?

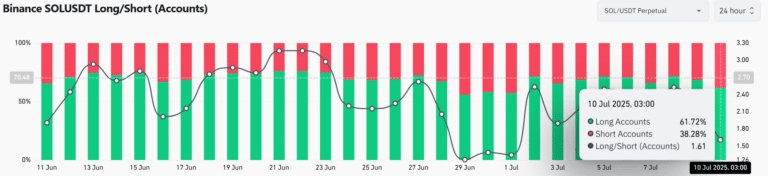

Derivatives data indicates that 61.72% of accounts remain long on SOL/USDT perpetuals, compared to just 38.28% short, at press time.

This skew reflects mounting confidence among market participants.

While the Long/Short Ratio sat at 1.61, such imbalances often lead to volatility as crowded trades become vulnerable. Therefore, while sentiment favors the bulls, any sharp pullback could trigger a chain of long liquidations.

Still, if momentum holds, these long positions could serve as the fuel needed for SOL to reclaim previous highs.

#HTX 12th-Anniversary Carnival#Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge#Do you think DELOREAN is promising?#Do you think LISTA is promising?

88Share

All Comments0LatestHot

No records