Crypto Express

06/19 01:26

Will long liquidations trigger BTC next major

Will long liquidations trigger BTC next major correction?

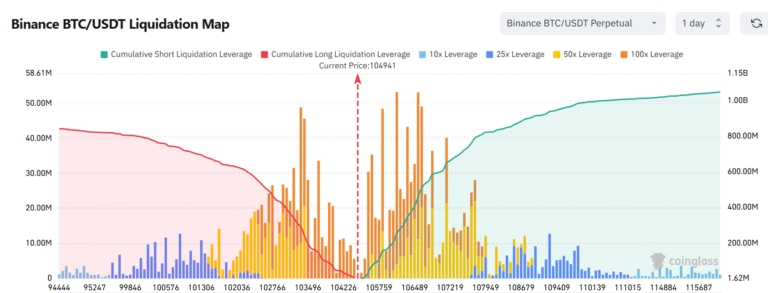

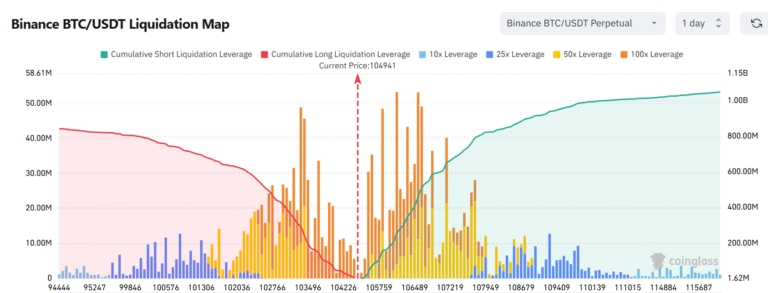

According to an exchange Liquidation Map, a large cluster of long liquidations sits just below the $104K level.

If prices fall below this threshold, it could trigger cascading forced sell-offs, intensifying downward volatility.

However, significant short positions lie just above, suggesting potential for a short squeeze if the price breaks higher instead

Therefore, the market remains at a critical crossroads where leverage dynamics could dictate the next decisive move.

Bitcoin’s rally above $100K has not triggered traditional signs of market overheating, as on-chain indicators remain neutral or even bullish.

Negative sentiment, declining valuation metrics, and holding behavior suggest the uptrend may still have fuel.

However, elevated long-term liquidation levels highlight short-term risk if support breaks.

Overall, the data paints a picture of cautious optimism, where fundamental strength remains intact, yet leverage and sentiment could shape near-term volatility.

#Post To Earn Bonus#Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge# Israel’s attack on Iran.#Share BTC or ETH Futures Trades

44Share

All Comments0LatestHot

No records