crypto complex

07/09 12:13

October 2025: The Next Blow-Off Top? Bitcoin’s cu

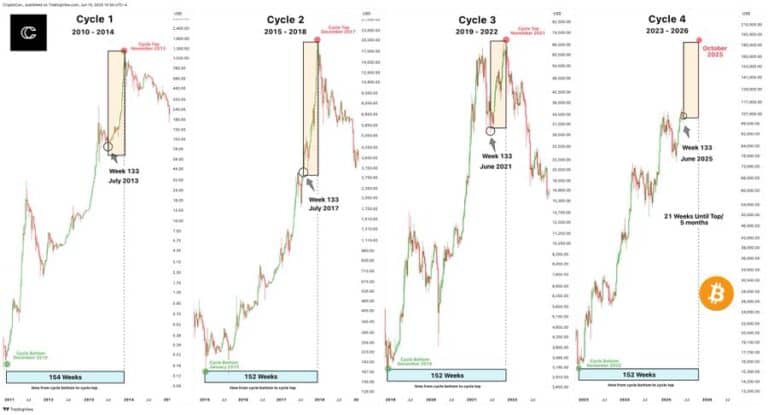

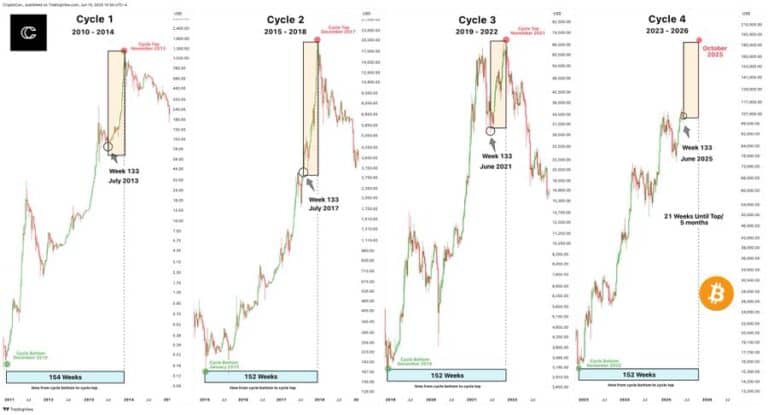

October 2025: The Next Blow-Off Top?

Bitcoin’s current cycle looks eerily like past ones. Based on previous halving-to-peak timelines (usually around 152 weeks), top could be just 2 to 3 months away.

Analyst CryptoCon said on X, “the Bitcoin cycle top will be in October this year. We’ve got about 21 weeks or 5 months until we get there. How are we shaping up so far? Other cycles had already completed their First Cycle Top by this time and were preparing for the final run. Some people are under the impression that the cycle can extend into 2026 (year of the bear market) because of the slower price action. Most data seems to favor that the cycle will be complete by the end of this year.”

Here’s the contrarian angle: maybe this cycle doesn’t blow off at all. Maybe the days of parabolic tops and brutal drawdowns are behind us, replaced by slower, more institutional price discovery. Bitcoin doesn’t have to repeat the past to make history. And with ETFs, sovereign accumulation, and Layer 2 activity picking up, there’s a chance this market looks more

October 2025: The Next Blow-Off Top?

Bitcoin’s current cycle looks eerily like past ones. Based on previous halving-to-peak timelines (usually around 152 weeks), top could be just 2 to 3 months away.

Analyst CryptoCon said on X, “the Bitcoin cycle top will be in October this year. We’ve got about 21 weeks or 5 months until we get there. How are we shaping up so far? Other cycles had already completed their First Cycle Top by this time and were preparing for the final run. Some people are under the impression that the cycle can extend into 2026 (year of the bear market) because of the slower price action. Most data seems to favor that the cycle will be complete by the end of this year.”

Here’s the contrarian angle: maybe this cycle doesn’t blow off at all. Maybe the days of parabolic tops and brutal drawdowns are behind us, replaced by slower, more institutional price discovery. Bitcoin doesn’t have to repeat the past to make history. And with ETFs, sovereign accumulation, and Layer 2 activity picking up, there’s a chance this market looks more like the S&P 500 on stimulants than the wild casino of 2017.

Still, the dream of a vertical moonshot this October lives on.

For now, the Mayer Multiple gives us one clear message: don’t let the high price fool you, BTC might still be cheap. Now might be the best time to buy Bitcoin and crypto from a risk-reward perspective.

the S&P 500 on stimulants than the wild casino of 2017.

Still, the dream of a vertical moonshot this October lives on.

For now, the Mayer Multiple gives us one clear message: don’t let the high price fool you, BTC might still be cheap. Now might be the best time to buy Bitcoin and crypto from a risk-reward perspective.

All Comments0LatestHot

No records