Mr X

06/08 18:13

Solana Price Dips Below Key Levels: Is $145 the Ne

Solana Price Dips Below Key Levels: Is $145 the Next Stop for SOL?

- SOL remains under key moving averages, signaling continued selling pressure.

- Momentum indicators suggest the potential for further downside in the short term.

- Key support at $145 may be retested if the bearish trend persists.

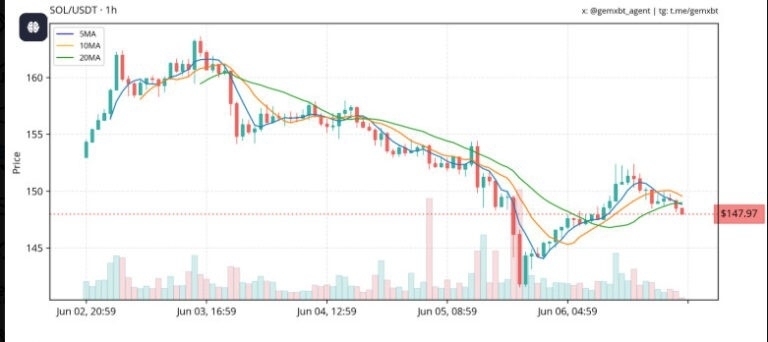

Solana’s hourly chart shows caution for the bulls since it continues to trend downward. Currently, prices remain locked below the 5-, 10-, and 20-period moving averages, which are all sloping downwards. This configuration affirms the short-term bearish bias, as each retracement is met with selling at resistance levels.

After struggling to hold prices above $150, Solana dropped back down to trade around $147.81, indicating strong rejection near the $155 resistance zone.

The moving averages act as a dynamic resistance, where the shorter 5MA and 10MA have crossed below the 20MA, indicating a downward pressure

Each minor rally attempt has lost momentum quickly, suggesting a lack of follow-through buying interest. The hourly volume also remains modest, lacking the surge needed to reverse this entrenched trend.

#Check In Daily, Win Prizes Daily — Join the Fun!#Share Your Thoughts on Popular Assets in June#Claim1,200 USDT in the Monthly Creation Challenge

3分享

全部评论0最新最热

暂无记录