Crypto Market News

06/11 09:57

Ether price hits 15-week high: Will $1.8B in short

Ether ETH $2,795 is on the verge of breaking its monthly range, hitting a 15-week high of $2,827 on June 10. A daily close above $2,700 would mark its highest since Feb. 24.

After a month-long price consolidation between $2,300 and $2,800, one Ethereum whale capitalized on the recent rally. According to an X post from onchain tracker Lookonchain, the whale sold 30,000 ETH for $82.76 million through an over-the-counter (OTC) trade on June 10, locking in a $7.3 million profit. The sale followed a $75.56 million ETH purchase on May 27.

The same whale bought 30,000 ETH for $54.9 million at $1,830 via Wintermute OTC on April 27. On May 22, it sold the ETH at $2,621 for $78.63 million, netting $23.73 million amid a 43% price rally.

The whale has secured $31 million in profits within just 44 days.

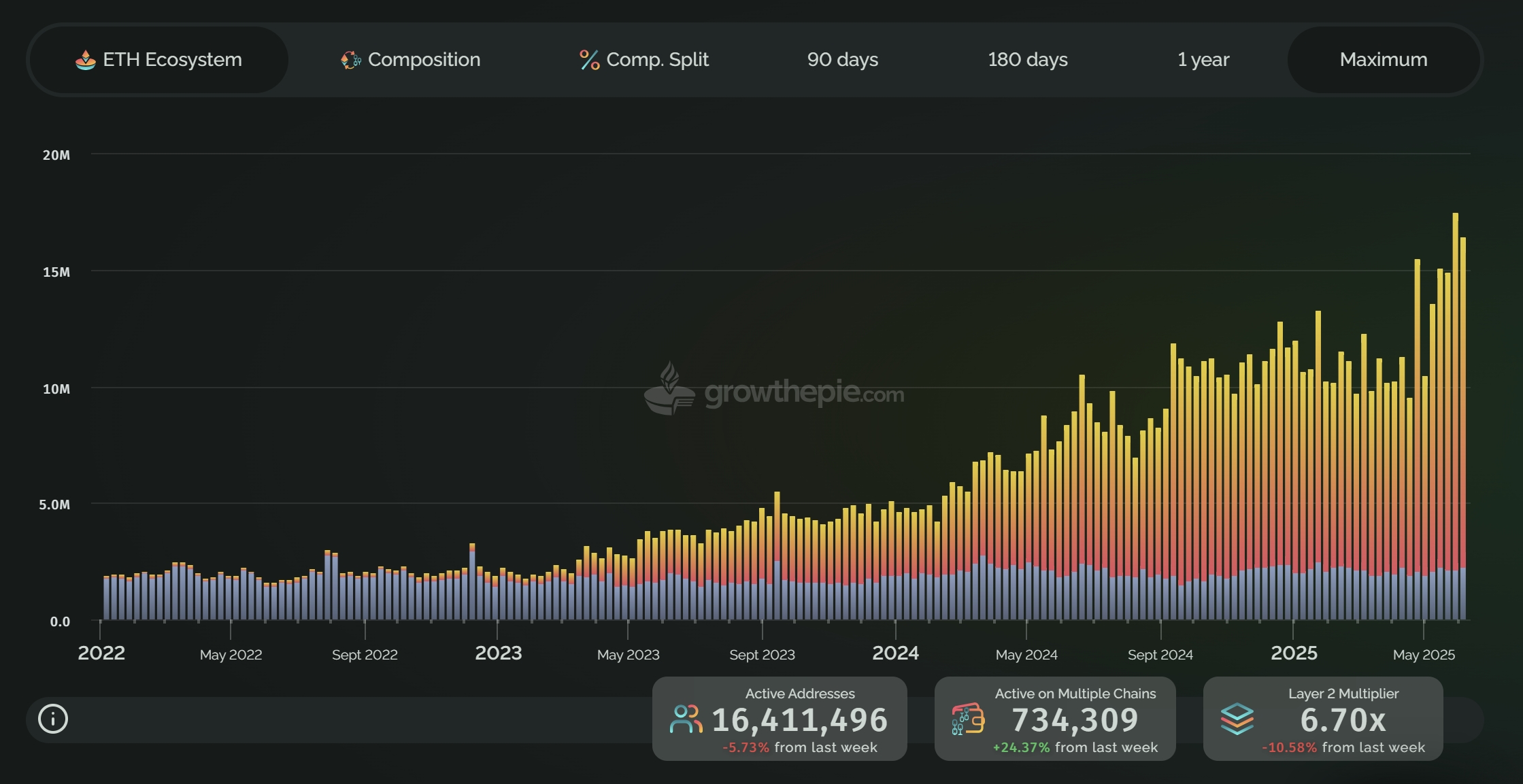

The number of unique addresses on the Ethereum network reached an all-time high of 17.4 million earlier this month. Data from growthepie highlighted that the number of ETH addresses interacting with one or multiple chains has increased by 70.5% since the beginning of Q2. ETH addresses remained elevated, with 16.4 million active addresses observed on June 10.

The Base network led this significant growth, accounting for 72.81% of 11.29 million this week, with Ethereum’s mainnet recording 2.23 million addresses or 14.8%.

Cointelegraph noted that Ethereum continued to dominate the decentralized finance (DeFi) sector, with ETH holding a 61% share of the total value locked (TVL) with roughly $66 billion.

However, concerns remain for its sustainability due to only having $43.3 million in fees over the last 30 days. Recent updates favoring rollups with low-cost data packets (blobs) have reduced staker returns, as ETH’s supply reduction relies heavily on network fees.

Ethereum bulls could liquidate $1.8 billion in shorts above $2,900

Ether’s futures open interest (OI) has surged past $40 billion for the first time in its history, signaling a heavily leveraged market. This elevated open interest suggests potential volatility.

Despite the risks, liquidity dynamics remain balanced. Data from CoinGlass shows $2 billion in long positions facing liquidation at $2,600, while $1.8 billion in shorts risk liquidation at $2,900. This equilibrium leaves market makers’ next move uncertain, as they could chase liquidity on either side.

#Post To Earn Bonus#Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge

3Condividi

Tutti i commenti0RecentePopolare

Nessuno storico