primeearn.verse

06/22 12:42

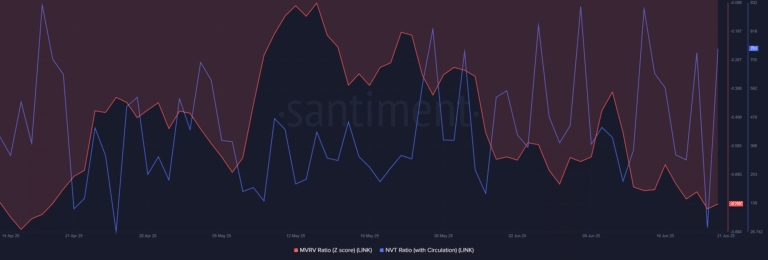

Do THESE metrics confirm LINK’s vulnerability?

Do THESE metrics confirm LINK’s vulnerability?

Chainlink’s NVT ratio was 751, meaning its market cap is significantly higher than its current transaction volume, which is definitely never a good sign.

Historically, these gaps occur when speculative demand pushes prices beyond what’s keeping the network active. So if LINK’s network utility doesn’t improve, it could herald further declines.

Meanwhile, the MVRV Z-Score has fallen to -0.78, suggesting that most holders are underwater, which is often a sign of undervaluation

But here’s the catch: with exchange net flows still rising and whale inflows growing, this discount may not matter. The signals are crossing, leaving traders wondering if they’re oversold or just oversold?

#Check In Daily, Win Prizes Daily — Join the Fun!#Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge# Israel’s attack on Iran.#US May CPI data

ThíchChia sẻ

Tất cả bình luận0Mới nhấtPhổ biến

Không có hồ sơ