Crypto Express

06/19 00:22

SOL Declining CVD

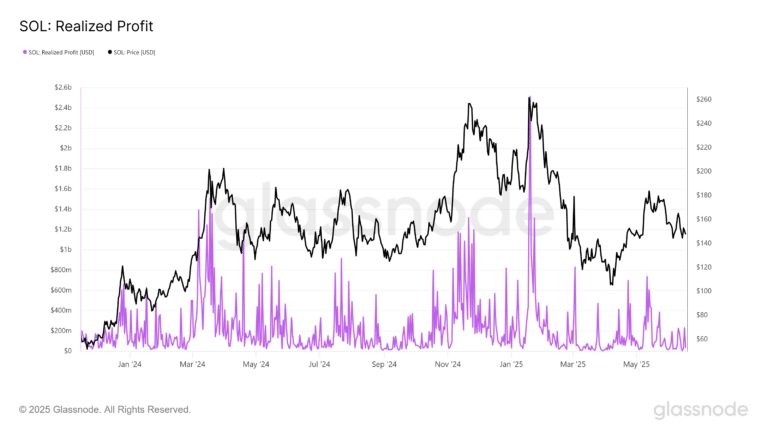

Meanwhile, past SOL local price peaks have attracted profit taking between $700M and above $1 billion. Put differently, current modest sell pressure suggested participants expected SOL to climb higher.

That said, SOL’s spot market demand has dropped since mid-May, as shown by the declining spot CVD (Cumulative Volume Delta).

Similarly, speculative interest has waned, as demonstrated by the southward movement of the CVD Futures.

In short, overall market interest has declined across spot and derivatives sectors, and could delay a strong rebound for SOL if the trend continues.

#Post To Earn Bonus#Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge#Do you think SPK is promising?#Do you think EDGEN is promising?

34Поділитися

Усі коментарі0НовіПопулярно

Немає записів