BTC31011

06/12 12:27

Unique’ Bitcoin holder trend backs BTC’s next pric

Unique’ Bitcoin holder trend backs BTC’s next price discovery phase: Glassnode

Bitcoin enters a unique market phase as rising long-term holder dominance and compressed volatility could potentially trigger a fresh round of price discovery.

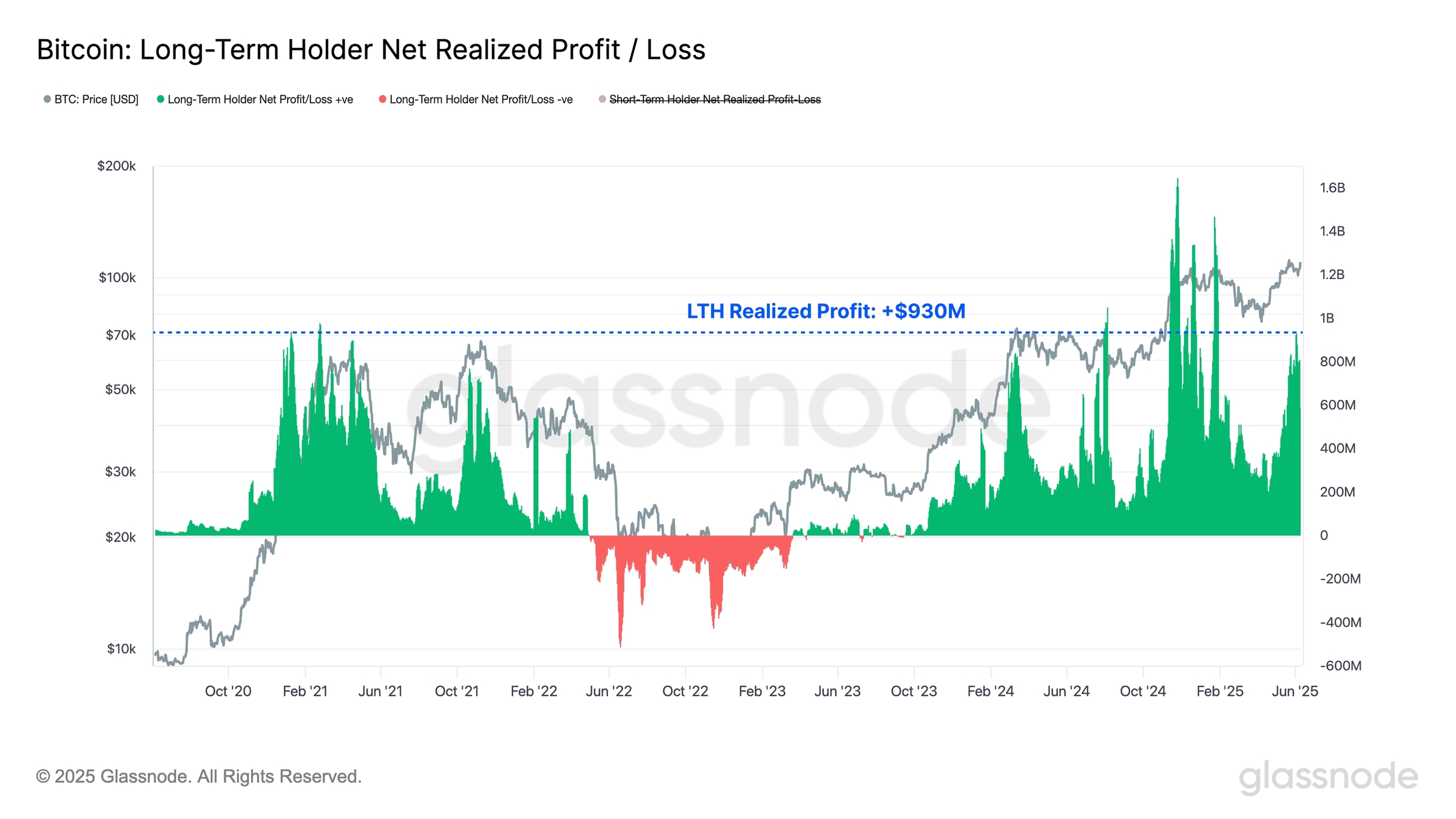

A unique divergence emerged as long-term Bitcoin holders took profits, while the overall supply held by this cohort continues to rise.

Bitcoin’s volatility has dropped to the 10th percentile, its lowest range in a decade, despite prices trading near all-time highs.

Bitcoin

BTC

$107,249

price is hovering just a few percentage points below its all-time high of $111,800, and data from onchain analytics provider Glassnode reveals a “unique dynamic of this cycle,” as long-term holders continue to dominate wealth distribution, even at the later stage of the bull market. This behavior deviates sharply from previous cycles.

The data highlights that long-term holders (LTHs) — those holding BTC for over 155 days — are realizing significant profits, with their net realized profit/loss peaking at $930 million per day. Despite this, the overall supply held by LTHs is still rising. This is unprecedented at this stage of a rally, where LTH supply tends to decline due to widespread profit-taking.

#US May CPI data#Post To Earn Bonus#Share Your Thoughts on Popular Assets in June

1シェア

すべてのコメント0Latestホットリスト

記録なし