Crypto Express

06/03 09:25

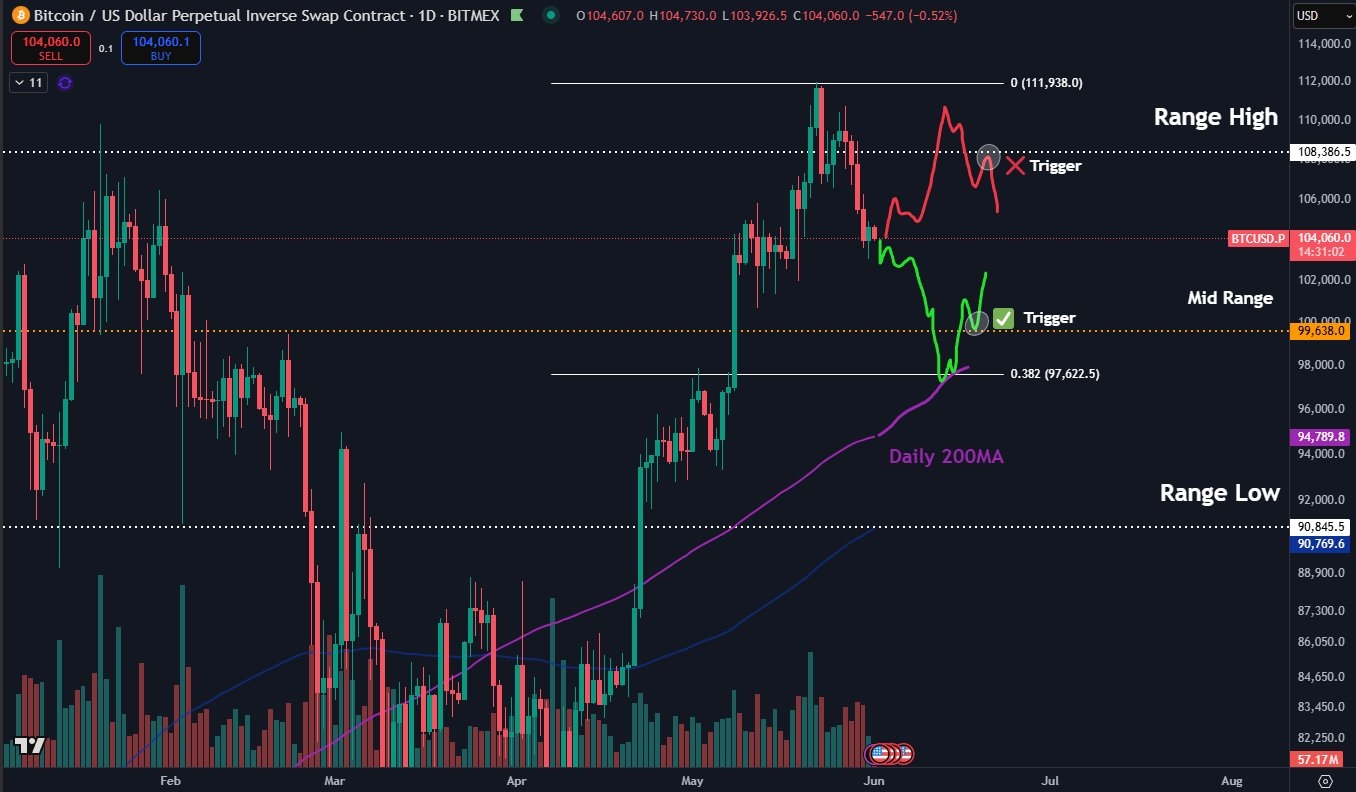

Bitcoin price dips under $104K

Bitcoin BTC $106,284 sought a retest of 2024 highs at the June 2 Wall Street open as Russia-Ukraine tensions returned to the market.

Bitcoin wobbles as bulls fight for 2024 peak

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD falling below $104,000.

US stocks opened cautiously amid expectations of geopolitical volatility to come. Commenting, trading resource The Kobeissi Letter underscored the uncertainty of the current situation.

“This is effectively the market pricing-out the Russia-Ukraine peace deal that President Trump has been working on for 3+ months,” it wrote in part of ongoing X coverage, referring to US President Donald Trump’s aims to halt the conflict.

“However, we have yet to receive a single comment from the US or President Trump. Clearly, something is going on behind the scenes. How will the US respond?”

Crypto voices had similar concerns, with independent analyst Filbfilb predicting an undesirable outcome for risk assets.

“Markets look like they are struggling to me, with gold looking strong & tensions with Russia escalating lead me to suspect selling today on the cards & for the start of June,” he told X followers on the day.

Filbfilb predicted that should stocks find fresh bullish momentum, Bitcoin would “probably outperform” as a result, adding that BTC “still looks bullish” long term.

Some traders shared that view, among them popular trader Jelle, who implied that reactions to the current retest of local lows were overly bearish.

Others complimented the May monthly candle close, which ended up as Bitcoin’s highest ever — albeit to little fanfare.

“This is one of the most beautiful monthly closes you could wish for $BTC,” fellow trader Moustache responded.

“Muted” BTC price action expected

Looking ahead, market participants were undecided — after recent volatility, they agreed, BTC/USD might need a sideways trading period.

“Despite the volatility, BTC continues to hover above $102k, a testament to underlying support. Volatility on the frontend has steadily compressed, and risk reversals have begun to normalise across tenors,” trading firm QCP Capital wrote in its latest bulletin to Teleg channel subscribers.

“This signals expectations for muted price action in the near term.”

QCP gave a $100,000-$110,000 price corridor going forward in the absence of further volatility catalysts.

Popular trader Daan Crypto Trades meanwhile looked to previous monthly opening behavior for clues.

“I think there's a good chance that the first week or so is likely a move that can be faded upon seeing the first signs of a local reversal. If this is the case, I will stick with that trend for the remainder of the month,” part of an X post on the topic read.

Daan Crypto Trades expressed “strong bias towards either direction” for June as a whole.

#Check In Weekly, Win Prizes Weekly — Join the Fun!#Picking Children's Day Token Gifts#Share Your Thoughts on Popular Assets in June

按讚分享

全部評論0最新熱門

暫無記錄