aht****@gmail.com

06/18 00:41

ZKJ Token Price Fall Breakdown

ZKJ Token Price Fall Breakdown

On-chain analytics platform Lookonchain reported that six whales (large holders) sold 5.23 million Polyhedra tokens, which triggered the price drop.

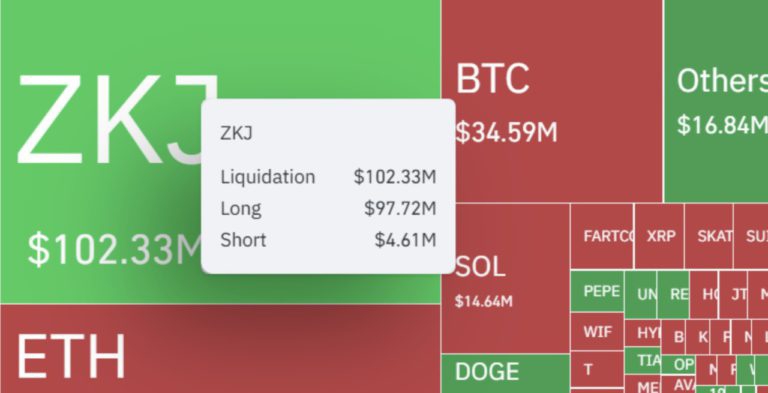

The whales first withdrew liquidity from the ZKJ and KOGE trading pairs, then swapped KOGE for ZKJ before engaging in mass selling. Along with this liquidity withdrawal, $102 million was lost in liquidation.

Interestingly, the price of the KOGE token also experienced the same fall as ZKJ. ETH APPLE on X (formerly Twitter) stated:

📉 [Breaking] ZKJ-KOGE Liquidity Pools Drained…

— ETH_APPLE🇰🇷 (@eth_apple) June 15, 2025

On June 15, both $ZKJ and $KOGE liquidity pools were drained, triggering panic among investors. The issue began when the KOGE pool ran out of USDT, leaving LPs unable to exit positions. This led to a mass sell-off of KOGE into… https://t.co/6Wy4tdSZz9 pic.twitter.com/ZHpvZ6DGV8

“The problem started when KOGE’s liquidity pool ran out of USDT, so LPs (Liquidity Providers) couldn’t exit their positions… This led to massive selling of KOGE into ZKJ.”

Liquidation data from CoinGlass revealed that $97.72 million of long positions were liquidated along with $4.61 million of short positions. Six traders lost $1 million each, while other holders faced significant losses.

Read also: SUI Price Prediction: Can SUI Jump to $10?

The crypto community also attributed the upcoming token unlock as the main reason for the crash, while some claimed that it was a planned “pump and dump”.

All Comments0LatestHot

No records