Horeen fatima

06/15 22:33

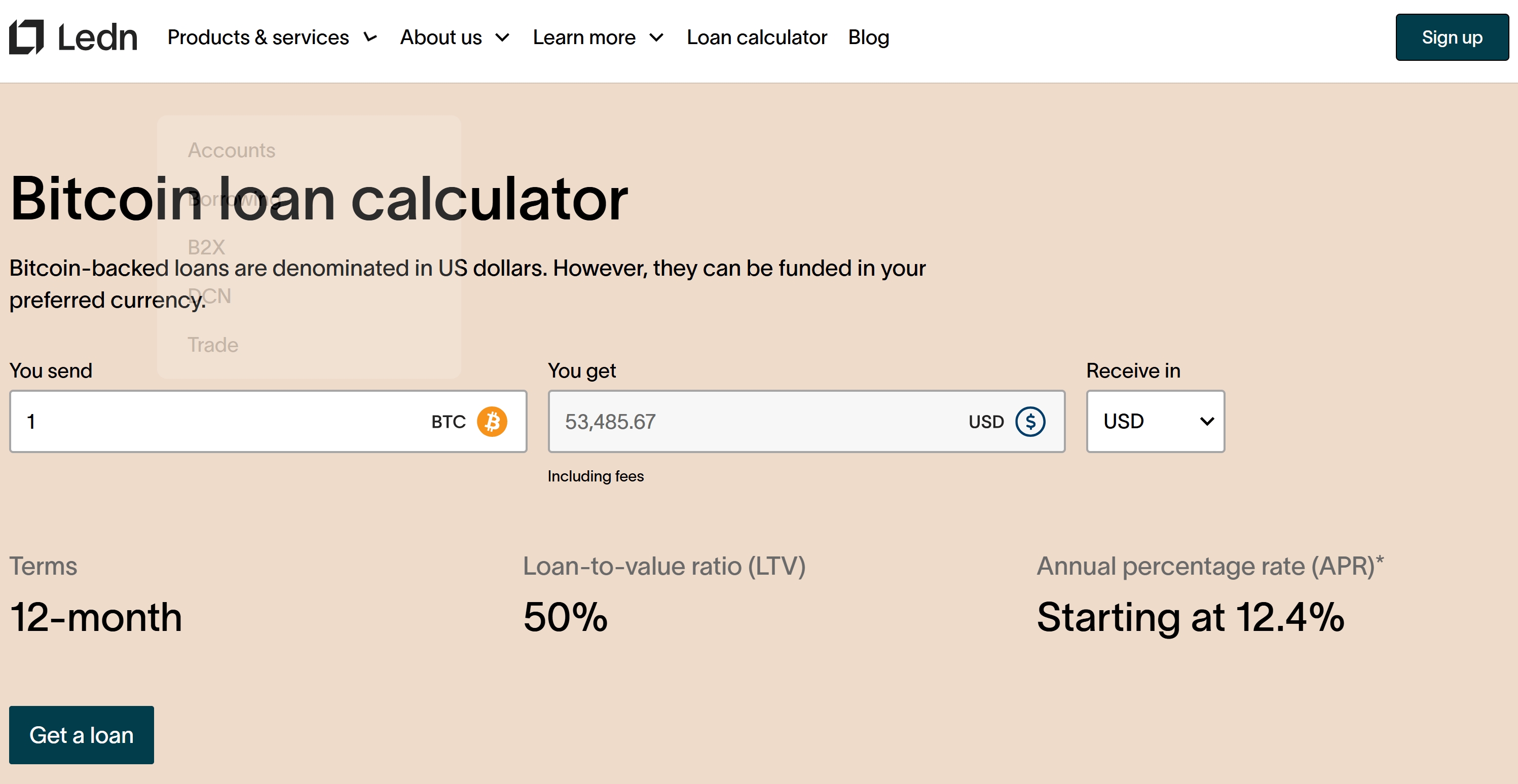

Bitcoin loans fund homes fast To secure a Bitcoin

Bitcoin loans fund homes fast

To secure a Bitcoin

The model also offers some flexibility. Interest and fees accrue over the loan term, with no mandatory monthly payments. Repayment can occur anytime without penalties, and loans can be renewed if the LTV remains under 60%. Borrowers also retain the right to withdraw excess collateral if Bitcoin appreciates during the loan term.

Di Bartolomeo said that Ledn’s Bitcoin loans have found strong adoption in Latin America, the US, and parts of Europe. “The beauty of Bitcoin as collateral is that it is borderless,” he said.

A recurring concern with BTC-backed loans is volatility. “As Bitcoin price drops and the LTV increases, clients will receive notifications to send additional collateral,” Di Bartolomeo explained.

If the LTV reaches 80%, the lender sells the necessary amount of BTC to repay the loan, returning any remainder to the borrower. Since the real estate transaction has already occurred, a liquidation doesn’t reverse the property purchase — it simply settles the loan.

All Comments0LatestHot

No records