FollowNoorr

06/12 01:59

Funding rates slip into negative territory In suc

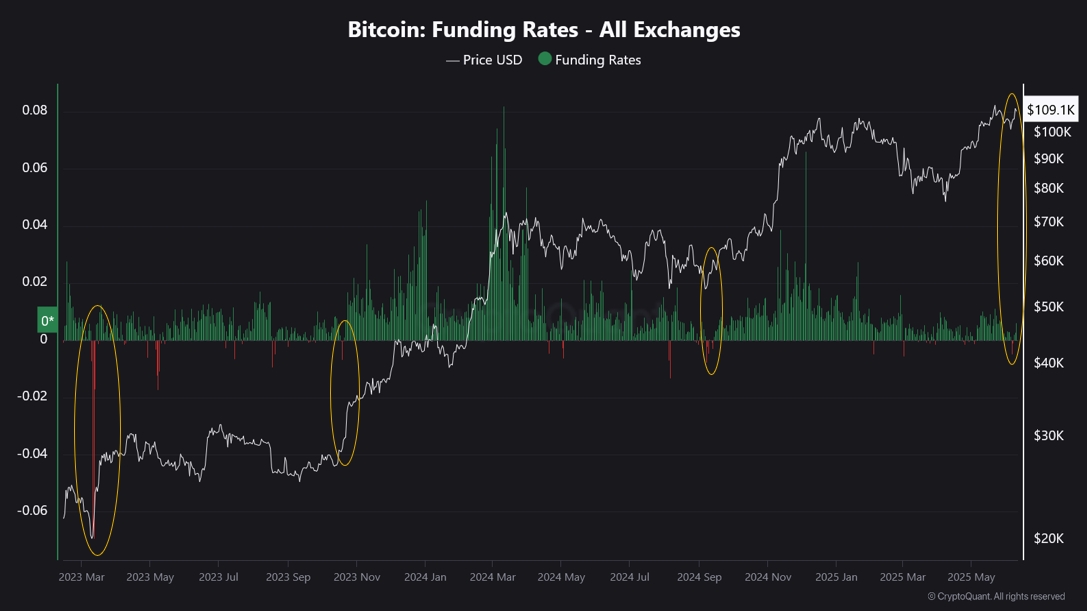

Funding rates slip into negative territory

In such a tight supply environment, even modest demand can move prices sharply, especially when the market is positioned the wrong way. The funding rate situation illustrates this well.

Funding rates are periodic payments between long and short traders in perpetual futures contracts, reflecting the market’s directional bias. Positive rates mean longs are paying shorts, typically a sign of bullish sentiment. Negative rates indicate short dominance and often signal local corrections.

However, when negative funding coincides with rising BTC prices, it’s a different story. It suggests that despite short traders dominating, the spot market is absorbing sell pressure, a potential sign of strong underlying demand.

This rare pattern has appeared three times during this cycle, each followed by a significant price surge. A fourth instance may have occurred recently: between June 6–8, funding rates turned negative while BTC shot to $110,000 from $104,000.

This kind of move suggests the rally may still have legs, especially if short positions continue to get liquidated — a feedback loop that can drive prices even higher.

Tutti i commenti0RecentePopolare

Nessuno storico