Crypto Express

07/10 02:11

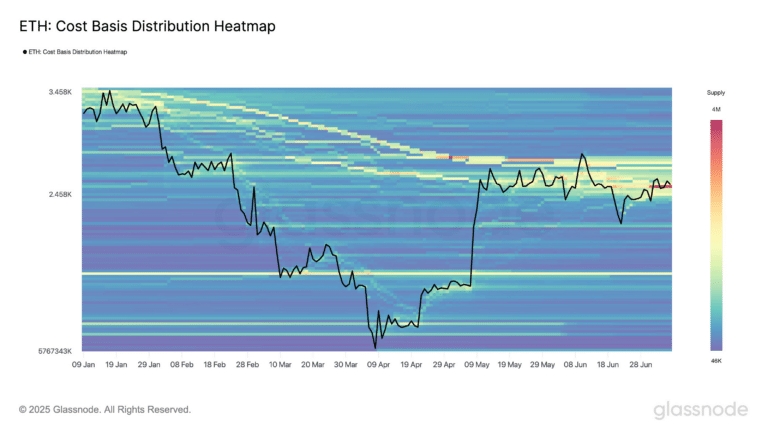

ETH carves out a solid base

Ethereum didn’t start July quietly. After a sharp 3.2% drop on the first day of the month, ETH snapped back with a 6.86% rally the very next day, triggering a classic short squeeze.

Crucially, this rebound in Ethereum projections wasn’t just driven by the 3.78% spike in the ETH/BTC ratio.

On-chain data from Glassnode highlights the $2,513-$2,536 range as a major demand pocket, with over 3.45 million ETH accumulated at that level, marking it as one of the strongest support zones ETH has seen in months.

Backing this up, spot ETH ETFs saw a sharp inflow spike of $148 million on the 3rd of July, the highest single-day total in nearly a month.

In fact, total ETF inflows for July now stand at $300 million, underscoring a steady build-up in spot-driven demand.

#Check In Daily, Win Prizes Daily — Join the Fun!#Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge

82Condividi

Tutti i commenti0RecentePopolare

Nessuno storico